Skyrocketing College Tuition - What Can You Do to Better Prepare?

March 4, 2024

By Dustin Saia

By Dustin Saia

Securities Analyst

From 1983 to 2023, the price of college tuition increased by an astronomical 873%, averaging a 5.7% increase annually. J.P. Morgan recently presented this data in its 2024 annual release of “College Planning Essentials” where they explore the most recent data surrounding the costs and benefits of higher education. Using this data, we highlighted a few key concepts to be better prepared as an investor if paying for higher education is in your financial plans. [1]

1. Don't Count on Scholarships or Grants

The total financial aid package for students is trending down in recent years. Part of this progression is the scarcity of grants and scholarships that help fund a higher education. Even when grants and scholarships are received, data shows they only cover a small portion of the total cost. Free rides are few and far between, and it is important not to count on outside funding to cover the costs.

2. Invest, Invest, Invest!

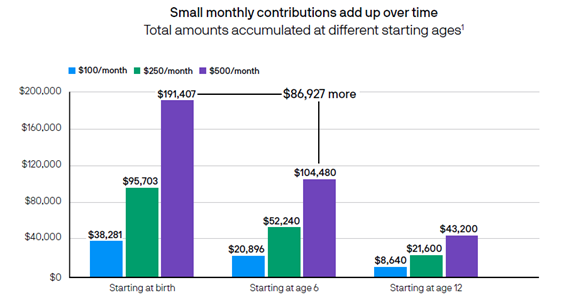

As with retirement investing, even a small amount invested can add up over time. Assuming an annual investment return of 6% compounded monthly, $100 a month could grow into approximately $38,000 by the time a child reaches age 18 if you started investing at their birth. If you increase your monthly investment to $500 a month, that amount grows to be over $190,000 by the time a child reaches age 18. Additionally, the earlier you start the more time you give your money to grow and compound. For instance, if you invest that same $500 a month, but start when your child is 6 years old, your total amount accumulated would be $104,000. Nearly $86,000 less than starting at birth!

____________________________________

[1] College Planning Essentials | J.P. Morgan Asset Management (jpmorgan.com)

3. Utilize a 529 Education Plan

When investing, consider utilizing a tax advantaged 529 education plan to increase the size of your educational fund. Investments in a 529 education plan gain the benefit of tax-deferred compounding, meaning your contributions and earnings are not subject to taxes while growing in the account. Additionally, withdrawals from a 529 plan are tax-free if used for qualified educational expenses. These qualified educational expenses are flexible and cover a wide range of educational expenses including tuition, books, computers, apprenticeship programs, and more!

A new feature in 2024 adds additional flexibility to the 529 education plan. Unspent funds from 529 plans can now be rolled into a Roth IRA if further education is no longer in your plans. For information on rules and eligibility surrounding this rollover please see: Unused 529 Plan Money? Consider the New Roth IRA Rollover Option.

With spring nearly here, and graduation ceremonies close behind, now is a great opportunity to begin planning for your family’s future educational needs. The road to higher education may be a long one, but it can be well worth the trip with proper planning and preparation. If you have any questions, or wonder how investing for higher education fits into your financial plan, please reach out and contact your Wealth Management team. Your financial success matters to us!