U.S. Exceptionalism: Why America’s Economic Resilience Makes a Great Bet

January 27, 2025

By Eric Johnson

By Eric Johnson

Securities Analyst

An idea emerged among investors in the later stages of 2024 that influenced the direction of financial markets. The idea? United States exceptionalism. The belief is the U.S. economy will grow more in 2025 relative to other countries. While it’s true the United States came out of the pandemic better than most countries, why do investors think this will continue?

Consumer Spending and a Healthy Economy

Consumer spending is a good barometer of an economy. Here in the U.S., it makes up nearly two-thirds of Gross Domestic Product (GDP). Many economists predicted a recession in the U.S. due to the aggressive interest rate hikes initiated by the Federal Reserve (Fed) in 2022. We have yet to see this come to fruition, largely thanks to consumers continuing to open their wallets.

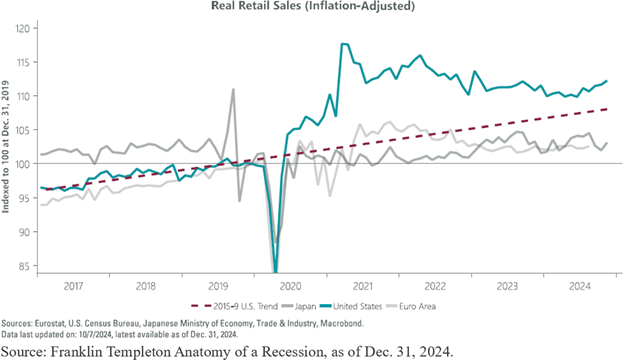

The chart below shows Inflation-Adjusted Retail Sales in the United States and other countries. Retail Sales is an economic report that monitors the health of consumers and their spending habits. The dashed red line shows the hypothetical scenario if U.S. Retail Sales from 2015-2019 continued its trend into the future. As you can see, we far outpaced the hypothetical scenario and are well above other countries, supporting the concept of U.S. exceptionalism.

Earnings Per Share: Domestic-vs-International

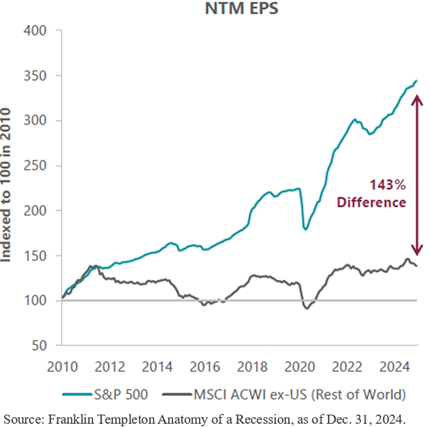

Another reason investors believe the U.S. will outperform is seen with the chart below. It shows the difference in Next Twelve Months Earnings Per Share (NTM EPS) growth of the S&P 500 versus the rest of the world. Since the early 2010s, a widening gap in profitability emerged between domestic and international stocks. This is attributed to U.S. companies operating more efficiently, having greater access to capital and resources, and being run by some of the best managers.

Over the long-term, stock prices move based on earnings. If domestic businesses can continue to grow their profits at a faster pace than other countries, U.S. exceptionalism may materialize. Investors see this as a realistic possibility, especially given the pro-business fiscal policy likely to be implemented by the new Administration.

This, along with the fact that some countries face political uncertainty and/or economic struggles, has led us to trim our exposure in international holdings as part of our annual portfolio rebalance. Please reach out to your Wealth Management Advisor if you have any questions or would like more information on our 2025 outlook or allocation changes. Your success matters to us.