The Burning Question: When to Start Social Security?

August 19, 2024

By Michael List, CFA, CFP®

By Michael List, CFA, CFP®

Investment Management Officer

The most common questions people have as they approach retirement are related to their retirement accounts, Social Security, and Medicare. What should I do with my 401(k)? When should I draw Social Security benefits? What are my Medicare options? We have a Medicare lunch and learn in a few weeks, sign up here to learn more about those benefits. Today, we will look at strategies for Social Security benefits and learn what you can do with your retirement accounts for a later commentary.

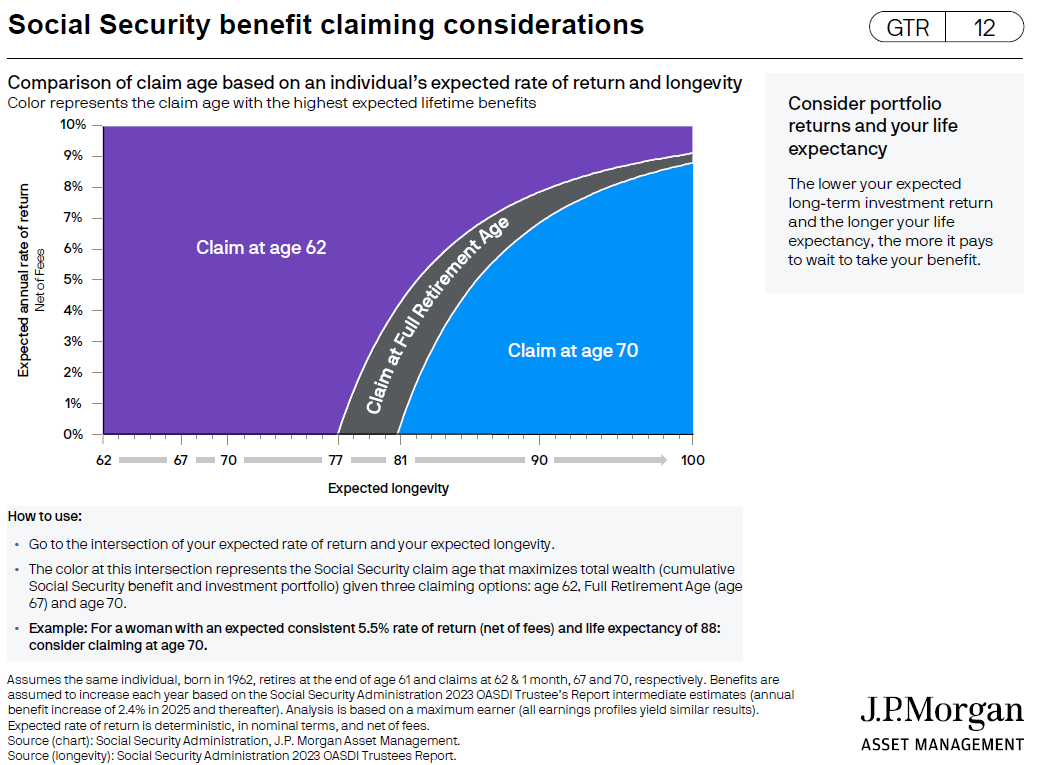

The question about Social Security (SS) retirement benefits is when should I start taking Social Security, 62, full retirement age or 70? Often, we narrow this to two options, as soon as possible or waiting for maximum monthly benefits at age 70. From there, with just a couple factors we know the optimal choice, what rate of return am I able to earn on my retirement assets? and how long will I live? The chart below from JPMorgan’s Guide to Retirement provides a nice visual for the optimal choice, with rates of return on the left and longevity along the bottom. The thin gray sliver in the middle is claiming benefits at full retirement age. It’s the smallest area so it has a minimal optimal range, allowing us to simplify and toss that one out from the start.

Claim at Age 62

Claiming at 62 is the largest area on the chart and is the best option when rates of return are higher or longevity is shorter. Longevity is the easiest to understand. If I do not live past age 70, I’m better off receiving smaller benefits in the early years than receiving no benefits at all. When we consider the rate of return, because SS benefits only grow by a set rate as we defer benefits, higher investment returns can exceed this growth rate. If I can earn a higher return on the SS benefits I invest or on my other retirement assets that I did not have to spend because I was living off social security income, then I benefit by claiming early.

Claim at Age 70

The option to wait until age 70 makes up the next largest area on the chart. It is the best option if returns are lower or longevity is longer. Current actuarial tables show average longevity for a 62 year old is between 19 and 22 years or age 81 to 84. Therefore, if returns are below 6%, deferring until age 70 could be a better option on average.

Unknowns and Other Factors

Unfortunately, we do not know how long we are going to live and what future returns will be in retirement. Those will only be known after the fact. To complicate things even more, there are often other factors to consider.

Benefit Reduction

Claiming SS benefits before full retirement age (FRA), subjects your benefits to being reduced if your income is above the earnings limit. Social Security will deduct $1 from your benefit for every $2 you earn above the annual limit ($22,320 for 2024) in years prior to your FRA. They will deduct $1 from your benefit for every $3 you earn above the annual limit (59,520 for 2024) in the year you reach FRA [good news for January and February birthdays, this only applies to earnings before FRA, there is no earnings limit after FRA]. This can significantly impact your ability or willingness for part-time or full-time employment while taking early benefits. If you are planning on drawing SS benefits and continuing to work, benefits could be reduced.

Spousal and Survivor Benefits

Spousal and survivor benefits are other factors. A spouse may be eligible for the spousal benefit income. This can be as much as half of the worker’s primary insurance amount, or their retirement benefit based off their own earnings, whichever is greater. Both spouses can claim SS benefits in retirement at the same time. However, when the first spouse dies, the surviving spouse will only retain one SS benefit, either their own or their spouse’s whichever is higher. This is a factor we need to consider if the plan is dependent on SS benefits to fund retirement expenses. Another area this can impact is inheritance as benefits will stop when the second spouse dies, which is different from your IRA and 401(k) that can pass to your heirs.

Spending

Another factor is spending. For most retirees, spending does not grow at a steady inflation adjusted pace. Retirement expenses look different for people in their 60’s, 70’s 80’s and 90’s. This is where a financial plan can be very helpful to build in variability in spending.

When we work through financial plans, waiting to claim until age 70 frequently provides higher chances for success. There are two reasons for this. First, SS benefits shift longevity risk from us to the government. We commonly estimate plans to age 93, but if we live longer, Social Security will continue to pay, so we won’t outlive the SS benefits. Second, when determining probability of success, successful scenarios are when we can fund all the goals and have money left over. Unsuccessful scenarios are when money runs out before time does. If a plan is successful with average returns, it will be successful with higher returns as well. On the other hand, the lowest simulated returns are the scenarios likely to be unsuccessful. And we know from our chart, lower returns are better when deferring to age 70. This will lead to fewer unsuccessful trials and a higher probability of success.

While retirement can be an exciting time, it can also be intimidating as well. Having the knowledge and time to think about these different aspects can help you make more informed choices. Join us for lunch to learn about Medicare or schedule an appointment with us to see how the different social security strategies can affect your financial plan.