Unwrapping the Gift of Capital Gain Distributions

December 21, 2020

By Ted Hanson

By Ted Hanson

Securities Analyst

‘Tis the season of giving. It is a time of joy as we look back at the past year and reflect on our blessings. From presents for loved ones, to charitable donations and volunteering, many families take part in the tradition of giving during this holiday season. Gifts are a way of expressing appreciation of the recipient’s role in the giver’s life. As we all may relate, investors are often surprised this time of year to receive a gift from an unexpected friend. For investors, this gift comes in the form of capital gain distributions from their mutual fund holdings. Let’s unwrap this gift and explore its meaning.

What are Capital Gain Distributions?

First, let’s clarify the difference between capital gains and capital gain distributions. In short, a capital gain is the increase in an asset’s value. If an investor sells an asset for more than what they bought it at, that’s a capital gain. Fund managers buy and sell assets throughout the year and these transactions trigger capital gains or losses. Fund managers are required (by law) to allocate profits (or losses) from those internal sales on to shareholders at least once a year. These allocations come in the form of capital gain distributions, although nothing is normally physically distributed to the owner. Since these gains happen because of transactions within the fund itself, an investor may receive a capital gain distribution from a fund even though they did not sell the fund itself.

Are All Capital Gain Distributions the Same?

The amount of capital gains distributed will differ between funds and vary each year. Some funds will distribute more than others, simply from buying and selling underlying assets more frequently. The more often a fund manager buys and sells assets, the more likely they will incur a capital gain. One situation that concerns many investors is that they may even receive a capital gain distribution from a fund that has posted negative returns for the year. A fund manager may have sold an asset within the fund that has appreciated in price; however, those gains may have been offset by other underlying investments that have lost money.

Tax Considerations for Capital Gain Distributions

Just like the puppy my parents gave my brothers and I for Christmas when I was younger, capital gain distributions come with some rules. Investors are required to pay taxes on capital gain distributions made by the funds they own. However, for funds held within a tax-deferred retirement plan (such as a 401(k), 403(b), or IRA) capital gain distributions will not be due for that tax year. The taxes will be due when the funds are withdrawn, typically in retirement. For funds held within non-retirement accounts, capital gain distributions will be due the current tax year.

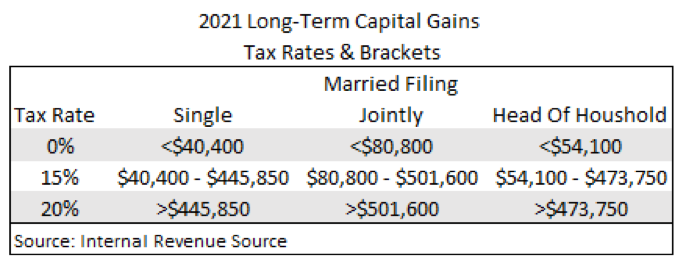

Capital gain tax rates differ depending on the length of time the investor has held the asset. A short-term capital gain is an asset sold within a year of its purchase and taxed at the same rate as the investor’s ordinary income. Investments sold after being held for more than one year are long-term capital gains. Long-term capital gain tax rates are typically lower than the individual’s ordinary income rate.

With capital gain distributions, the question whether the gain is long term or short term is based on how long the fund held the assets and not how long the investor held the fund. Investors will receive a Form 1099 detailing capital gain distributions from the previous tax year. To review how capital gain distributions may affect your tax situation, you should consult your accountant.

The Gift that Keeps on Giving

Just like the membership to Jelly of the Month Club Clark Griswold received in National Lampoon’s Christmas Vacation, capital gain distributions are “the gift that keeps on giving”. Investors frequently have the ability to reinvest capital gain distributions to purchase additional shares (which really are a much better return than Jelly of the Month). While mutual fund companies are legally required to distribute this “Christmas present”, they are still grateful for the investor’s role within the company.

As I reflect on the past year, I am also filled with appreciation. I am especially grateful for the relationships created and maintained in a year that has been difficult for many. While it has been an unforgettable year, I look forward to the opportunities ahead. Please reach out to your advisor for how we can assist you this holiday season. Most important, from our family to yours, I hope you have a safe and happy holiday season.