Turning Gloom Into Bloom

July 11, 2022

By Jonathan Smith

Securities Analyst

Long-term investing can be compared to a hiking excursion. There are ups and downs, twists and turns along the path. Often times, the weather forecast turns out different than we had anticipated, as well. Fog, haze, mist and clouds can often cast a shadow on the views we had hoped to see on our hike.

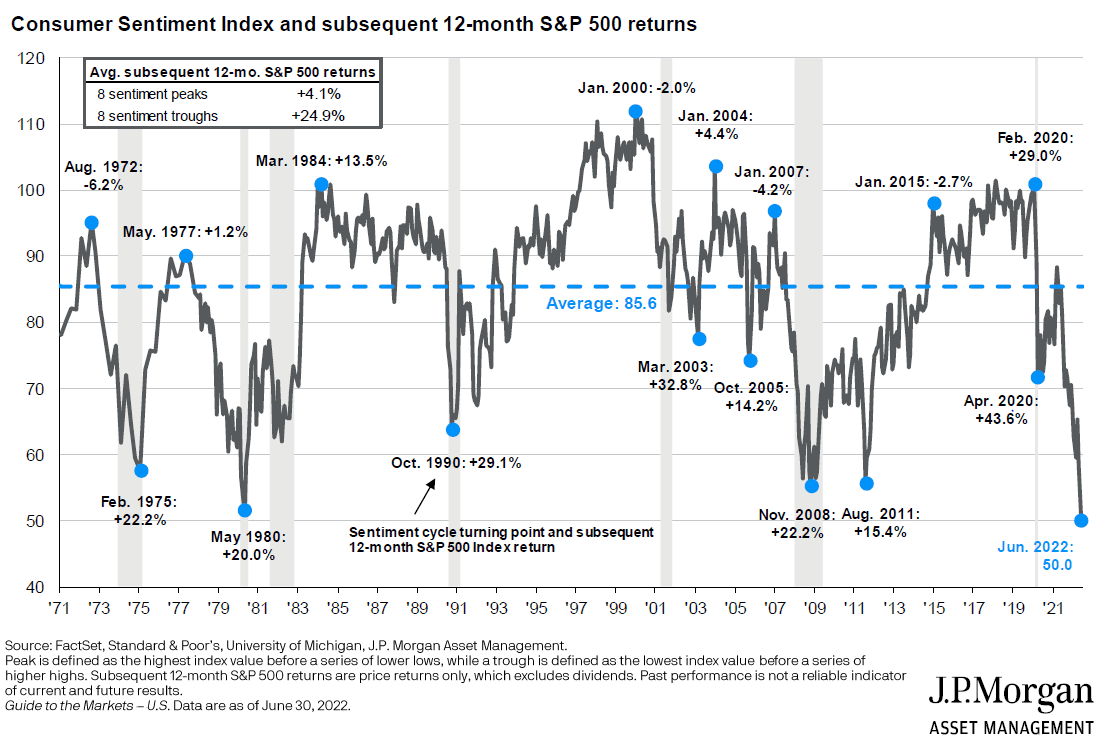

As we reach the mid-point of the year, the public is concerned about a shadowy outlook for the U.S. economy. A haze has rolled in, as the overall consumer sentiment index fell to a record low, dropping to 50.0. That is 14.4% below last month’s reading of 58.4, and 41.5% lower from the prior year.

The Federal Reserve has been aggressively focused on taming inflation this year. In June, the Fed raised interest rates by 0.75%, and communicated further increases throughout the year. From the survey, consumers expect inflation to rise at a 5.3% annualized rate by the end of June. That’s down from a preliminary reading released earlier this month, which showed consumers expected inflation to increase 5.4%. This shows that many Americans still anticipate inflation will remain higher and stick around longer than the Federal Reserve is forecasting.

While consumers have low confidence in inflation easing, consumer sentiment is a contrary indicator. In most cases, the stock market has performed worse following higher sentiment readings. Conversely, the stock market has outperformed when consumer confidence is low. The average investor tends to over exaggerate fears and becomes overly pessimistic, which causes the stock market to decline more than is reasonable. In a high inflationary environment, consumers tend to believe it will remain high for a much longer period than is reasonable. This causes consumers to be incorrect about the turning point, when inflation starts to subside.

Because of this contradiction, low consumer sentiment may bring good news to the stock market. When consumer sentiment was lower than the average of 85.6, the subsequent 12 month total return for the S&P 500 on average was 24.9%. Back in April 2020, when consumer sentiment dropped from 81.9 to 71.8, the S&P 500 gained 43.6% in the following 12 months. The current outlook lacks confidence, but may, in fact, result in heading toward positive returns.

While the forecast of the U.S. economy appears to be overcast, for investors the sun may be ready to peek out and shine. Remaining invested and diversified is the key to take advantage of times while the path ahead in the economy appears gloomy. No one has a crystal ball, but history has shown that there may be great opportunities ahead while consumers are feeling down about the economy.

We are here to help stay focused on your investment strategy and goals through this uncertain time. Your financial success matters to us, reach out today to discuss your portfolio!