How Presidential Elections Impact the Stock Market

October 21, 2024

By Michael List, CFA, CFP®

By Michael List, CFA, CFP®

Investment Management Officer

With news headlines constantly covering every aspect of the presidential race, you may be wondering how the 2024 election may impact you and your finances. After all, every four years, uncertainty about the next president and their economic policies can lead to more uncertainty in the minds of investors.

The long and short of it is you may care passionately about who wins, but your investment portfolio probably doesn’t.

While it is common to believe elections can have a large impact on financial markets, historically we see that any impact has been short-lived and muted.

This year's volatility leading up to the election

True to historical patterns, we have seen market volatility increase in the months leading up to the election (August, September, and October). In previous elections, this volatility has been short-lived and decreases in the months following the elections. We expect this year to be no different.

Source: Morningstar Direct and Security National Bank

The volatility in the election leadup happens because financial markets are often touted as a forward-looking indicator. They're a tool for investors and speculators to gauge expectations for the future.

Does the market care which party actually wins?

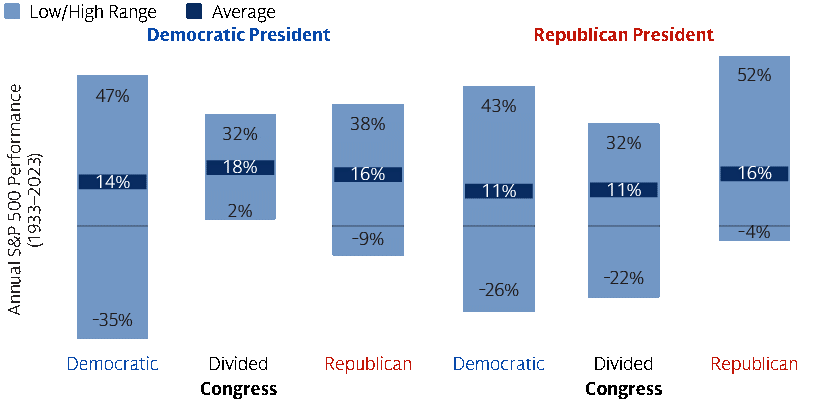

As this chart shows, while the stock market has fluctuated under the leadership of both parties, the S&P 500 has trended higher over the long term, no matter who’s in office.

Source: Bloomberg and Goldman Sachs Asset Management

The trend suggests that the stock market's performance may have more to do with the overall strength and resiliency of the U.S. economy rather than the person who sits in the Oval Office, or which party controls Congress.

This is not to say the structure of government is unimportant, but the impact on the economy and markets will be more subdued than we may expect.

The most important takeaway

Elections often create some short-term uncertainty, so it’s best to prepare for some volatility over the next few months. But don’t allow unexpected price swings to influence your overall approach.

Hopefully, this provides some context on what to expect from markets in the weeks and months ahead. It feels like this election cycle has been dragging on for years, but it is finally upon us. Take the opportunity to cast your vote. As always, if you have any questions or concerns about your investments, please reach out to a financial advisor today. Your financial success matters to us.