Baseball Strategy: Surprisingly, An Effective Home Run For Investments Too

May 8, 2023

By Tom Limoges

By Tom Limoges

Vice President - InvestmentsLast weekend, I helped coach a youth baseball tournament in the Omaha area. By coincidence, it was also the weekend of the Berkshire Hathaway annual shareholder meeting.

In previous years, tens of thousands of shareholders from all over the world would flock to Omaha to attend this event. As a result, traffic from Sioux City going south seemed heavier than normal on Saturday morning.

Warren Buffett is known not only for his successful career as an investor, but also for his love of baseball. Buffett often uses baseball analogies to explain his investment philosophy and is known to incorporate baseball metaphors into his famous investment quotes.

“When investing, always remember to play the long game.”

This quote emphasizes the importance of a long-term approach to investing. Just as a baseball team must play for the full nine innings, investors should focus on the long-term potential of a company rather than short-term gains.

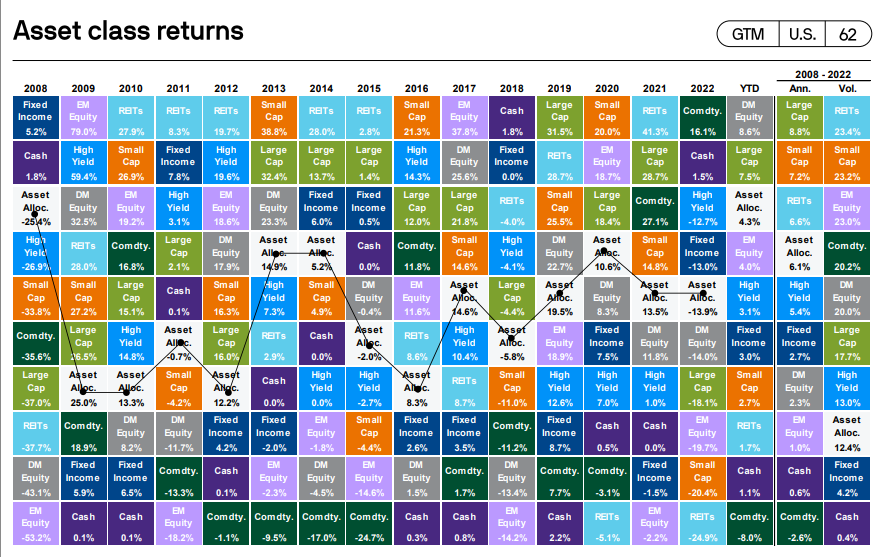

Source: JP Morgan Guide to the Markets. Data as of 3/31/2023

The chart above highlights the importance of staying diversified and taking the long term approach to investing. The asset class return chart or “quilt” chart highlights the challenges that most asset classes faced last year as both bond and stock markets experienced negative returns. This year, most investment options are positive and last year’s winners are now underperforming. It is important to take note of the white boxes that represent a diversified asset allocation portfolio. Annual time periods can be volatile in the short term; however, the far right of the chart shows that the diversified portfolio produces consistent returns and reduces volatility over the longer-term.

“It’s not about making a few good plays, but about avoiding mistakes.”

This quote highlights the importance of risk management in investing. In baseball, a player must avoid making mistakes that could cost their team the game. One mistake that investors make with investing is attempting to time the market.

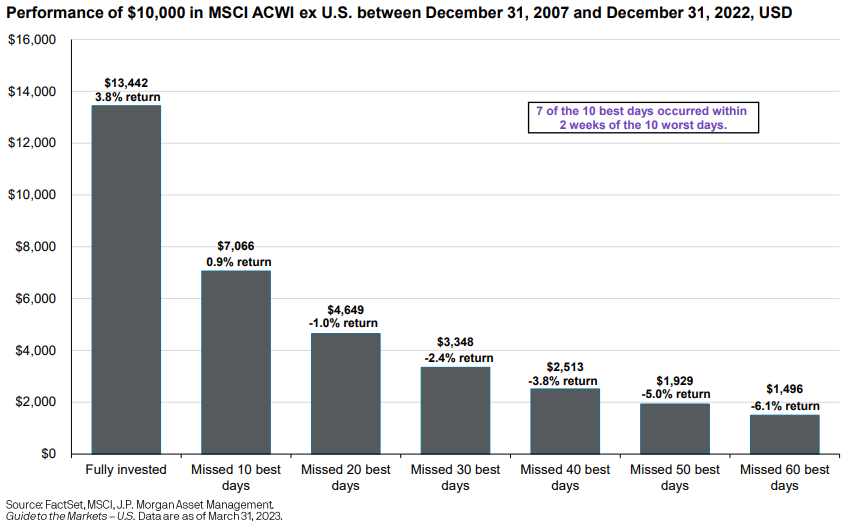

Market timing involves attempting to predict future market movements and basing your investment decisions on those predictions. Accurately predicting market movements can be difficult, if not impossible. The chart below highlights the performance of a diversified global equity portfolio over the last 15 calendar years. This time period covers two deep recessions - plenty of temptation to sell out of the markets. A buy and hold strategy would have resulted in nearly a 4% annual return. Missing the ten best return cuts that return by nearly three quarters. Missing the 60 best days (1.5% of the total days) resulted in an annualized return of (6.1%).

In conclusion, Warren Buffett's love of baseball has led to many memorable quotes that highlight similarities between investing and America's favorite pastime. By using baseball analogies, Buffett explains his investment philosophy in a way that is both relatable and understandable to a wide audience.

Our investment strategy at Security National Wealth Management is to stay well diversified and balanced – hitting singles and doubles rather than swinging for the fence. This proven investment strategy produces consistent returns for our clients over the longer term. If you have questions for our investment team at SNB, please don’t hesitate to reach out to myself or any of our other team members. Your success matters.