Spring Cleaning: Time to Cultivate Your Financial Plan

April 15, 2024

By Matthew Andera

By Matthew Andera

Securities AnalystAs the old adage goes, April showers bring May flowers. Depending on where you are from or walk of life, this proverb can take on many meanings. Here in the Midwest, it means that we have finally made it through winter (aside from the occasional spring snowfall). The way I interpret the classic saying is that April represents a time for preparation. A time to do some spring cleaning and tackle projects neglected during the winter months. For farmers, it means a return to long days in the fields. For accountants, it signifies the conclusion of an arduous three months of tax preparations.

April also happens to be Financial Literacy Month as designated by US legislators in 2003. According to a 2022 Federal Reserve survey on the economic well-being of households, 75% of Americans had some form of retirement savings, but only 40% felt that they were on track for retirement. With quarterly statements recently sent out and account information fresh on the mind from filing taxes, now is a great opportunity to assess your financial plan and ensure you are on the right path to achieving retirement goals.

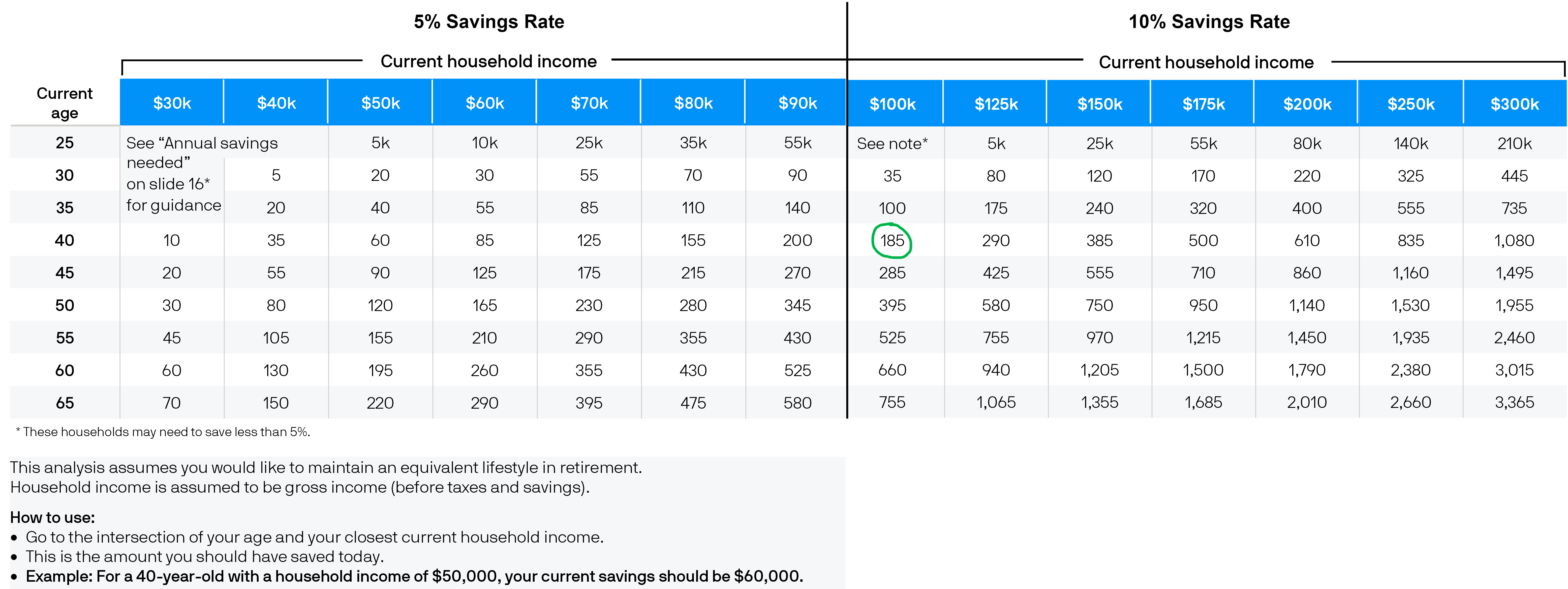

With the help of J.P. Morgan’s Guide to Retirement, let’s check in on a base case scenario of current retirement savings. The following chart represents an ideal level of retirement savings given current age and household income. The cross section of these two points will give you an estimate of what current household retirement savings should look like. For example, a couple in their early 40’s with household income of $100,000 should have combined retirement savings of roughly $185,000.

Feeling behind? That is ok. These figures are general guidelines and do not necessarily account for your cost of living needs. They are also designed for a retirement period of 35 years. So if retirement begins at age 65, having sufficient funds to last until age 100.

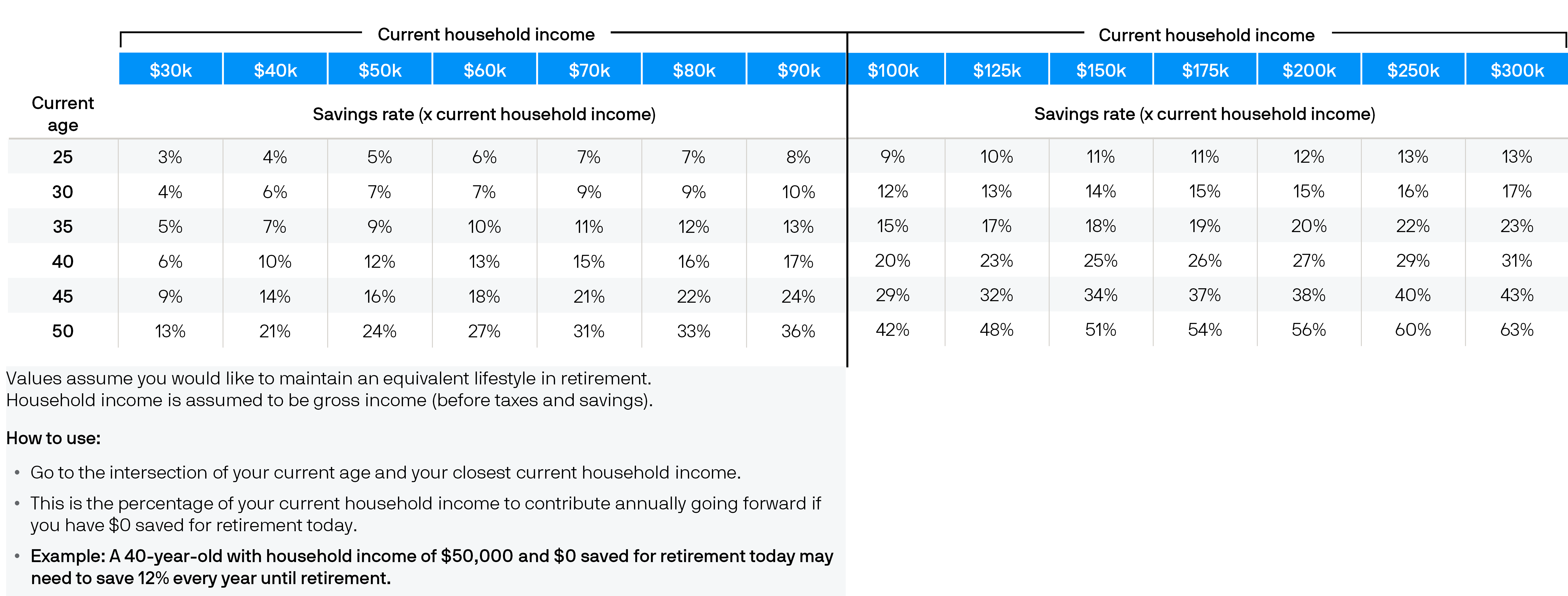

Have life events prevented you from saving for retirement altogether? This next chart helps project a savings scenario to get you back on track. Let’s revisit our couple in their early 40’s from the previous example and assume that they currently do not have any retirement savings. They should expect to start setting aside 20% of their annual income for retirement.

If you are concerned with where your retirement savings fall in the previous charts, do not be alarmed. These are broad guidelines that make numerous assumptions. More importantly, they do not reflect the reality of everyone’s circumstances. If you are uncertain about your current trajectory, allow us to help. We can take into account your specific situation and with financial planning software, tailor a savings plan that is right for you.

With the right preparation and hard work, your investments can blossom into a bountiful retirement. If you are unsure of how to best grow your investment assets, please contact your Financial Advisor. Your financial success matters to us.