The Market's Silent Response to Middle East Turmoil: Uncovering the Clues

November 20, 2023

By Michael Moreland

By Michael Moreland

Retired VP - InvestmentsSometimes the absence of a reaction is as big a clue to the puzzle as an overt event. In the Sherlock Holmes short story ‘Silver Blaze’, it was the dog that did not bark in the night that suggested the identity of the culprit as someone known to the dog and the victims of the crime.

This story came to mind with the bond market’s near non-reaction to the October 7 Hamas attack on Israel. Throughout modern times, the reaction to unexpected, negative events has been a ‘flight to quality’. Risk assets are sold, with proceeds rushed to risk-free assets, primarily US Treasury issues. Prices rise and yields fall on such issues.

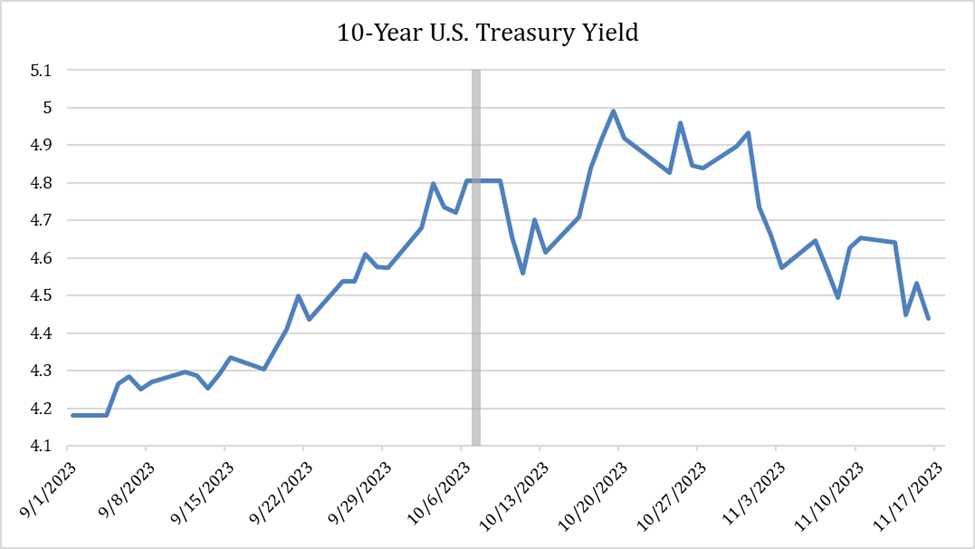

Bond Yields Continued Climbing Following Attack

The market move immediately following October 7 was negligible. Bond yields dipped a few basis points (a basis point is one one-hundredth of one percent), and then continued their upward climb through the end of October. The performance of the benchmark ten year Treasury note is below:

Why the anomaly? My conclusion is that markets are feeling the weight of continued federal deficit spending and debt buildup. The Treasury Department announced the fiscal 2023 deficit was $1.7 trillion, with spending rising to $6.1 trillion versus receipts (unexpectedly!) falling to $4.4 trillion. Total federal debt now exceeds $33.5 trillion, well above our nation’s GDP – with no sign of moderation in the future.

Higher Interest Rates on U.S. Debt will be Impactful

In the current (2024) fiscal year, interest on the federal debt is expected to exceed $1.0 trillion – higher than all but two federal line items: the Department of Health and Human Services and Social Security. One-quarter of every dollar the federal government brings in will go toward servicing debt – not to defense, infrastructure, or human services.

In the past, we’ve relied on the rest of the world to support us through purchases of our debt. That is changing as other global economies – particularly China – scale back their purchases of U.S. Treasury debt.

What all this means is, all other things being equal, markets will demand higher yields to absorb the additional supply of Treasury debt expected for the foreseeable future. And, higher yields will also be required to compensate buyers for higher credit risk. A few days ago, Moody’s placed U.S. debt on its credit watch for a potential downgrade, citing the same failures to control spending as discussed above.

So, referencing the graph again, why did yields fall again in late October and mid-November? The start of the rally was a matter of expected supply over the near term. The Treasury announced its planned financings and revealed a heavier reliance on short-term debt issuance (two years or less) than markets were anticipating. Longer-term debt witnessed a quick ‘relief rally’ on this news.

Last week’s surprisingly low inflation report added fuel to the rally, with participants increasingly convinced the Fed is done raising short-term rates. Time will tell whether this is correct.

Beyond today, our situation points to most interest rates remaining ‘higher for longer,’ regardless of the Federal Reserve’s intentions. Keep in mind that the Fed directly controls the short end of the yield curve, but markets dictate the level of longer-term rates. Yields will move up or down with world events, but the weight of additional supply will place a floor on how low longer rates might go.

How will Equity Markets Fair Going Forward?

A higher-for-longer scenario for longer-term interest rates will affect valuations of other asset classes as well. Equity markets are sensitive to returns available on competing investments. Equities have enjoyed the benefit of being the only game in town for many years, and that is changing. It doesn’t mean prices will fall, but it does suggest that a price-conscious, value-oriented approach to stock investing is appropriate.

Interesting times indeed, and our staff will explore this further in future blogs. In the meantime, as we approach year-end, consider meeting with your Wealth Management advisor for a review and planning session. Your success matters to us.