By Ted Hanson

By Ted Hanson

Portfolio Manager

There is excitement in the air and widespread buzz of anticipation. Players around the country are competing to be at the top of their game. Who will be victorious and emerge as the leader above the rest? This certainly applies to the College World Series, as it closes out today in Omaha. However, I’m talking about the latest competition in the artificial intelligence (A.I.) sector.

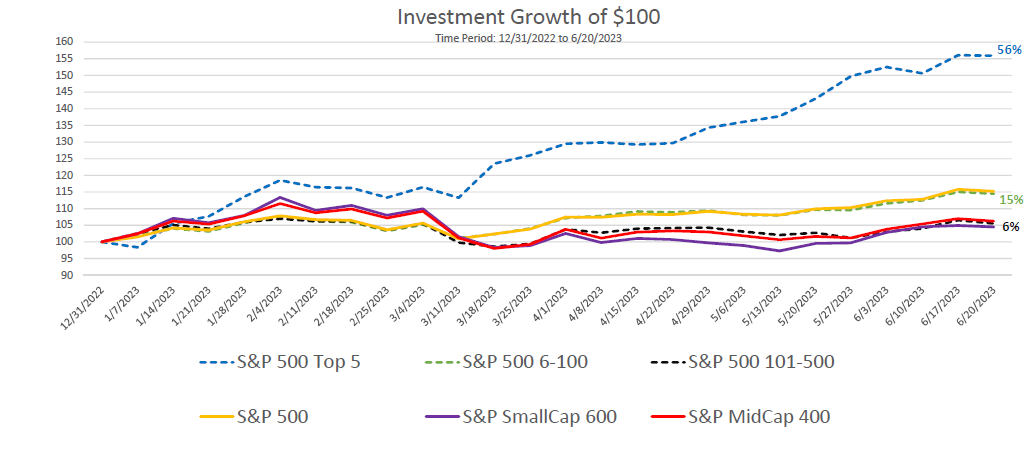

The rise of ChatGPT, an artificial intelligence chatbot developed by OpenAI, has sparked an increase in excitement and speculation on what our future has in store. The power of ChatGPT has drawn interest and money into any company with ties to A.I. development. As a result, many ETFs centered around A.I. have increased 25-40% year-to-date, significantly above most other sectors. In fact, shown in the chart below, the top five weighted stocks in the S&P 500 Index (which happen to have involvement in A.I.) outperformed the rest of the index by a wide margin and have driven most of the index year-to-date performance. This outperformance helped the S&P 500 enter bull market territory earlier this month (defined by a gain of more than 20% from its previous low), ending the longest bear market since 1948.

Source: Morningstar Direct

Speculation Over AI's Pivotal Role in Shaping Future Markets

While this bodes well for those invested in A.I. this year, caution is warranted. It is too early to determine if A.I. has led investors toward another asset bubble or a great long term investment. Throughout history, we’ve seen the rise and fall of multiple assets classes and sectors as investors pile excess cash into the newest trends. Recent examples include the explosion in “meme stocks” and cryptocurrencies. Oftentimes when the latest trend drives speculation, it is not uncommon to see those companies come crashing back down to earth. For example, in early 2021 the price of GameStop shot through the roof like other “meme stocks”, gaining 434% in five trading days. However, over the course of the next two weeks the stock gave up that gain and then some. While companies can prevail and emerge from the ashes, most do not recover. With more headwinds than tailwinds in the markets today, investors can expect continued volatility.

Diversification Still The Key To Taming Today's Turbulent Markets

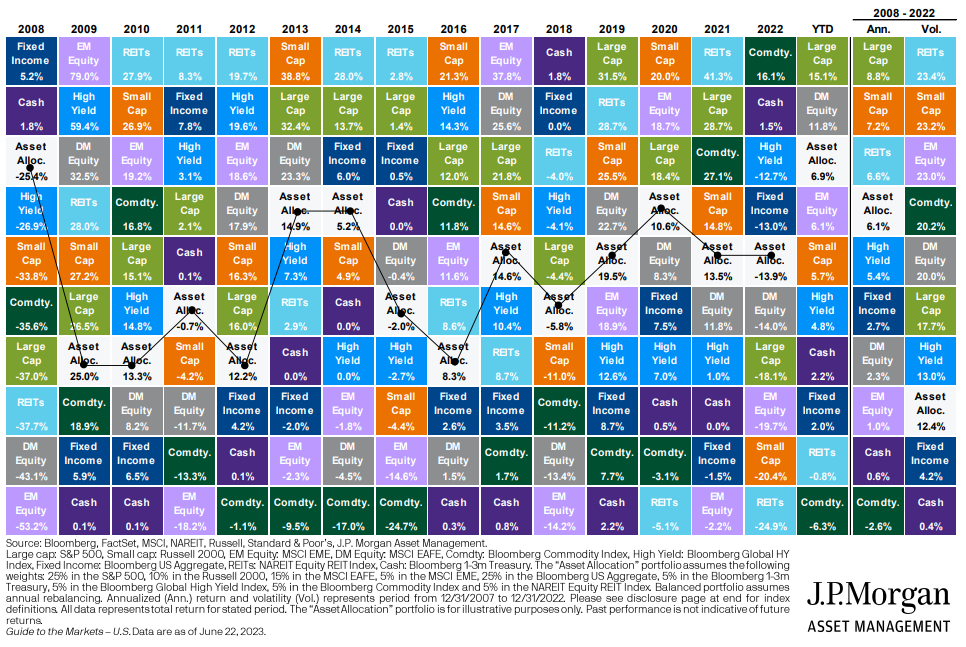

Due to uncertainty of human nature and volatility with chasing the latest trend, we continue to believe in broad diversification. The chart below, provided by J.P. Morgan, provides a visual of how asset classes move in and out of favor any given year. While the peaks may not be as high and the valleys not as low, the long term performance of a well-diversified portfolio tend to provide more consistent and favorable returns.

As a fiduciary, we are responsible for prudent management of your hard earned dollars. While A.I. has a place in future development of our daily lives and economy, we don’t fully know to what extent. That said, we are optimistic on our economy’s future, but we will continue to be cautious and conservatively invest on your behalf. A broad diversification across all asset classes will continue to serve long term investors well. If you’d like to discuss your portfolio, please

reach out to your Advisor or Investment Manager today; your success matters to us!