The Road to Tax Reform Is Just Beginning

December 4, 2017

By Michelle Holmes

By Michelle Holmes

Trust Investment Officer

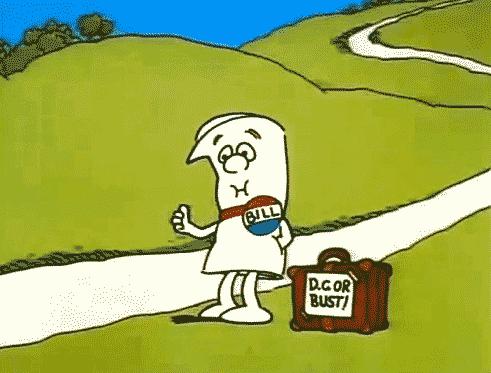

Hearing the news of the tax reform bill moving through Congress, I remember watching the Schoolhouse Rock cartoon as a child that explained the long road a bill has to journey down in order to become a law. A bill needs to pass the House and the Senate before the President can sign it into law but it is not as easy as it sounds.

As the Schoolhouse Rock’s cartoon points out, it is a long road for a bill to make it into law. A bill starts out in a subcommittee that works out the basis for the bill. Then the bill goes before the House and Senate separately for debate and approval. Sometimes the bill comes out without further negotiations. However, larger and more complex bills go into conference committees to work out the differences in the versions of the bill passed by the House and the Senate. Then the compromise bill must pass both the House and the Senate before going to the President for signing into law. We are facing this case for the current tax bill.

Source: newyorker.com

The House passed a tax bill on Nov. 16. It took the Senate until this last weekend to pass their version of the tax bill. Now the real work begins. The House and the Senate need to form a committee to work out the differences between the two versions of the bill before voting on the final version and sending the bill to President Trump to sign into law.

No one knows for sure what the final bill will look like, but the House and Senate versions have some similarities. Major themes expected include:

- Lowering the tax rate for corporations

- Changing individual tax brackets.

- Increasing the standard deduction.

- Eliminating the personal exemption.

- Repealing of state and local tax deduction.

- Increasing the child tax credit

- Increasing deductions for estate tax.

Once complete the final bill must meet the budget reconciliation process in order for the GOP to pass with a simple majority vote without any help from the Democrats. To comply, the bill must not cut total taxes more than $1.5 trillion over the first 10 years and the bill cannot add to the budget deficit beyond the 10-year window.

The House and Senate are likely to start working on the compromise bill in committee this week with a final version expected before Christmas. The stock market reacted positively to the news of the Senate passing its version of the tax bill. If everything goes well, President Trump will sign the bill into law in early 2018 ending the tax bill’s long road to becoming a law.

For most of us, the question is not if the bill will affect our finances, rather it is just how much it will impact us. If you want to know how this or other news items that may affect your portfolio, contact the Security National Bank Wealth Management team today.