“The Best Way to Predict the Future is to Create It”

October 23, 2023

By Michael List, CFP®

By Michael List, CFP®

Investment Management OfficerWhen we look ahead to what the future will look like, we often start by looking to the past for clues. We look back for times of similar circumstances and then to the subsequent outcomes. We can also dig deeper into what people at that time were concerned about, what their predictions were for the future, and what things they could have done differently to improve outcomes.

What does the future hold for the stock and bond markets? Let’s take out the crystal ball and gaze at history.

A look at bonds:

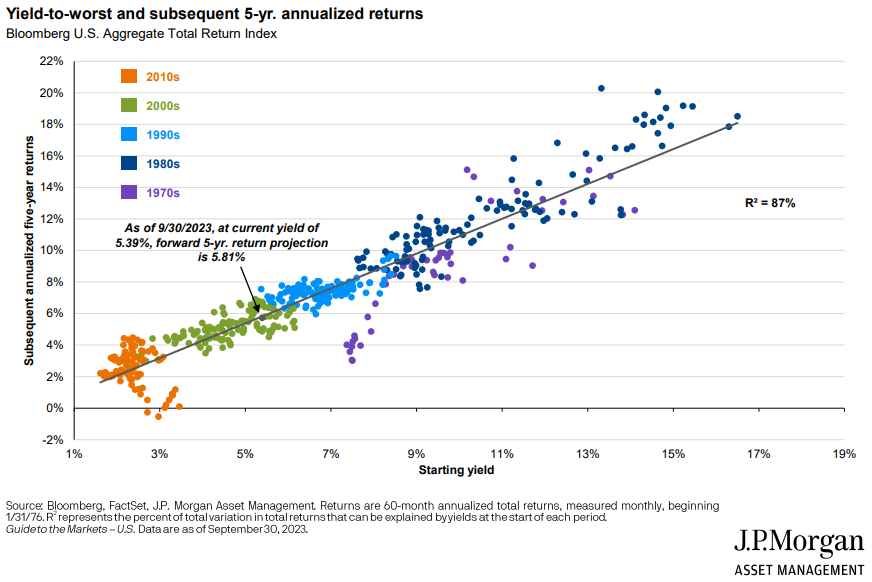

Looking back, bonds have been disappointing. They provided less protection from equity declines in 2022 and the aggregate bond market has a negative return over the past three and five years. However, the next five years will likely look very different from the last five. We cannot be certain of many things five years from now: yield curve shape, inflation rates, GDP growth, and employment will all be important factors. Still, we do know one thing, which has been the most important estimating factor of all, the starting yield.

The yield on the aggregate bond market today is nearly 5.4%, twice the starting level from five years ago and higher than most of the past two decades. As the chart below shows, there is a very strong relationship between the starting yield and the subsequent 5-year return.

A look at stocks:

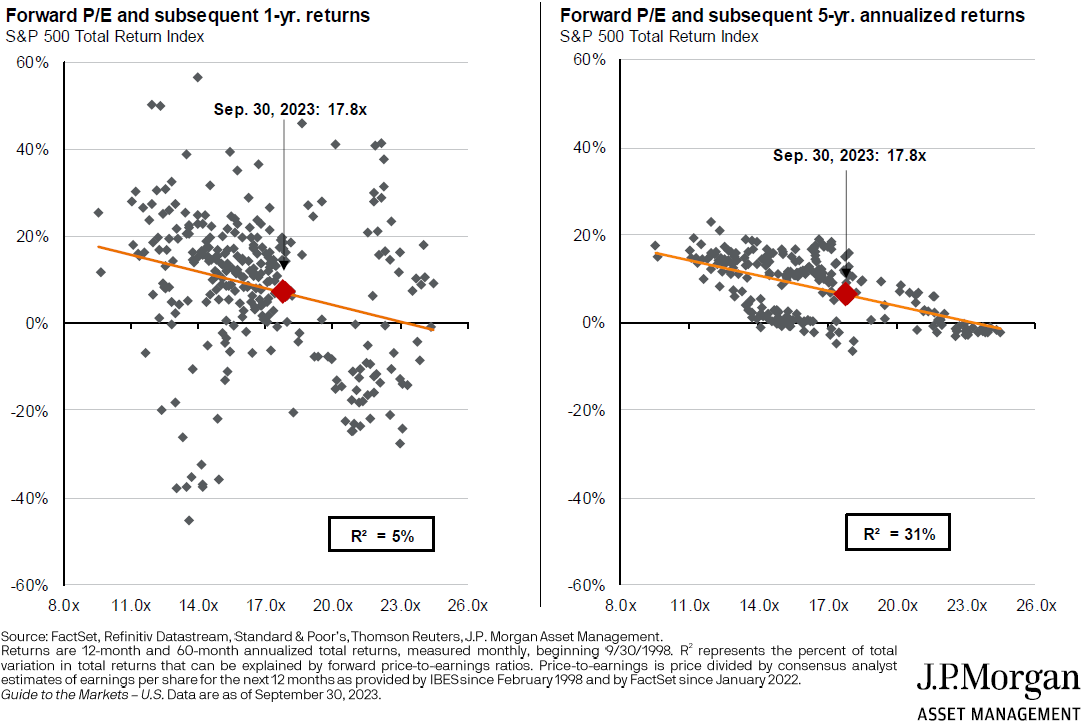

Stocks have provided modest returns during the past five years, but they have certainly been volatile. Similar to bonds, we often look at the starting yield for the stock market for an indication of future returns. From today’s starting price to earnings (if we flip this ratio to earnings over price it becomes the earnings yield: the markets 17.8 P/E ratio becomes 5.6% E/P or earnings yield) stocks have historically provided future 5-year returns in the upper single digits, as seen in the chart below.

Unfortunately, the relationship between earnings yield and stock returns is not nearly as strong as bond returns and yields, in addition stock returns will be more volatile. The increase in volatility is reasonable, because with stocks we are buying a share of future cash flow and earnings which are far from certain.

Whereas, with a bond we are buying coupon payments and principal repayment, which are set when the bonds are issued.

There are few things we can know with certainty, besides death and taxes. Looking in the past, we can also be confident that surprises await us in the future. We have seen that even the best laid plans don’t get everything right and require discipline and monitoring.

On the other hand, if we do not plan at all, as Winston Churchill said, “He who fails to plan is planning to fail.” Your success matters to us. Call your advisor to update your financial plan or get one started.