Silver Linings Investors Can Be Thankful For

November 22, 2022

By Tom Limoges

By Tom Limoges

VP Investments This year has been a difficult year for both stock and bond investors. However, on this Thanksgiving week, let’s highlight the silver linings for which we, as investors, can be thankful:

Higher Interest Rates

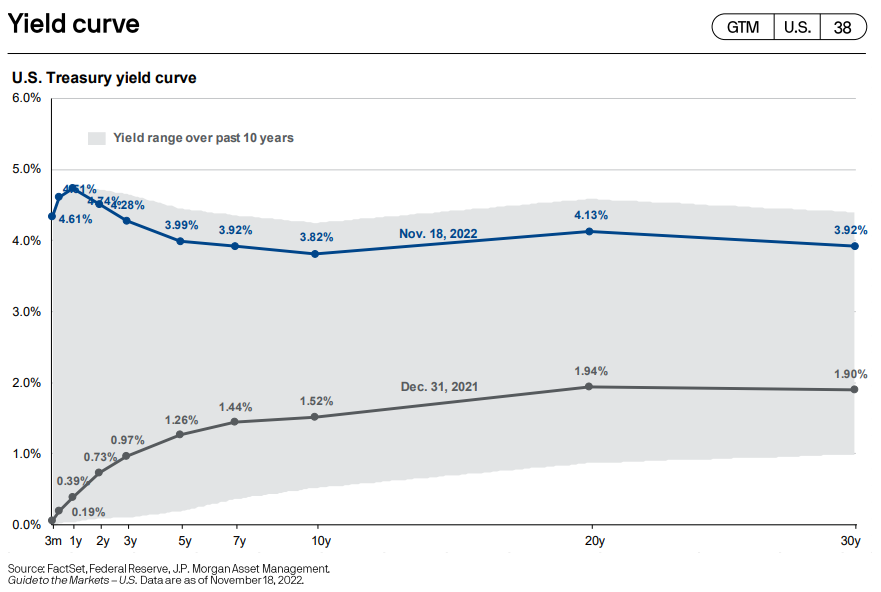

With inflation running at uncomfortably high levels, the Federal Reserve has affirmed its commitment to raising rates until the job is done. The increase in rates has put pressure on bond prices; pushing returns to their lowest level in decades. The bottom grey line reflects the yield curve as of end of 2021, while the blue line reflects current interest rates. The shaded area is the range of rates over the last 10 years.

Source: JP Morgan

What is the silver lining? Current yields are substantially higher when compared to the beginning of the year and near the high point when compared to the past decade. Going forward, this will provide better income stream to yield oriented investors.

In addition, the higher yield provides protection against interest rate price volatility in the future. While higher interest rates have put pressure on bond prices in 2022, investors will appreciate the higher income levels in their bond portfolios going forward.

Lower Stock Valuations

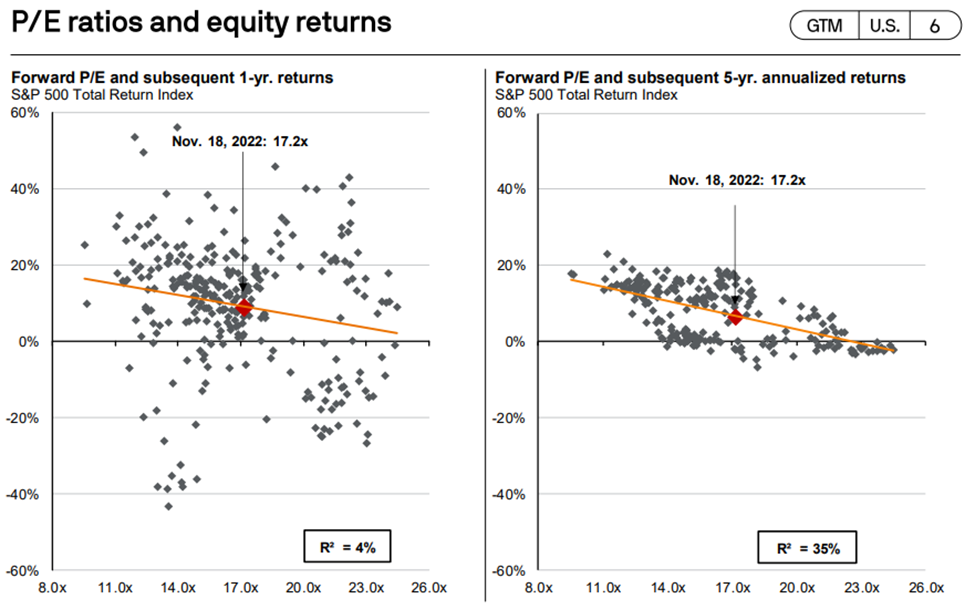

Investors can appreciate the higher returns in the equity markets thus far in the fourth quarter, but most stock market indexes remain well below levels from the end of 2021. One of the measures of stock market valuations that we monitor is the price-to-earnings ratio. Simply put, it is the stock price divided by the earnings. Over time, we use this measure to determine the valuation of a stock (or group of stocks).

The data points on the chart below show monthly market valuations (horizontal axis) and subsequent one-year and five-year returns (vertical axis). While one-year returns can remain more dispersed, five- year returns are more correlated to valuations. The overall theme is that valuations tend to be a good predictor of longer-term returns. While the declines in stock prices have been painful in 2022, the lower valuations should be good for longer term results.

Our Customers

We, at Security National Bank, continue to be grateful to our customers, both existing and new, and the relationships we form with you along your financial journey. During this upcoming holiday season, we hope you can find time to cultivate an attitude of gratitude for those silver linings in your daily life. Happy Thanksgiving, from our SNB family to yours.

If you would like to review your future goals and how we can help achieve them, reach out to an advisor today. Your success matters to us!