The U.S. dollar is mighty right now. Here's why it matters:

September 12, 2022

By Samuel Richter

By Samuel Richter

Securities AnalystThe U.S. dollar has surged this year compared to other currencies around the world. Back in July, the dollar reached what's called “parity” with the euro for the first time in 20 years (reaching parity means the currencies have a 1:1 exchange ratio).

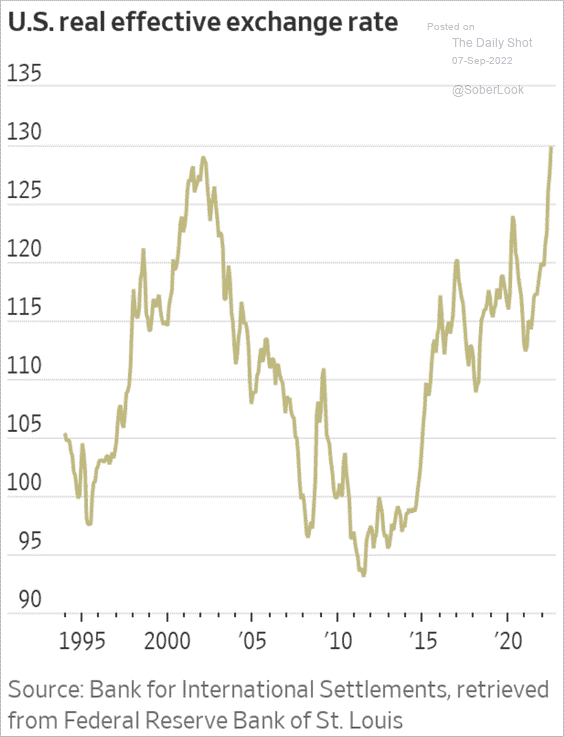

The dollar also reached its strongest point against the Japanese yen in 24 years and against the British pound in 37 years. What's more, the U.S. real effective exchange rate surpassed its previous high from 2002 (real effective exchange rate compares the dollar’s strength to a basket of major U.S. trading partners’ currencies).

Let’s take a look at what has caused the dollar's strength, and what impact this has on you and the economy.

Source: The Daily Shot

What's caused the dollar to surge?

A key contributor to the dollar’s surge has been the Federal Reserve's aggressive interest rates this year. As we have discussed in previous commentaries, the Fed chose to take aggressive action to fight the four-decade high inflation. This is a more hawkish approach than many other central banks have taken. The higher U.S. yields attract global investors who purchase more dollar-denominated investments, thus strengthening the dollar.

What is the impact?

A strong dollar means more purchasing power for U.S. consumers relative to other countries. If you have a vacation abroad coming up, you may notice your dollars get you more than they would have in previous years. It also helps keep U.S. inflation lower. A strong dollar makes imports cheaper, which leads to lower-priced products at U.S. stores than there would be with a weaker dollar. You may think inflation is high anyway — but rest assured, it'd be even higher with a weaker dollar.

Looking ahead

We will see if the strong U.S. dollar can help limit inflation as the Consumer Price Index and Producer Price Index are released later this week. The next Federal Open Market Committee (FOMC) meeting is a little over a week away. The odds currently favor a 75-basis-point rate hike. These inflation data points will factor into the rate hike decision.

Although it is an important factor, the strength of the USD is only one of many factors we analyze when investing for clients. Our client portfolios are built to meet your specific long-term goals. Please talk with an advisor today about how the U.S. dollar's value can affect your portfolio.