See the Big Picture: Stay Diversified for the Long Haul

April 14, 2025

By Matthew Andera

By Matthew Andera

Securities Analyst

We are halfway through April and the weather finally feels like spring has arrived. While we have not had many April showers to bring May flowers in this part of the Midwest, there has certainly been some thunderous activity in markets the past couple of weeks. The volatility we have experienced is largely due to uncertainty around trade policy. Market participants hoped to gain clarity on trade policy at the President’s Rose Garden address on April 2nd, however more questions emerged as the announced tariff rates were substantially higher than anticipated. Opinions on tariffs aside, these proposed changes could significantly alter many companies’ current business models. With stock valuations already high by historical standards and a new threat to corporate earnings, volatility spiked and equities descended further into correction territory. In the days following the address, trading volume hit record levels. Markets do not like uncertainty, and the future of global trade became increasingly opaque amid rapidly changing policy. In this type of market environment, what is an investor to do?

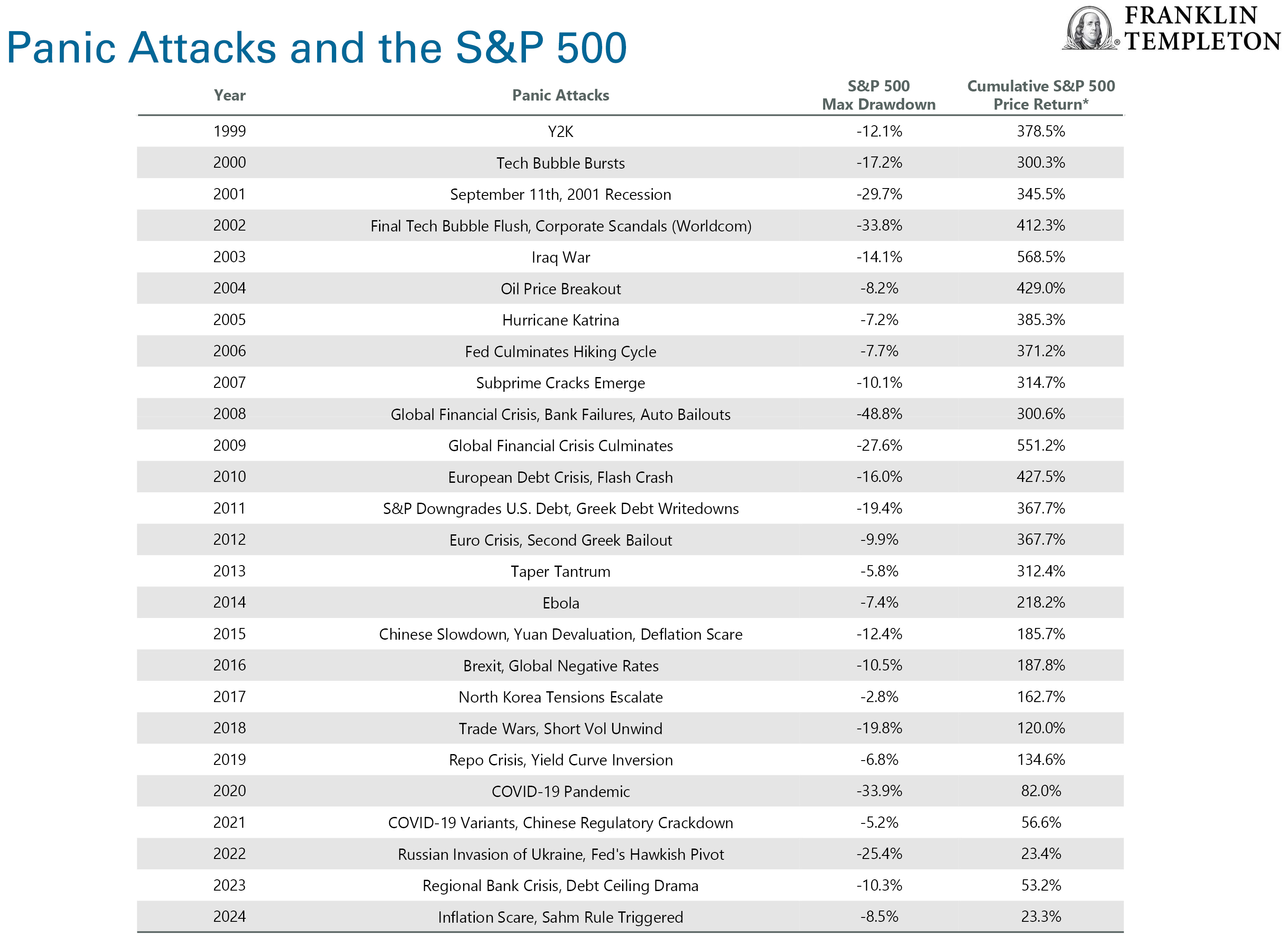

First and foremost, do not panic. In times of stress, it is important to remember your long-term goals and worry less about the short-term outcomes. History can help put this into perspective. As seen in the chart below, there has been no shortage of panic-inducing events over the past 25 years. Yet in all instances of drawdowns, markets remained resilient and produced positive returns in the years that followed as seen in the cumulative return column on the right.

Volatility is unavoidable, even for the savviest investors. As the saying goes, time in the market is much more important than trying to time the market. We can see evidence of this in the chart below. Investors often feel inclined to sell when they see declining portfolio values. The problem in doing so is that you are likely to miss out on any rebound. Over the past 20 years, seven of the 10 best days for the S&P 500 occurred within two weeks of the 10 worst days. If you were to miss the 10 best days over that 20 year period by being out of the market, your annualized performance would drop from 10.4% to 6.1%. We saw this phenomenon firsthand last Wednesday when the index had its best day since 2008, closing up 9.5% in response to the 90-day reciprocal tariff pause.

Source: JP Morgan Data as of 12/31/2024

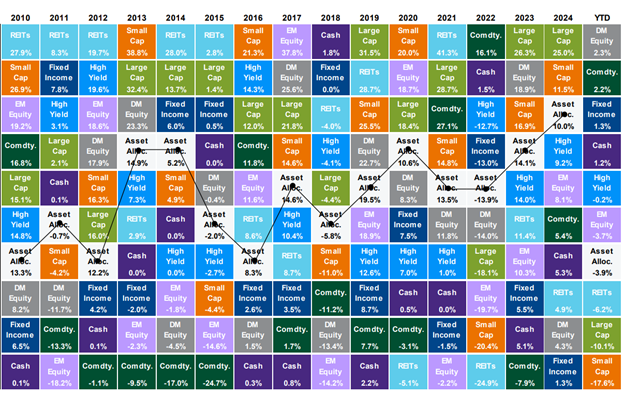

Most importantly, investors should stay diversified to weather market volatility. The chart below shows that asset class returns vary greatly from year to year. However, a diversified portfolio (represented by the white ‘Asset Allocation’ square) can help to smooth out the ride.

Source: JP Morgan Data as of 4/10/2025

It is important to note that what you hear or see in market news is not necessarily indicative of your portfolio returns. Most headlines we see are in reference to the S&P 500 or Dow Jones Industrial Average and only reflects performance of the largest companies in the U.S. Akin to the white squares above, our portfolios are broadly diversified with exposure to various asset classes.

While much uncertainty remains, the best course of action is to stay diversified and focus on your long-term goals. Market volatility will come and go, but we will always be here to help you along your journey. To further discuss the steps we take to limit volatility, please reach out to your advisor. Your financial forecast matters to us.