The Latest CPI: More Shoveling of Inflation is Needed

January 15, 2024

By Ted Hanson

By Ted Hanson

Portfolio ManagerAs we begin a new year, it is common for investors to feel overwhelmed with an influx of data, forecasts, and returns placed in front of them. It feels like you are constantly having to shovel accumulated information to stay up to date (see what I did there?). While all of it may be important, some is more relevant than others. Last week we received an economic report that will not only be relevant now but will remain so for the rest of the year. The consumer price index will help us determine how much inflation remains to be scooped out of the economy.

The Consumer Price Index (CPI)

The consumer price index is a measure of the overall price changes on a variety of goods and services over time. This monthly report is not only a useful tool to measure inflation but is also utilized for cost-of-living adjustments, business decisions, and a variety of other uses. Last week’s report of December’s CPI allowed us to gauge the progress made in bringing inflation back down to the Federal Reserve’s 2% target.

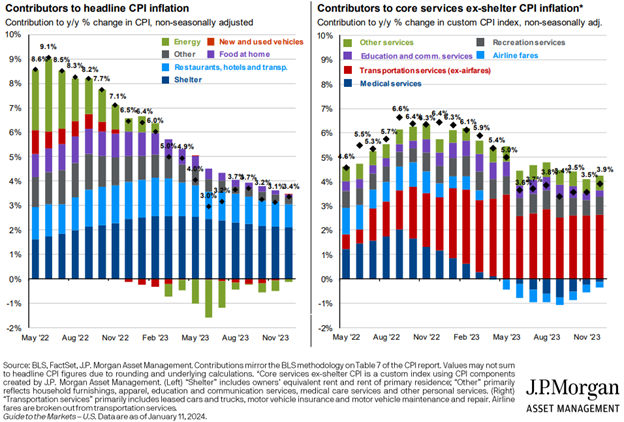

CPI rose 0.3% in December or an annualized rate of 3.4%. Both 0.1% higher than expected but a significant improvement from the 9.1% peak in mid 2022. The primary driver of the recent inflation print remains the shelter and services sectors.

Contributors to the Increase

Shelter saw one of the biggest increases in months with a 0.5% gain in December. Overall shelter continues to trend downwards but remains significantly elevated. Given how much rents, mortgages, and housing costs account for household budgets, shelter inflation will continue to be closely monitored this year. There is optimism shelter inflation will continue its downward trend in 2024, as apartment supply increases and new leases are signed.

Other core services rose 0.4% in December and an annualized rate of 3.1%. Primary drivers of the service inflation were led by medical services rising 0.7% and airfares gaining 1.0%. Rental car rates and other intercity transportation helped offset those gains by declining 0.7% and 2.6%, respectively.

Cautious Optimism Going Forward

Overall, last week’s CPI reading was higher than expected. Nonetheless, inflation significantly trended downward last year and optimism remains it will continue to do so in 2024. The Federal Reserve will continue to closely monitor inflation (like CPI) and other economic indicators. The Federal Reserve’s commitment to bringing inflation back down to its 2% target means both higher interest rates and a restrictive monetary policy could be around for longer than currently anticipated.

We remain encouraged that inflation will continue to trend downward in 2024. In the meantime, we’ll continue our cautiously optimistic portfolio structure, focusing on quality, income, and diversification. Portfolios under our charge will remain fully invested throughout an economic cycle. Please reach out if you ever feel an avalanche of information, we’ll be here to help dig you out! Your success and future matter to us.