The Flip Side of the FOMC Dual Mandate

May 24, 2021

Michelle Holmes, CFA

Michelle Holmes, CFA

AVP - Investments

Inflation is back but for how long? This is an ongoing debate that has captured headlines for the last few weeks. The bond market and the Federal Reserve are on opposite sides of the inflation debate. Some economists are predicting the current rise in inflation we are seeing will stick around longer than the Federal Reserve (Fed) is anticipating. This, as my colleagues have discussed in recent articles, could cause the Fed to raise short-term interest rates sooner than they had planned.

The Full Picture

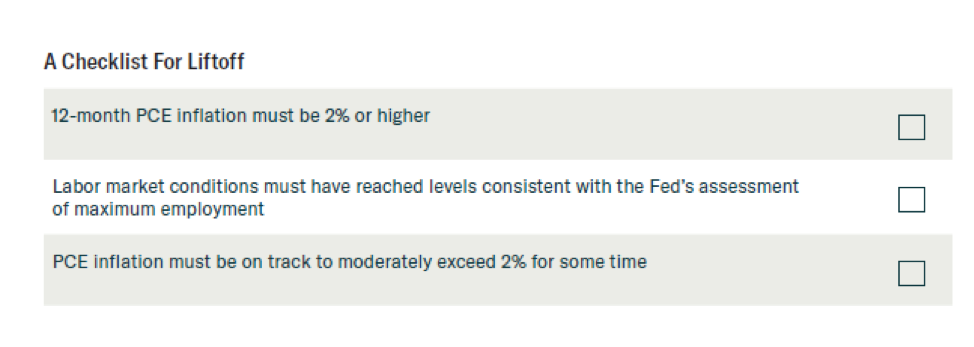

Although inflation is an important factor to consider when deciding when to raise short-term interest rates, it is only half the picture. The Fed has a dual mandate of stable prices and maximum employment. It gauges price stability through the rate of inflation using the personal consumption price index (PCE) and maximum employment through the unemployment rate. The Federal Reserve will want to see progress in both areas of the dual mandate before deciding when to start raising short-term interest rates.

Source: BCA Research

The Fed's New Viewpoint

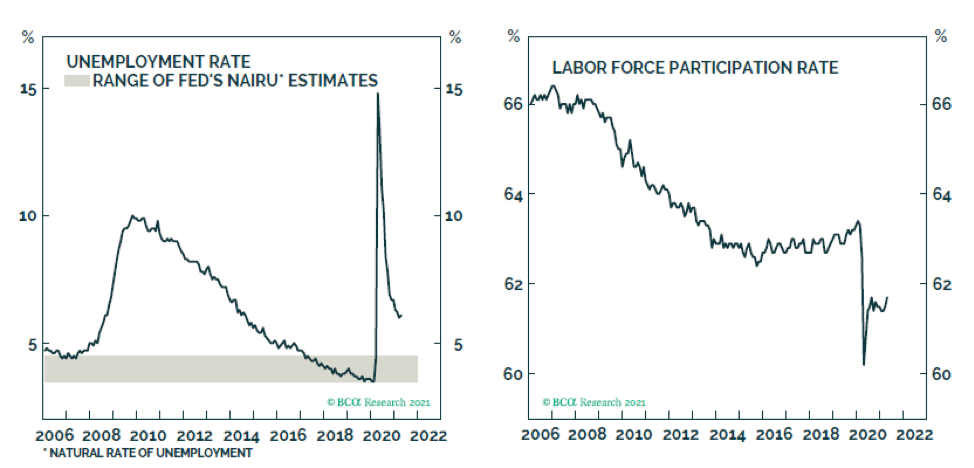

The Fed not only changed its inflation target to an average over time, it also changed the way in which it views maximum employment. The Fed will still want to see the economy reach maximum employment which by its estimates would be in a range of 3.5% to 4.5%. It will also want to see the labor force participation rate move back to pre-pandemic levels. The Fed will want to see progress in participation rates of those areas and demographics hardest hit during the pandemic including minorities and lower-wage earners.

Source: BCA Research

Inflation and the Labor Market

We typically do not see wage inflation with such a large number of people unemployed. However, many employers are finding it hard to fill open positions, especially in the hardest hit areas like the leisure and hospitality sector. There are a number of reasons for this lack of supply in the labor market. Some people are afraid to return to work during the pandemic and some are receiving more money with the extra unemployment benefits. Others can’t work until schools go back to in person learning and daycare centers open.

This lack of supply in the labor market should resolve itself as vaccinations continue, when the extra unemployment benefits end, and as daycares and schools open again. The bigger challenge is how quickly the Fed will act if inflation remains higher than it anticipates as these supply issues not only in labor but in many other parts of the economy work themselves out.

As my colleague Mike Moreland mentioned in Influencing Inflation and the Economy, it is hard to tame inflation once it becomes embedded in the economy and consumers’ expectations and behaviors. The Fed may have to act sooner and more emphatically than is now projected.

Portfolio management for our clients is a process that equally weights return and risk management. Your success matters to us. Let us know how we can help you.