By Jonathan Smith

Securities Analyst

Happy Independence Week! As we celebrate our freedom, let’s start the week off by reflecting on the first half of the year in the markets. The year got off to a warm start after a continuation of market momentum from the previous year. Major global indices maintained solid growth trends from last year’s momentum. The technology sector continued its dominance, while other industries began catching up providing good returns for the first half.

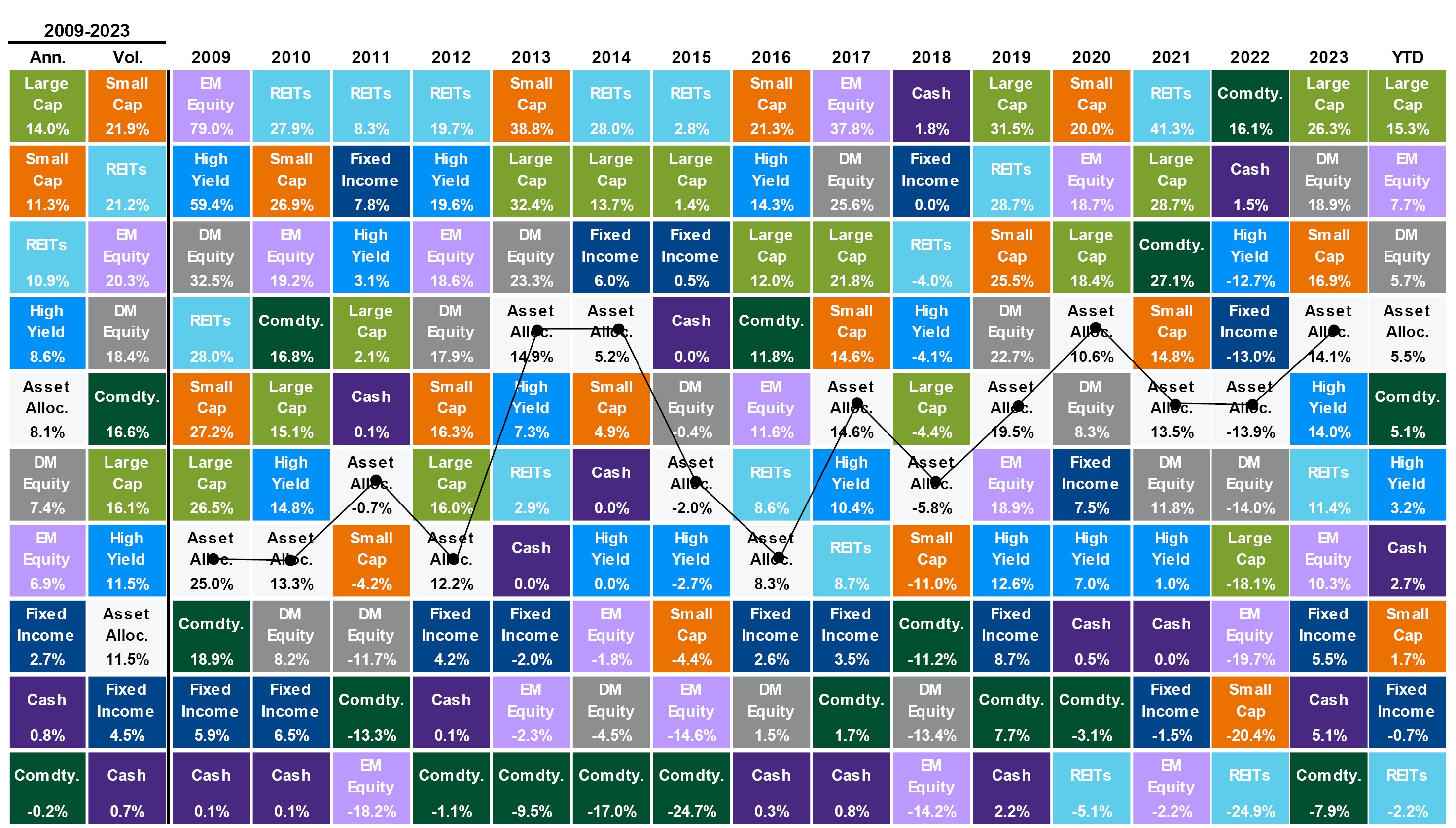

Asset Class Returns

In the chart below, the asset class returns chart displays the top and bottom performers each year in each category. U.S. large cap equities continue to carry strong momentum, especially in tech and healthcare, which saw significant gains as investors bet on continued artificial intelligence adoption and healthcare advancements. Commodities and oil prices rebounded from supply production cuts and recovering global demand. Government bond yields and cash are maintaining reliable returns amid the uncertainty of monetary policy shifts. Diversifying and spreading your risk among various asset classes continues to be an excellent long-term strategy for investing.

Source: JPMorgan Asset Management

What's Next?

As we are enjoying summer weather and vacations, we begin considering which themes may shape the next quarter. Let’s highlight some key major economic themes that will determine the course for the next few months.

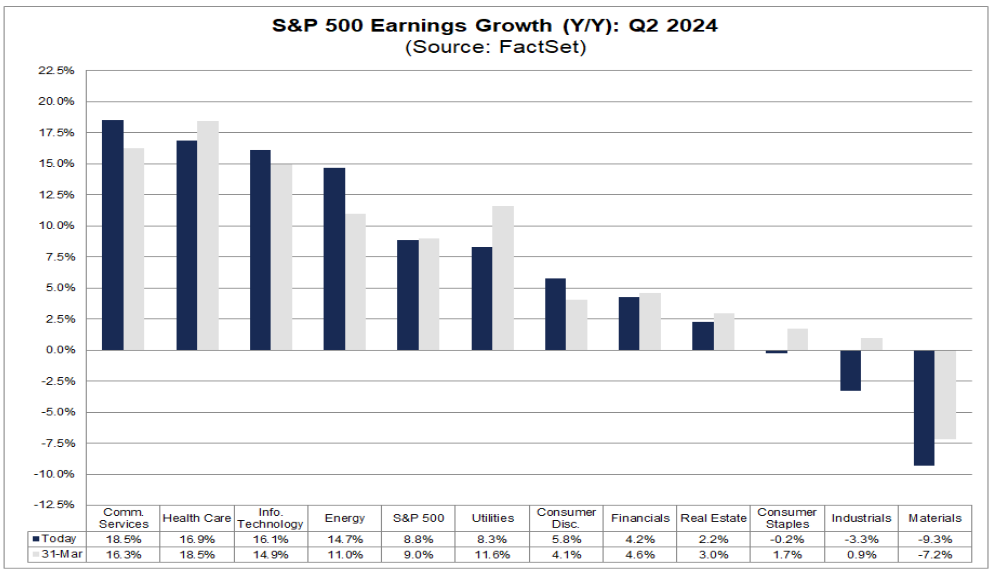

Q2 Earnings Season

Second-half corporate earnings reports will provide critical insights into corporate performance and future growth prospects for the economy. In the chart below, second quarter earnings expectations for the S&P 500 are slightly below estimates from the start of the quarter but are expected to report its highest earnings growth in more than two years.

U.S. Economy

The U.S. economy is gradually cooling. The unemployment rate ticked higher from 3.4% to 4% year-over-year, suggesting further softening in the labor market as businesses feel pressure from higher interest rates. Tightness in the housing market persists as buyers feel the pinch of high home prices and high interest rates. Inflation is slowly trending downward as the personal consumption expenditures (PCE) index data from last week showed that consumer price growth edged down to 2.6% on a year-over-year basis.

Despite the apparent slowdown in fundamentals, the economy remains in decent shape as household balance sheets and real incomes steadily grow at a healthy rate. From an economic data standpoint, consumer spending and manufacturing components are showing signs of growth. However, data suggests more weakness in corporate earnings and a softening of the labor market during the summer. This may provide the Federal Reserve with enough evidence to begin easing interest rates at their September meeting.

As the sun sets on the first half of the year, let’s prepare for whatever the markets bring over the coming summer months. We believe equities should continue to outperform bonds as growth and inflation lose momentum, even though the upcoming U.S. election may cause short-term volatility. Today is a great time to capture attractive longer term bond yields and move out of short-term cash positions prior to the Fed lowering rates. Contact your Wealth Management Advisor today when questions arise as you enjoy the warm weather! Your success matters to us!