Are we in a recession or not?

August 8, 2022

By Ted Hanson

By Ted Hanson

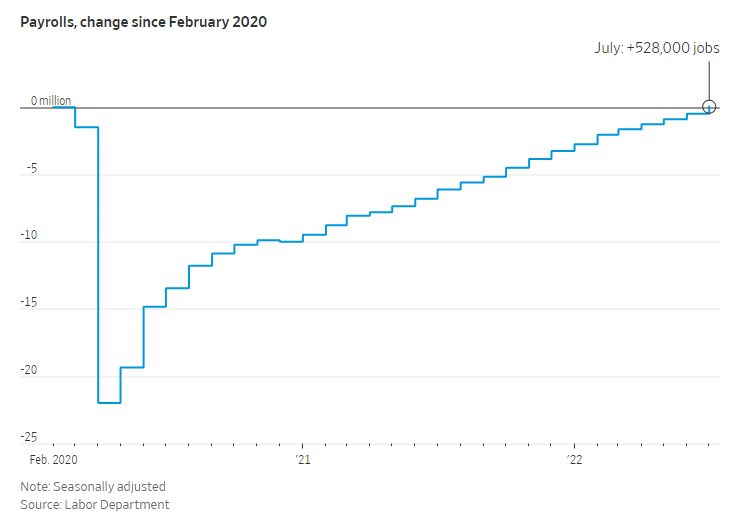

Portfolio ManagerThis is a confusing time for investors. After gross domestic product (GDP) declined for the second quarter in a row, many headlines read the U.S. economy was in a recession. However, last week’s release of July employment numbers painted a different picture.

Employers added 528,000 jobs in July bringing the economy back to pre-pandemic payroll levels. With that, the unemployment rate dropped to 3.5%, matching the half-century low seen in early 2020. These combined with a drop in supplier delivery times, inventory sentiment, and other factors, signal an economy not currently in a recession.

Source: Wall Street Journal

However, it is difficult to ignore two consecutive quarters of declining growth, persistently high inflation, and an inverted yield curve signaling a recession on the horizon. The Federal Reserve sees an economy with inflation significantly above the 2.0% target and a tight labor market. This sets the stage for more aggressive rate hikes in the coming months. With this risks will remain tilted to the downside. Both the Federal Reserve and market activity will remain data dependent in the coming weeks.

As you can see, a case can be made for drastically different outcomes. Whether we are in a recession or not, accounts under our charge will remain fully invested throughout a market and business cycle. Portfolios will continue to be conservatively structured with your long-term goals in mind. If you’d like to discuss your portfolio please reach out today. Your success matters to us.