The Willing Suspension of Disbelief...

December 27, 2022

By Michael Moreland

By Michael Moreland

Retired Vice President of InvestmentsThe headlines of recent weeks have been dominated by the collapse of FTX Trading Ltd. and the associated cryptocurrency trading firm Alameda Research. While a full post-mortem is well in the future, a few things are clear today. First, by any modern standards, the businesses were incredibly shoddily run, lacking internal controls, external oversight, and effective risk management. Second, this didn’t matter for many investors – faith was sufficient to commit capital. Due diligence was far in the background.

It’s a sign of the times. As the market cycle reached a mania peak, there was always the ‘next great concept’ to attract funds. After a couple of years of ‘free money’ flooding the financial system, the opportunities to speculate were abundant. It worked well – until it didn’t. As Warren Buffett once said, ‘Only when the tide goes out do you discover who’s been swimming naked.’

Our clients trust us with their wealth for many reasons. One common to all is the expectation that we do not get caught up in fads where portfolios suffer collateral damage from ill-conceived ventures. The ‘Three Ds’ – discipline, diversification, and due diligence – cannot prevent all losses in bad times. They can, however, keep bear markets from turning into lifestyle-changing events. This is a tenet of our management. We do not suspend disbelief in the investment process.

No Pivot to Lower Rates Yet

As telegraphed throughout November, the Federal Reserve’s Open Market Committee moderated its regular rate hikes to 0.5% at its December meeting. At the same time, Chair Jerome Powell reiterated the Fed’s intention to effectively bring final demand to a level consistent with supply. This implies the tightening cycle will not end anytime soon.

Still, we are witnessing some limited softening of price pressures. Shelter cost inflation is moderating and energy prices are down. Many economic sub-sectors affected by global supply chain disruptions are returning to normal operation. That said, there remain major obstacles to a Fed pivot to a neutral policy.

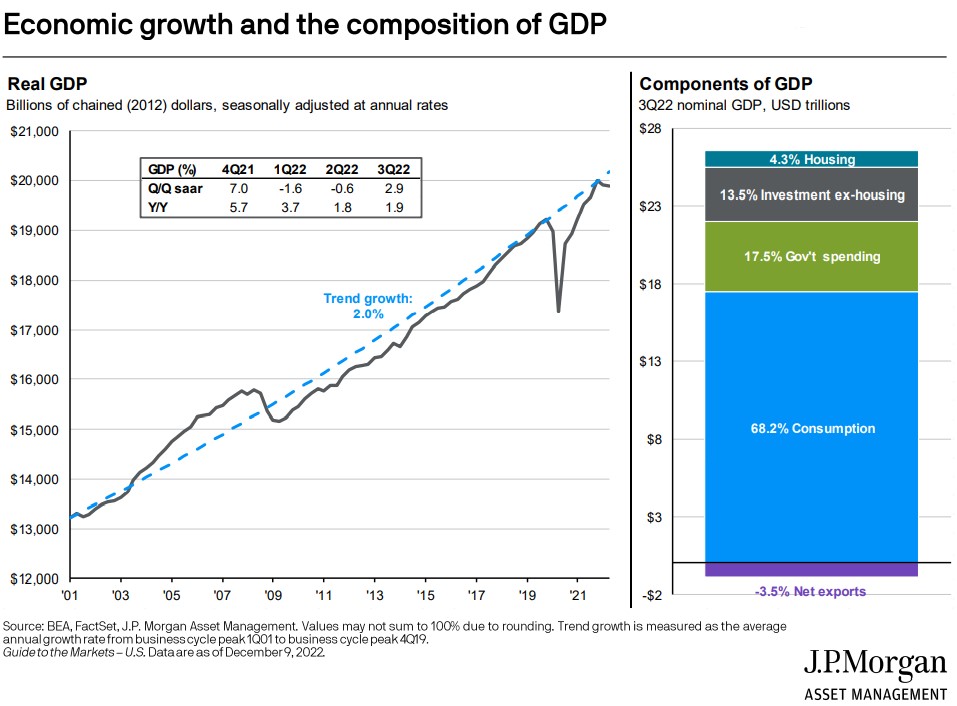

In Washington’s view, U.S. consumers continue to spend too much money. In a late November appearance on a late-night talk show, Treasury Secretary (and former Fed Chair) Janet Yellen noted that splurging on “grills, technology, and home office equipment” during the Covid-related shutdown exacerbated supply chain bottlenecks and helped fuel today’s inflation. There’s certainly truth to this – after all, a trillion-plus dollars of federal pandemic-related ‘stimulus’ was specifically designed to encourage consumption. It worked. And, since consumer spending is the dominant component of economic activity, it’s no surprise that U.S. economic growth – and inflation – are proving more resistant to higher rates than anticipated by most observers. The Fed has more work to do to dampen demand.

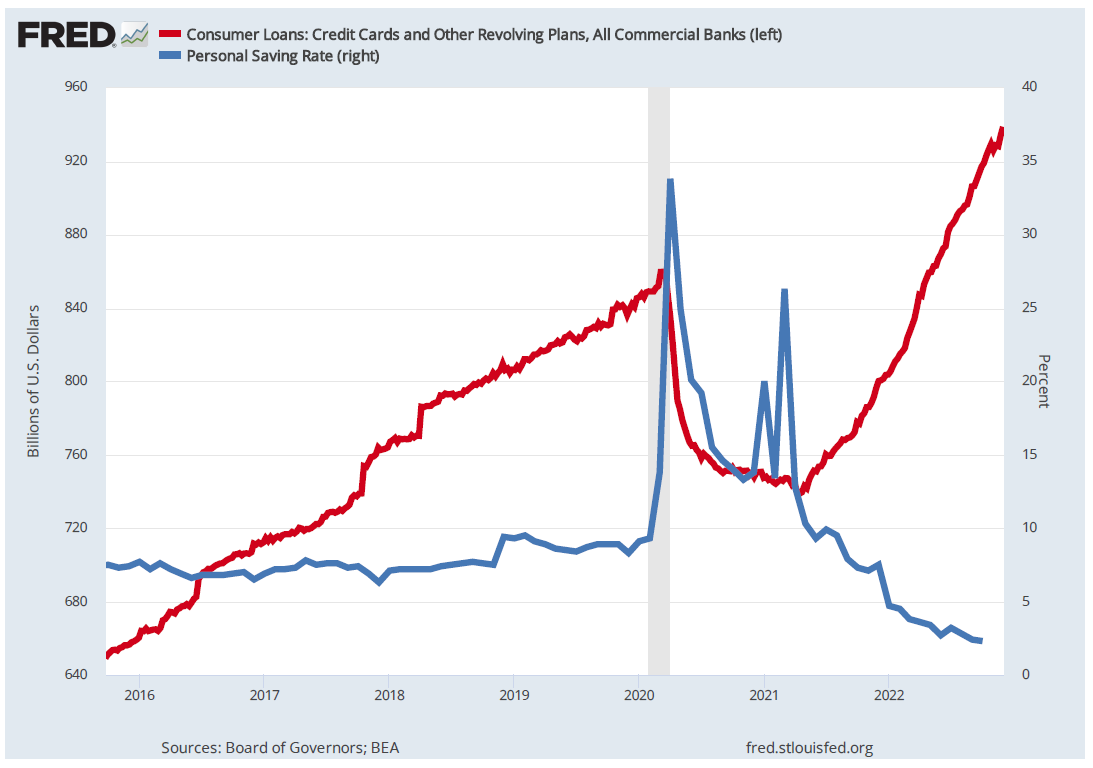

But perhaps we’ll be surprised. While consumer spending has been strong, its sources have deteriorated. Savings rates have plummeted and credit usage has rebounded to pre-pandemic levels. This trend cannot continue. As borrowing costs rise, and employment data continue to soften, demand-driven inflation data will moderate. The Fed understands its actions affect economic activity with an indeterminate time lag; it may pause to assess risks sooner rather than later regardless of current intentions. Bond markets already anticipate poorer economic times ahead; the yield curve inversion (longer term rates below short term rates) is more pronounced today than at any point in decades. Yield curve inversions have an excellent track record of predicting recessions. Even as the Fed ‘dials back’ the trajectory of rate hikes, the U.S. economy faces a difficult time in 2023.

But perhaps we’ll be surprised. While consumer spending has been strong, its sources have deteriorated. Savings rates have plummeted and credit usage has rebounded to pre-pandemic levels. This trend cannot continue. As borrowing costs rise, and employment data continue to soften, demand-driven inflation data will moderate. The Fed understands its actions affect economic activity with an indeterminate time lag; it may pause to assess risks sooner rather than later regardless of current intentions. Bond markets already anticipate poorer economic times ahead; the yield curve inversion (longer term rates below short term rates) is more pronounced today than at any point in decades. Yield curve inversions have an excellent track record of predicting recessions. Even as the Fed ‘dials back’ the trajectory of rate hikes, the U.S. economy faces a difficult time in 2023.

The Markets in 2023

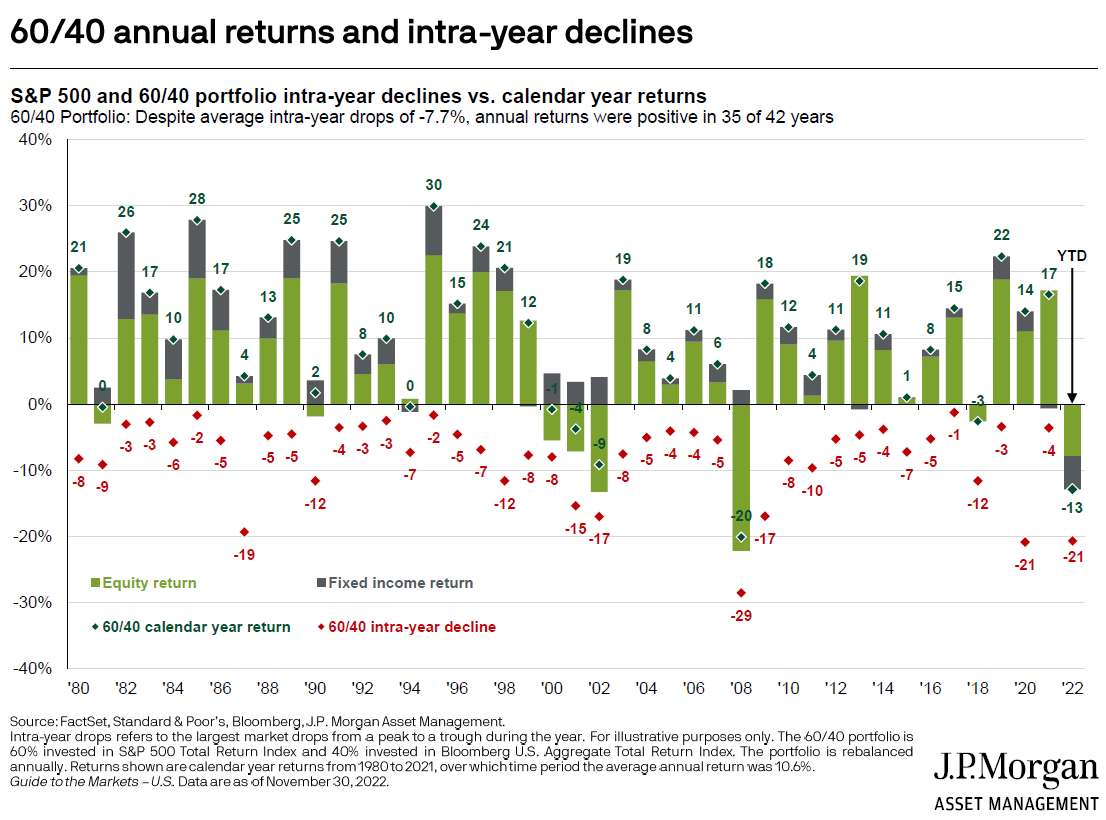

As of mid-December, the financial markets were on course for their worst performance since the financial crisis of 2008-09. The difference in 2022 was the abysmal performance of fixed income. As shown in the accompanying chart, bond markets – due to the action of the Federal Reserve to tame rising inflation – produced their worst total returns in over four decades. The long standing practice of owning bonds to mitigate the risk in equities failed in practice.

We do not expect a repeat of this behavior in 2023. As noted above, while the Fed’s work is not done, the likelihood of further aggressive tightening is low. Bonds will return to their traditional role as an income-generating tool to reduce the volatility of equity exposure.

And this may prove valuable in 2023. While signals increasingly point to an economic slowdown, equity markets in the U.S. are not pricing in this risk. While prices are lower today than a year ago, valuations are not far removed from long term averages. On the one hand, this suggests that a significant decline is unlikely. However, any sharp economy-related market downturn will not be countered by Federal Reserve largesse. In recent decades, investors counted on a ‘Fed Put’ to rescue markets. This did not occur for bondholders in 2022, and it will not be present for equity investors in 2023. The Fed is clear on its intentions to put inflation control above financial market stability.

This brings us full circle to the ‘Three Ds’ – discipline, diversification, and due diligence. We expect a challenging year ahead on many fronts, but will remain conservatively invested, attentive to quality, and focused on valuation. Good times or bad, these practices lead to successful outcomes for our clients. To learn more of how the 'Three Ds' can help you reach your financial goals, reach out to an advisor today. Your success matters to us!