One Casualty in the Inflation Fight: U.S. Household Debt

May 30, 2023

By Samuel Richter

By Samuel Richter

Securities AnalystPresident Biden and House Speaker Kevin McCarthy came to an agreement on the debt ceiling over the weekend. The deal suspends the borrowing limit for two years and restrains government spending during that timeframe. There is still work to be done for this agreement to pass through both the House and Senate before June 5. Treasury Secretary Janet Yellen has said the government could run out of the cash it needs to pay its bills on time by this date.

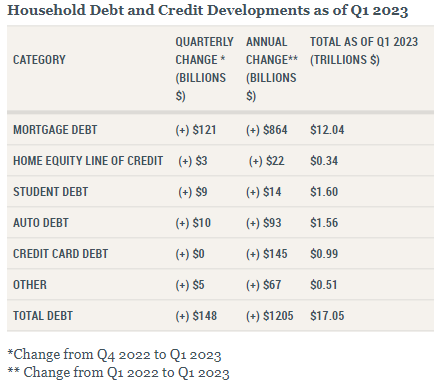

While the debt ceiling debate is a top news story, U.S. consumer debt is also on the rise. Total household debt rose above $17 trillion for the first time in the first quarter of the year. The Fed’s aggressive rate policy is a significant factor in this increase. The chart below shows the components of total household debt. Higher interest rates increased the cost of borrowing in all of these areas.

What Contributes to Household Debt?

Mortgage debt makes up the largest percentage of the total. It increased $864 billion over the past year. The national average rate for a 30-year mortgage ended the first quarter around 6.8%, after reaching a 20-year peak of 7.6% in October 2022. These are well above the sub 3% mortgage rates a couple years ago. The higher cost of borrowing slows the pace consumers are able to pay down their mortgage balance.

Student, auto, and credit card debt all work in a similar way. The higher interest rate environment increases the borrowing costs for consumers. Total household debt rose over $1.2 trillion in the past year. This is a consequence of the Federal Reserve’s aggressive policy aimed at tackling inflation.

Debt and Inflation

The Fed is hoping the tighter financial conditions will continue to have a dampening effect on inflation. Also, it is having a cooling effect on the U.S. economy. As the inflation battle continues, so will volatility. In volatile times, it is important to remain diligent and focused on long-term success. Portfolios under our care will remain fully invested and broadly diversified. If you you would like to discuss your portfolio, please reach out to us today. Your financial success matters to us!