The Dual Purpose of the Rate Hike

March 27, 2023

By Jonathan Smith

By Jonathan Smith

Securities Analyst

Amid growing banking concerns, sticky inflation and elevated recession risks, the Federal Reserve has a complex task ahead of them to manage a soft landing for the U.S. economy. The Federal Reserve’s dual mandate is to maintain long-term price stability while maximizing employment in the U.S economy.

While the Federal Reserve has a dual mandate, they have been focused on ensuring confidence in the U.S. banking system due to the recent bank failures. Over the last week, immediate measures were taken by the Fed, FDIC (Federal Deposit Insurance Corporation), the Treasury Department as well as other banks to boost liquidity due to capital shortages to limit potential lingering effects in the financial system.

Federal Open Market Committee Meeting

The Federal Reserve raised interest rates for a ninth straight meeting by 0.25% last Wednesday. This moved the Federal funds rate to a range of 4.75% to 5.0%. Federal Reserve officials considered a 0.50% increase at their last meeting, prior to the banking issues; however, the recent bank failures led them to question if additional rate hikes were a wise move at the meeting.

If the Fed did not raise rates last week, it may have sent a message that they are immediately concerned about health of the U.S. financial system. That move would have also questioned the Fed’s commitment to tame inflation. By raising the short-term interest rates 0.25%, the Fed was able to address both purposes of continuing to tame inflation and boosting confidence in the financial system.

Summary of Economic Conditions

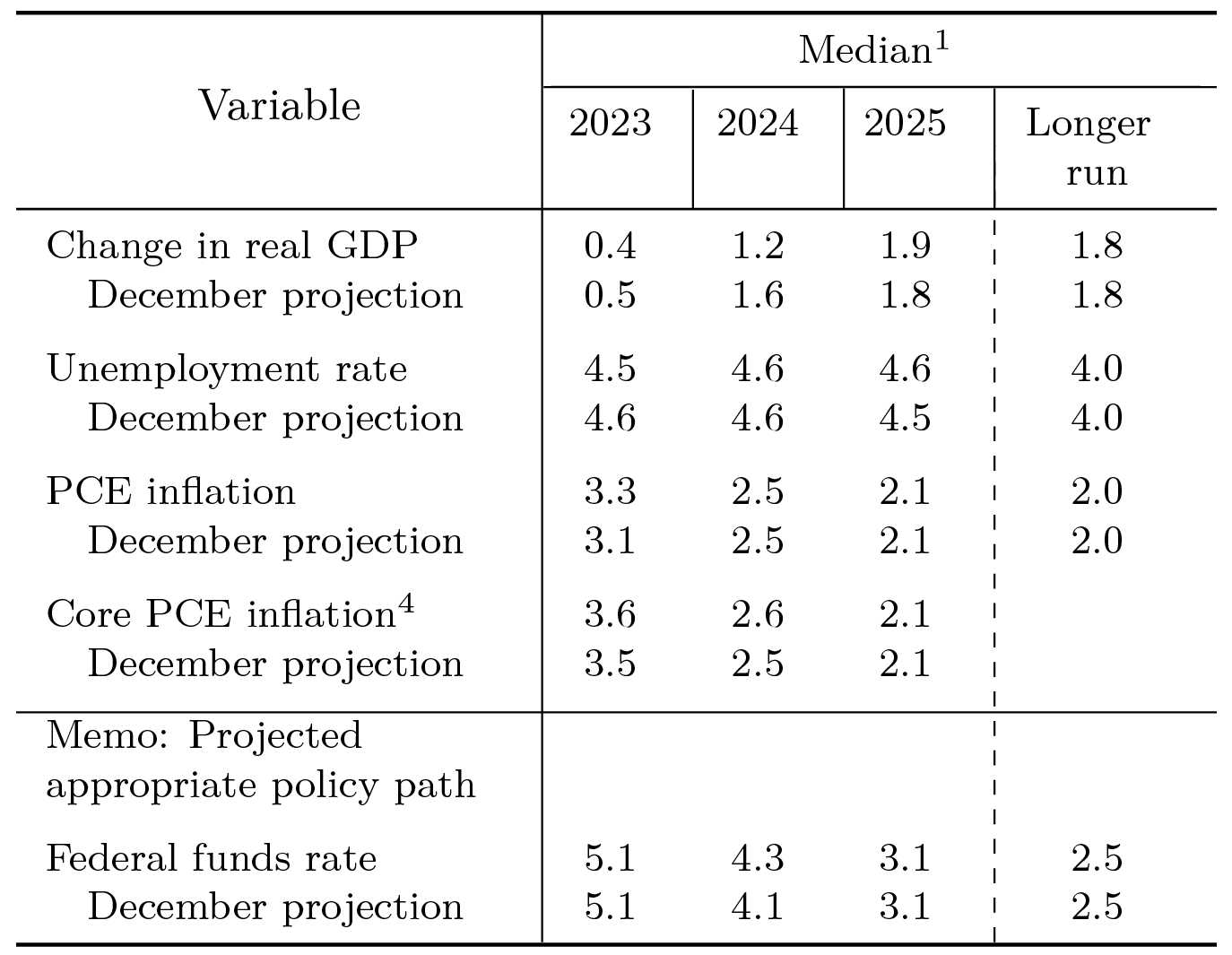

The Federal Reserve releases a quarterly summary where members forecast GDP, employment levels, and inflation. The summary below shows that policy makers are expecting slower growth and a tighter labor market than their previous December projections. Inflation is expected to be a bit more persistent than previously forecasted while signaling the Fed may be at the end of their rate hiking cycle.

Source: FederalReserve.gov

With recession risks rising, we encourage you to remain disciplined on your long-term strategy and financial goals. Diversification and risk management is crucial in today’s current market environment. Please do not hesitate to contact your SNB Wealth Advisor if you have any questions or concerns about how your portfolio is positioned to navigate the market volatility.