Sir Isaac Newton on Investing (or, Where's the Value in Growth?)

August 9, 2019

By Mike Moreland

By Mike Moreland

Vice President Investments

One of the phenomena of this market cycle is the stark performance difference between value and growth themes. For the last several years, shares of companies whose earnings are growing faster or more consistently than most are far outpacing the performance of defensive or cyclical companies.

This is not unusual in and of itself. Styles go in and out of favor, generally based on our position in the economic cycle. So far, so good.

The magnitude of today’s divergence, however, is approaching extremes last seen at the peak of the ‘dot.com’ bubble nearly three decades ago. That era did not end well.

Breaking Down the Widening Gap Between Value and Growth Stocks

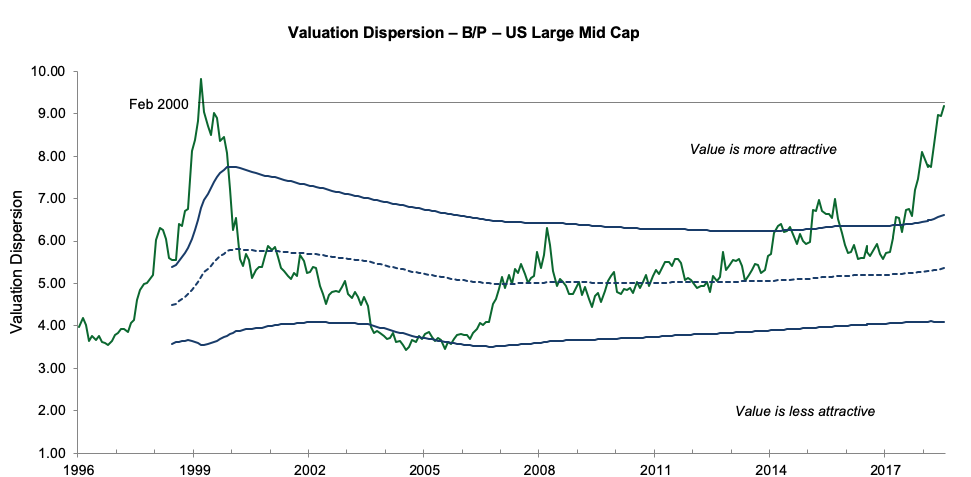

Let’s look at the big picture first. If one accepts the validity of “reversion to the mean,” the chart below, courtesy of SEI Investment Management, suggests value is the place to be. More conservative sectors are historically cheap (based on price/earnings multiples). And, as we learned in last week’s blog, one of the best predictors of future returns is valuation at the starting point. Buying what’s statistically cheap today should produce favorable outcomes down the road.

Source: SEI Investment Management Corp

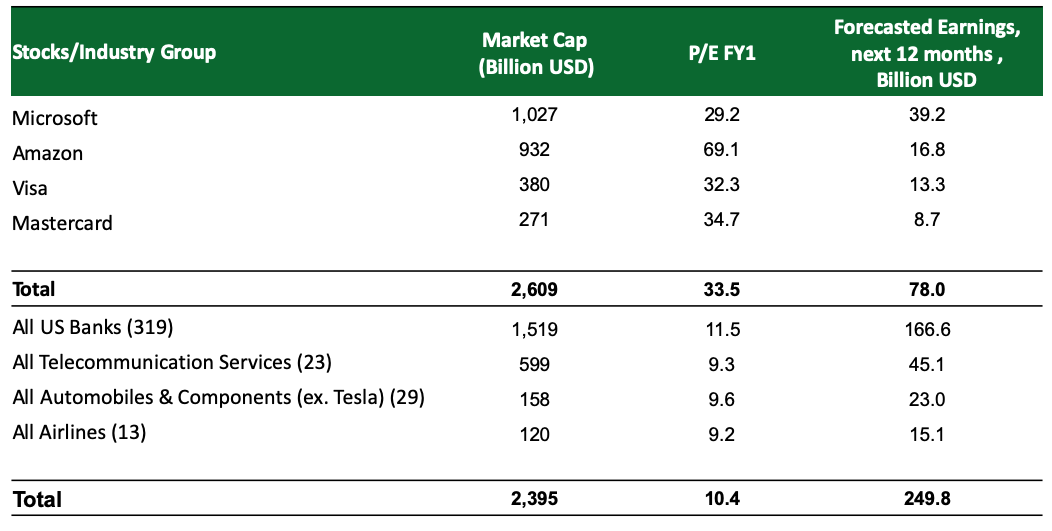

Source: SEI Investment Management CorpOn a more granular level, consider the following table. The top four companies, all popular growth stocks (and likely over-represented in most mutual funds), have a combined market capitalization of $2.6 trillion. That’s about the same as the entire banking, telecommunication, automotive and airline industries. At the same time, the aggregate profitability of the latter is about six times that of the growth leaders, and the group sells at less than one-third the multiple of the top four. That’s a huge disconnect. It will be corrected over time.

Source: SEI Investment Management Corp

Source: SEI Investment Management Corp

Will the changing of the guard be as disruptive as the collapse of the tech bubble three decades ago? No one knows, but we consider it unlikely. There is no Internet Capital Group or Pets.com (to name two earlier speculative implosions) among today’s leaders. Still, there is little doubt that momentum leaders are extended; a lot of high expectations are built into their prices.

Keep in mind Newton’s First Law of Motion: “An object in motion tends to stay in motion unless acted upon by an external force.” Our task as your manager is not to predict the catalyst of this change (no one knows until it’s upon us); instead, it is to position your portfolio to best participate when times are good and to protect value when the environment is more chaotic. Talk to your Advisor today to see how we work for you.

Leave Your Comment Below: