Sentiment Low, Opportunity High: A Look at the Historical Patterns

May 16, 2025

By Michael Moreland

By Michael Moreland

Retired VP - InvestmentsRudyard Kipling (1865-1936) was an English journalist, novelist, poet, and short story writer. At the time, he was the youngest Nobel Prize for Literature laureate. Among his works was a short poem on overcoming life’s challenges, titled If --. It begins, ‘If you can keep your head when all about you are losing theirs…’

Good words to keep in mind when times are difficult. From mid-February through mid-April, the major U.S. equity markets fell 15% to 20%. Tariff-induced fears of product shortages, higher inflation, and possible recession pushed hedge funds and short-term traders to the sidelines. Gold – historically viewed as a safe refuge in troubled times – produced its sharpest spike in some time. Headlines were rife with ‘doom and gloom’ scenarios for financial markets and global economies.

A Look Over the Valley

While the economy remains in uncharted territory, the recent behavior of the financial markets suggests that investors are ‘looking over the valley’. Most indices have fully recovered their earlier losses, despite the uncertainties ahead.

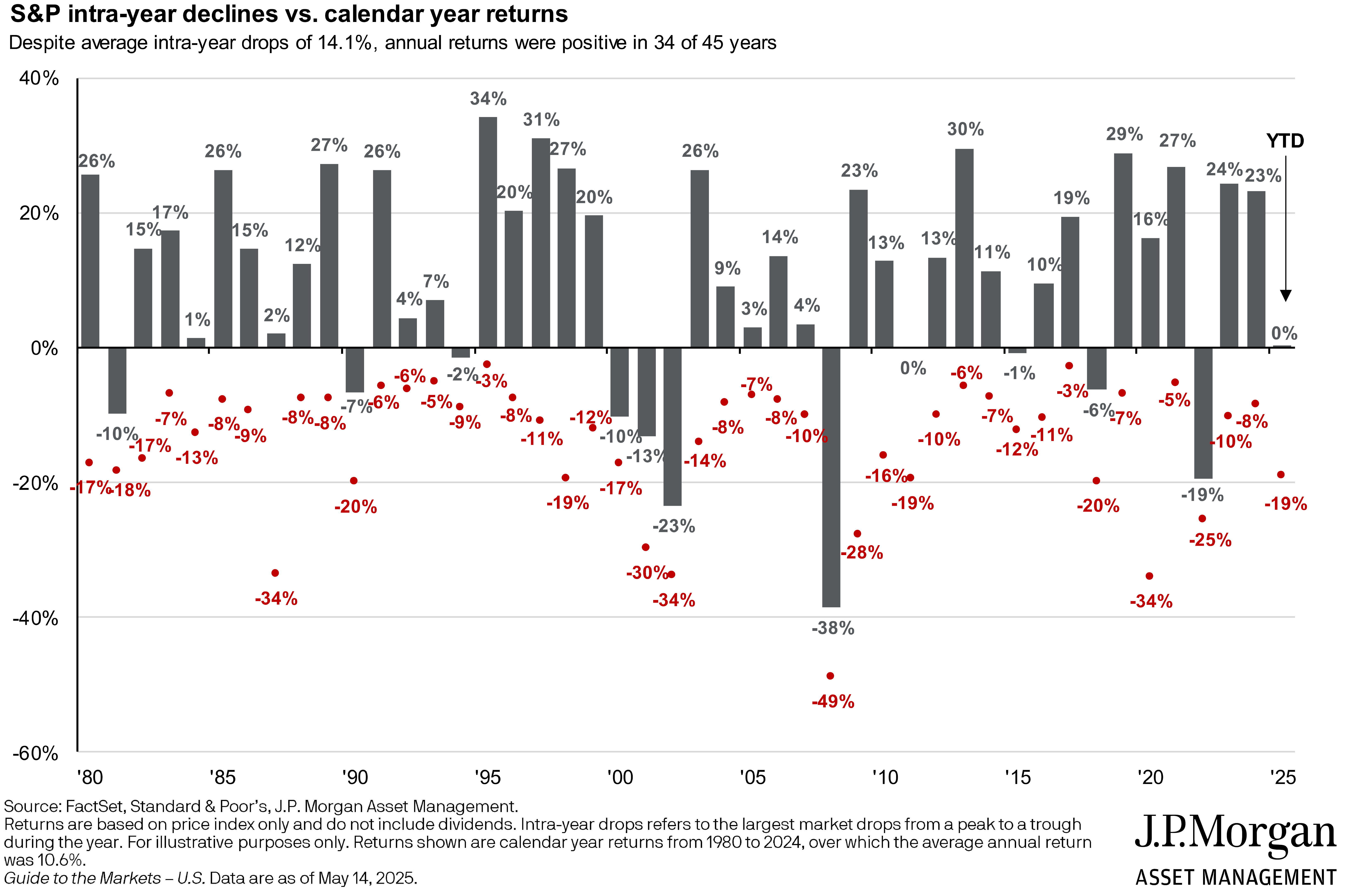

And, a longer term view shows that recent market behavior is not out of the ordinary.

Going back forty-five years, the average intra-year price decline in the S&P 500 was 14.1%. Of course, this is skewed by a handful of truly bad periods (the crash of 1987, the bursting of the internet bubble and 9/11 in the early 2000s, the credit crisis in 2008, and the pandemic panic in 2020). Still, prices recovered and patient, long-term, goal-oriented investors were rewarded. Positive returns were produced in over three-quarters of the years measured.

How Telling is Consumer Sentiment?

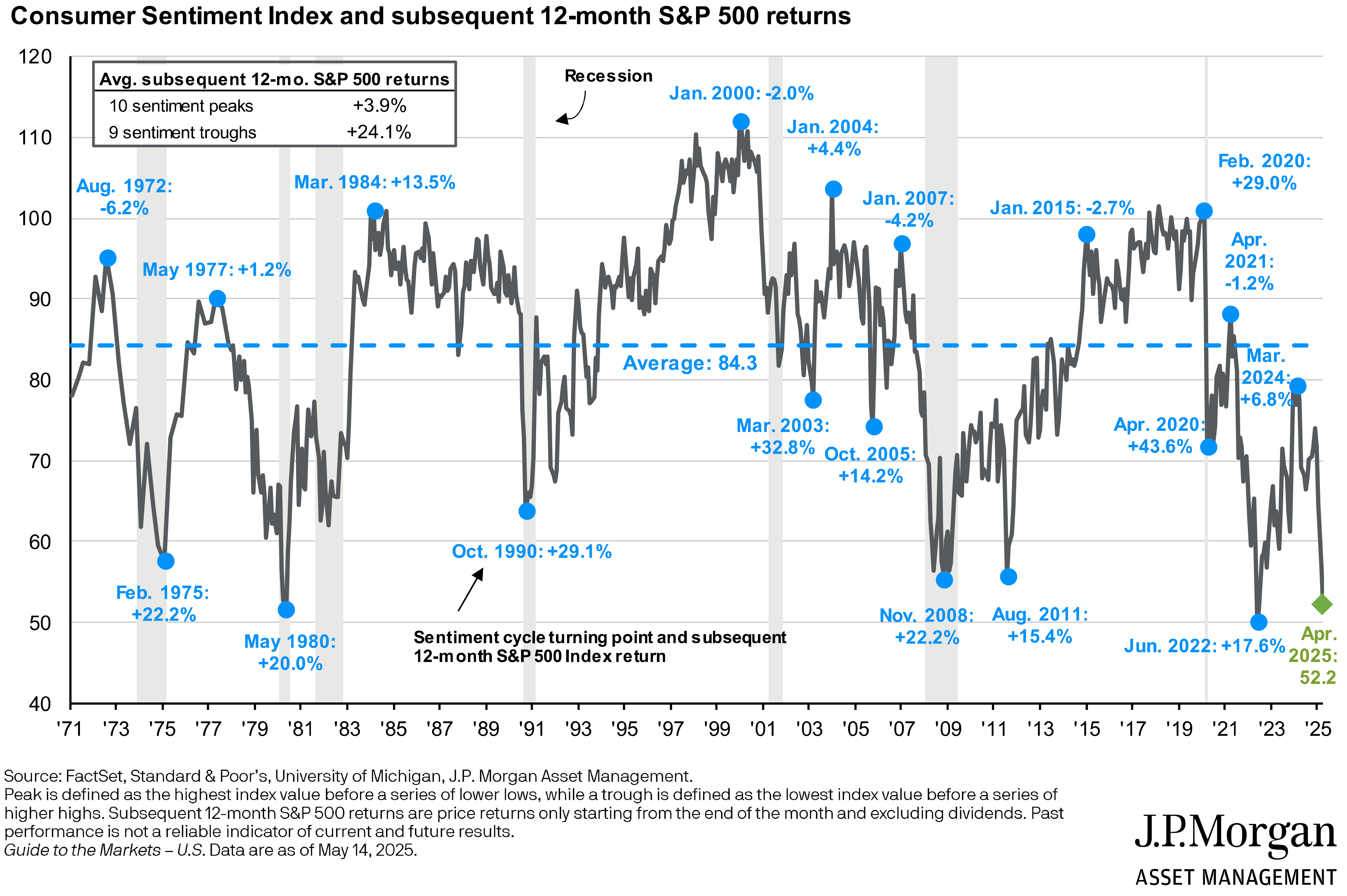

Let’s consider another perspective. Consumer sentiment is at its third-lowest reading since the early 1970s. Again, this is not a surprise given the news of the day and the uncertainties that abound. And, since consumer spending accounts for two-thirds of our economic activity, this is not good news for the stock market. Or is it?

Note that every significant trough in consumer sentiment since 1971 coincided with the start of significant market advances over the subsequent twelve months. On average, stock prices rose 24.1% in the year following a sentiment trough – nine out of nine times. Conversely, price advances tend to stall out as sentiment reaches a peak. Over the same period, prices rose an average of 3.9% in the year following a sentiment top.

Is this counter-intuitive? Not really. Remember, financial markets are forward-looking. All the information (and speculation) you see today is already reflected in stock prices. While the uncertainty of our new environment may create additional downdrafts and cap potential gains until the clouds part, we believe most of the worst is past.

What if we’re wrong? This is where the disciplines of the Wealth Management Division work for you. Portfolios are conservatively structured, value oriented, and broadly diversified across asset classes and market sectors. This does not guarantee against losses, but history shows this philosophy limits damage in poor periods while allowing participation in favorable times. Talk to your Investment Manager and Advisor to see how we employ these principles for your long term success.