School's Out, but So Is the Student Loan Repayment Pause

June 2, 2025

By Eric Johnson

By Eric Johnson

Securities AnalystIt’s the best time of the year, according to my 10-year-old nephew. He had his last day of 4th grade last week and is excited to be “school-free” the next few months. Summer also brings graduation season, which means recent post-secondary graduates must start thinking about repaying those student loans. For years, federal student loan borrowers were able to pause payments without penalty. That has since changed, as the U.S. government decided it wants its money back. Let’s review a timeline of federal student loan developments and the implications for borrowers moving forward.

Timeline of the Student Loan Repayment Pause

The Coronavirus Aid, Relief, and Economic Security (CARES) Act was signed into law in March 2020, suspending federal student loan payments, lowering the interest rate on that debt to 0%, and halting debt collection on defaulted loans. Originally set to end in September 2020, the program was extended multiple times before expiring in September 2023. During this three-year window, former President Biden attempted to pass a student loan forgiveness initiative. However, the U.S. Supreme Court ruled against it and concluded it was unconstitutional. In its place, he introduced the Saving on a Valuable Education (SAVE) Plan to provide further student loan relief. This was ultimately blocked by the courts earlier this year. These shifts left many borrowers confused about where their debt stood. So, where are things now?

Interest on federal student loan debt started accruing again in September 2023. Payments resumed in October 2023, but delinquencies couldn’t be reported to credit bureaus, meaning anyone who missed a payment didn’t receive a negative hit to their credit score. This ended in October 2024, concluding the so-called “on-ramp” period. Last month, the Trump administration restarted collections on defaulted loans. Such efforts include wage garnishment, tax refund offsets, and reductions in Social Security benefits. Only recently have we begun to see how many borrowers are affected.

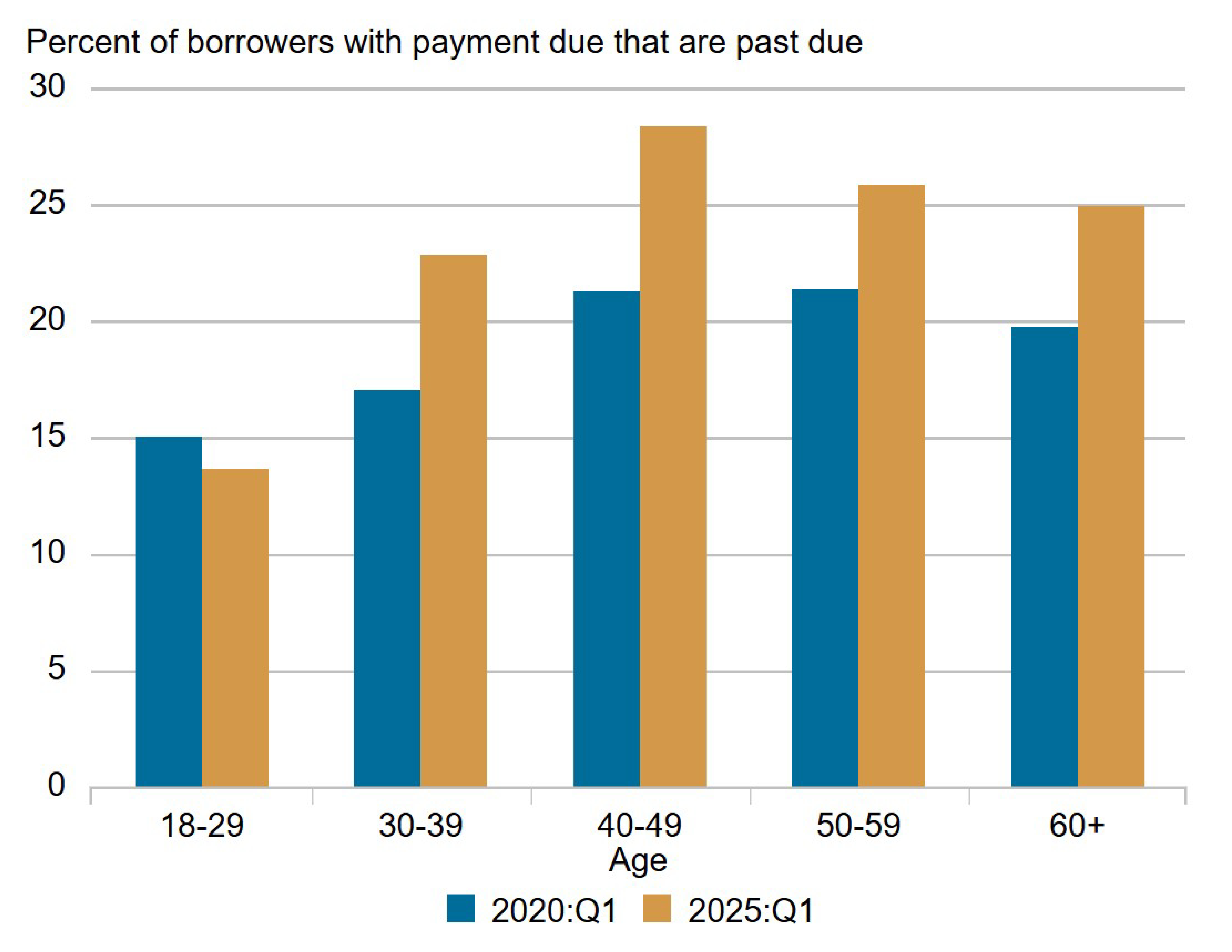

Source: Federal Reserve Bank of New York

Implications of Student Loan Default

According to the Department of Education, nearly 43 million borrowers collectively owe more than $1.6 trillion in federal student debt. Of those borrowers, over 5 million are in default and 4 million in late-stage delinquency (between 91-180 days past due). Compared to five years ago, delinquency rates are up in all age groups except for borrowers aged 18-29. This trend is especially prominent in the 40–49-year-old group (see chart above for reference). Missing a payment lowers the borrower’s credit score and hurts their financial situation due to higher interest rates, loan denials, and limited credit access. These side effects slow credit flow and ultimately impact economic activity. With federal student loan payments paused for so long, people became accustomed to having more discretionary income than usual. Now, with payments resumed, borrowers may have to cut back on those recreational activities, such as dining out or going on vacations. Despite rising, delinquency rates remain within historically healthy ranges and don’t pose a significant threat to the overall economy.

While the student loan landscape has gained clarity, further legal challenges and policy proposals are likely. We’ll continue to monitor these developments and their potential impacts going forward. Reach out to your Wealth Management Advisor if you have questions about student loans or our outlook on their macroeconomic implications. Your financial success matters.