The Stock Market's Wild Ride

July 13, 2020

By Michelle Holmes, CFA®

By Michelle Holmes, CFA®

AVP - InvestmentsSummer always reminds me of swimming, softball games and family vacations. Most of the time we went camping for our family vacations, but the summer when I was 10 years old we went to Adventureland in Des Moines. That was the summer I rode in the front seat of a roller coaster for the first time. I remember it like it was yesterday.

I anxiously waited in line with my father to ride the tallest roller coaster in the park, the Tornado. I was so excited when I heard the lap bar click as the attendant pushed it down and the ride began to move. It seemed like an eternity as the coaster inched its way up to the top of the first hill. When we reached the top, I couldn’t see the tracks below us anymore. I yelled as the cart fell forward over the top of the hill, quickly picking up steam as we descended toward the bottom. The rest of the ride went by in a blur as the roller coaster twisted and turned through its course. What a thrill!

Being invested in the stock market the first half of the year has certainly been like riding a roller coaster.

The stock market experienced a quick, sharp decline in the first quarter and has already recovered from most of the downturn in the second, as seen in the chart below. While this may be thrilling for some, others experience gut-wrenching fear when faced with big ups, downs, twists and turns that come with the wild ride of investing in the stock market.

Source: Morningstar. Data as of June 23, 2020

Can the Market Keep Rolling?

The short answer is yes, the stock market can continue to rally.

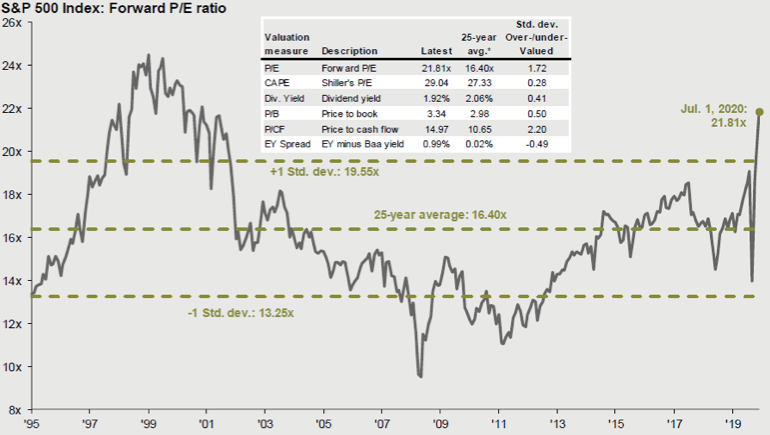

Today, stocks are expensive compared to their own historic value, but undervalued versus bonds. The average price-to-earnings ratio (P/E) on the stocks in the S&P 500 are now trading at 21.8 times their earnings — well above the average of 16.4 times. The dividend yield on the stock market is higher than that of the bond market. When this happens, it usually means it is a better time to own stocks than bonds.

Source: FactSet, Robert Shiller, Standard & Poor’s, Thomson Reuters, J.P. Morgan Asset Management

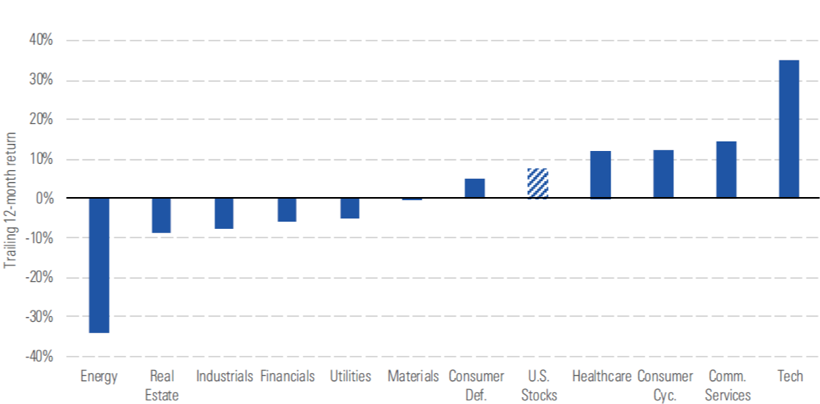

The previous chart gives the ratio of the market as a whole, but the recovery has been better for some companies and sectors than others. There was a wide dispersion of returns between the various sectors of the stock market over the last 12 months. Technology, health care and other sectors less affected by the economic downturn have risen more than other sectors like energy and real estate. This means there are sectors of the market that could be undervalued.

Source: Morningstar

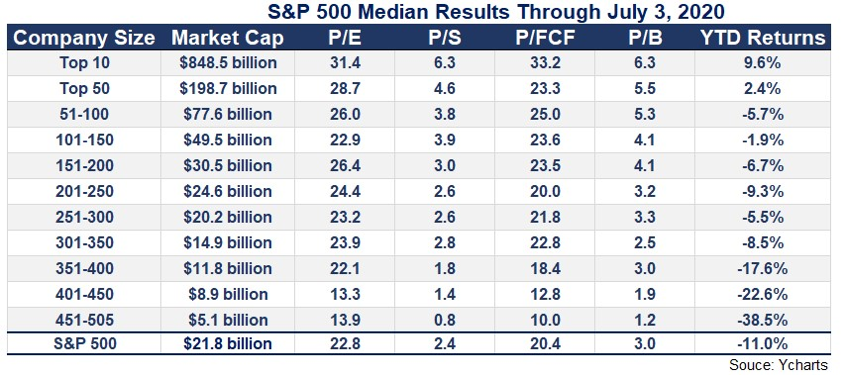

There is also a wide range of returns in the last six months depending on the size of a company. The chart below shows the larger companies recouped their price declines from the first quarter while smaller companies have a ways to go. This means there are several small and medium sized companies that could also be undervalued.

Source: Wall Street Journal The Daily Shot®

Another supporting factor for a continued rally in the stock market is the Federal Reserve, which announced at its June meeting that it will keep short-term interest rates low well into 2022. This should support financial markets as economic activity recovers.

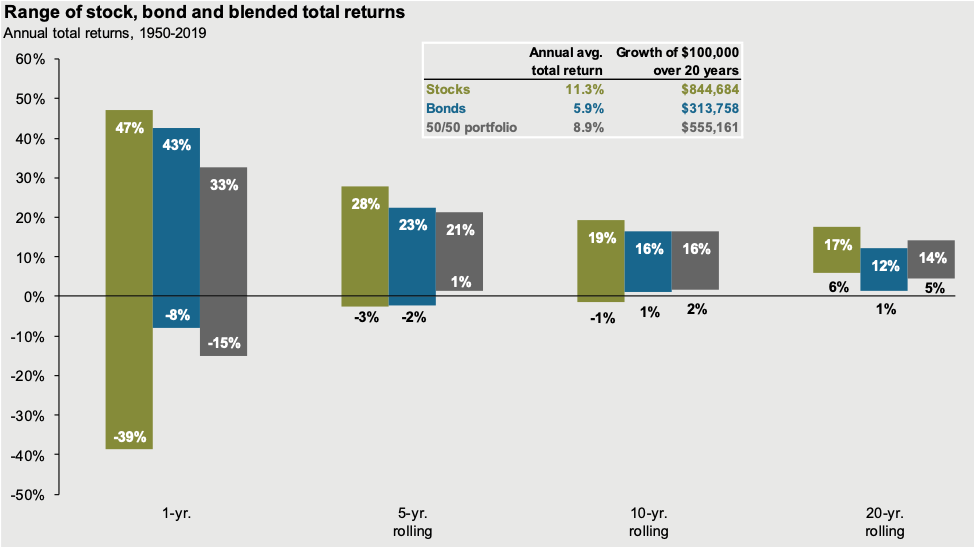

For those that do not like the wild ride, diversification can help. Having a diversified mix of both stocks and bonds reduces the amount of volatility experienced while producing most of the stock market return over time. As shown below, a diversified portfolio split between stocks and bonds (50/50) averaged 8.9% per year, which was nearly 80 percent of the average stock market return since 1950. At the same time, the 50/50 portfolio reduced the downside risk by more than half in any given year.

Source: Barclays, Bloomberg, FactSet, Federal Reserve, Robert Shiller, Strategas/Ibbotson, J.P. Morgan Asset Management

Given the valuation considerations for both stocks and bonds are high versus history, greater attention should be placed on risk control and diversification. While the markets can feel like a wild roller coaster ride in the short term, history and the markets favor those who demonstrate consistency, discipline and patience. Portfolios under our care will remain broadly diversified, conservatively structured and risk conscious.

If you would like to learn more about how the markets can help you prepare financially for the future, please come in and talk to an advisor today. We promise, unlike the roller coaster, you won't have to wait in line!