Seeking the Magic Combination to Unlock Rate Cuts

August 5, 2024

By Ted Hanson

By Ted Hanson

Portfolio ManagerLast week the Federal Reserve concluded its July Federal Open Market Committee (FOMC) meeting. While there wasn’t a change in rates, a change in tone from Fed Chairman Jerome Powell set the table for potential cuts at the next FOMC meeting in September. Let’s look at what was said and the implications going forward.

What The Fed said:

There were some changes in the commentary from this meeting versus previous statements. First, the Fed acknowledged employment moderated, a change from “remains strong”. Chairman Powell also stated the Fed has “gained some confidence on inflation over the last several months…” highlighting the improvement toward the 2% inflation goal.

With inflation trending downward and the unemployment rate moving higher, Powell noted economic risks have come into better balance and the Committee is attentive to both sides of its dual mandate (stable prices and full employment). These comments mark a shift in tone, as inflation previously received most of the attention given the elevated rate compared to the strong labor market at the time.

What now?

The Federal Reserve believes they still have time to assess incoming data and the risks of cutting rates too early or late. Jerome Powell noted in his press conference that if the totality of the data trends as expected, policy members could view September as an appropriate time to begin to cut rates.

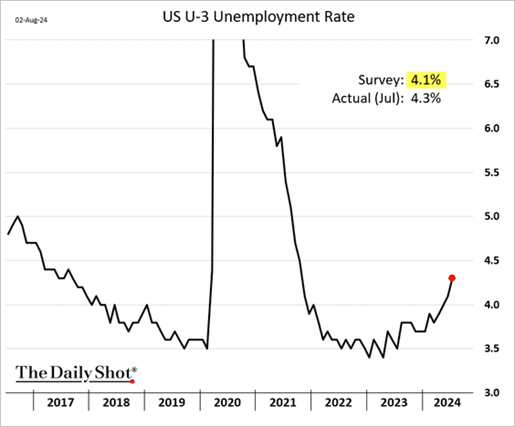

Many economists and market participants don’t agree, expressing there is no need to wait, especially after Friday’s labor release. The unemployment rate jumped to 4.3% in July, not only was this more than the 4.1% expected, but also the highest level in three years. This increase is largely due to a pickup in those coming back into the workforce and seeking employment rather than losing their jobs.

Nonetheless, this weaker than anticipated job data places an increased focus on the health of the U.S. economy and the Fed’s ability to keep rates elevated:

Implications Going Forward

Both stocks and Treasury yields continued their decline Monday over worries of an economic slowdown and increased pressure for the Fed to cut rates sooner rather than later. Short-term yields declined more than longer maturities, a result of having a higher correlation to the Fed’s interest rate policy.

With inflation continuing to show broad base improvement toward the 2% goal and the unemployment rate rising, the next two months of data will be highly anticipated. If the labor market continues to weaken it will force the Fed’s hand in cutting rates.

It remains appropriate to prepare for an environment where the Federal Reserve cuts rates. After more than two years of short-term rates rising and remaining elevated, investors can anticipate earning less on savings in the future. Extending maturities and locking in rates on excess savings can prove beneficial.

Maintaining a well-diversified equity portfolio will reduce the impact of market fluctuations. While volatility will continue as the markets digest the latest headlines and data, there are opportunities for a prepared investor to leverage. Reach out to your Advisor today to discuss how you can prepare for the future.