Diversifying Your Portfolio in 2023 is as Important as Ever

January 30, 2023

By Tim Hayes

By Tim Hayes

Securities Analyst Risk and reward are two themes that coincide within the investment industry.

There are a variety of ways one can invest using this risk-to-reward relationship. Maybe you are nearing retirement and would like to be as safe as possible with your investments. You would likely enjoy the conservative risk within the fixed income market (bonds) and limit your exposure to the volatility and risks within the stock market. Or maybe you’re in your 20’s and can afford to take on that added risk for potential of beneficial rewards.

No two people are the same with their investing strategies and risk aversion. However, the two individuals in the example above likely have something in common when it comes to their investment portfolios—diversification.

What is Diversification?

Diversification is an often pursued tactic of allocating capital in a way that reduces the exposure to any one particular asset. One could choose to diversify their portfolio within certain asset classes such as stocks and bonds. This can also be achieved by buying investments in different countries, industries, sizes of companies, or term lengths of fixed income investments (bonds). As stated before, no two investors employ the same strategy.

Why Diversify?

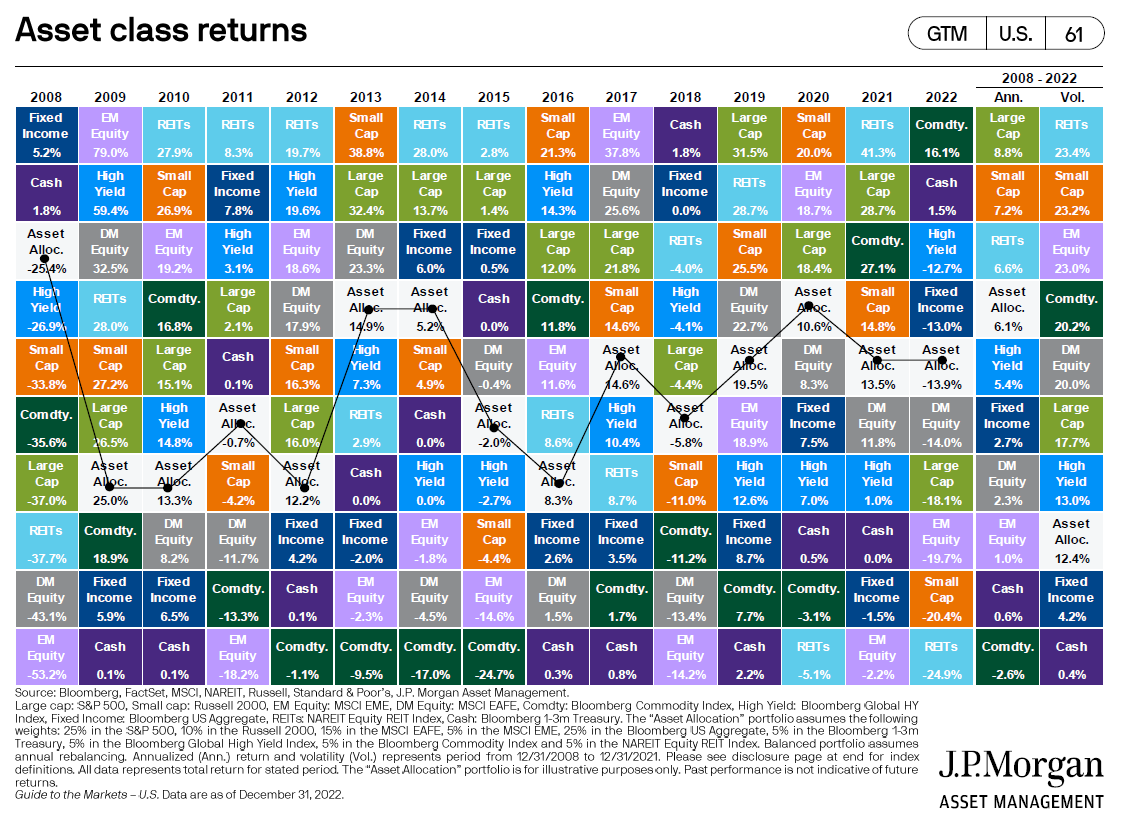

Nobody has a crystal ball on where financial markets will go in the next week, month, or year. If we had perfect knowledge of the future, diversification wouldn’t be plausible. Looking at returns of asset classes over the last 15 years in the above graphic, we can see why it is important to diversify.

Changing economic conditions will have a direct impact in how different assets behave and perform in any given year. Just last year in 2022, REITs (real estate investment trusts) were the bottom performer. However, from 2010 through 2015, this asset class prospered and was a top performer.

Creating a portfolio with a variety of assets is a great risk management strategy that will help to mitigate losses during economic turmoil.

Strategy for 2023

Given the many variables the economy will face in the foreseeable future, performance among asset classes will likely remain volatile in 2023. Diversification will continue to be just as important this year as it was for any given past year.

Conversely, it is not advised to put all your eggs in the same basket, which has potential for disaster. This is the risk to reward relationship that is different for every investor. While this high risk strategy may reap great rewards one year, it may also experience negative returns the next.

No strategy is 100% perfect, but employing a well-diversified portfolio is a useful tactic for downside protection with favorable returns in the long run. Please reach out to an advisor today to ensure your portfolio is diversified in a way to meet your needs. Your success matters to us!