Sticking to the Game Plan through Economic Bracket Busters

March 24, 2025

By Ted Hanson

By Ted Hanson

Portfolio Manager

Last week the Federal Reserve met for its regular Federal Open Market Committee (FOMC) meeting. In addition to the statement release and press conference, the Federal Reserve also released its quarterly Summary of Economic Projections (SEP). In the true spirit of the NCAA basketball tournament, the Fed filled out a bracket but acknowledged there will likely be multiple upsets in its forecast. Let’s take a look:

Gross Domestic Product (GDP)

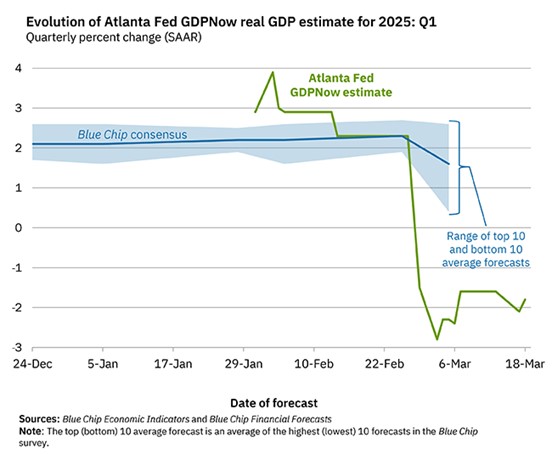

The median forecast for economic growth in 2025 was lowered to 1.7% from the previous projection of 2.1%. The downward revision was not surprising as many economists predict first quarter growth to slow due to tariff induced trade imbalances and slowing consumer spending. The Atlanta Federal Reserve’s GDPNow highlights the possibility of negative growth in the first quarter as risks remain elevated. However, expectations are for positive growth in the following quarters, resulting in the Fed’s 1.7%-year end projection.

Inflation

The median forecast for year-end core (excluding food and energy) inflation was revised higher to a rate of 2.8% from the previous projection of 2.5%. However, the expectation for year ends 2026 and 2027 did not change. This implies Fed members expect the new trade policies and tariffs will result in a short-term increase in inflation. However, Fed Chairman Jerome Powell noted they anticipate the inflation effects of tariffs to be a one-time transitory boost and not affect the Fed’s ability to reach the 2.0% inflation target by 2027. We are all aware of the risks of using the term “transitory” to describe inflation.

Fed Funds Interest Rate

There were no changes made to the short-term interest rate set by the FOMC. The median forecast for 2025 indicates 0.5% worth of rate cuts this year. Chairman Powell noted there is plenty of uncertainty in the rate forecasts given the challenging environment. Some risks (higher inflation) call for rates to remain elevated while other challenges (slowing economic growth) indicate the Fed needs to lower rates and be stimulative. Therefore, Fed members elected to remain on pause and continue to assess economic data before determining the next path forward.

Implications Going Forward

The updated projections highlight the increased level of uncertainty since the last FOMC meeting. In the press conference afterwards, Chairman Powell acknowledged how the Trump Administration is currently looking to make significant changes in trade, immigration, deregulation, and fiscal spending. All of which bring its own level of risks and uncertainties that can drastically influence the economic landscape and the Fed’s actions moving forward. While uncertainties are elevated, the economy is starting from a solid place of roughly 2.0% growth, 2.5% inflation, and a 4.1% unemployment rate. Due to this, the Fed will remain patient and assess incoming data for a clearer economic picture before deciding on an action plan.

Last week was another reminder for financial markets that we are in uncertain times. With volatility expected to continue, a focus on broad diversification and valuations will remain essential to long-term success. There remain opportunities for both equity and fixed income investors, however caution is warranted. Please reach out today to discuss your goals and path to successfully achieving them. Your success matters to us.