Hotter Inflation: What Will The Fed Do To Fight It?

April 18, 2022

By Samuel Richter

By Samuel Richter

Securities AnalystPrices at the pump and grocery store continued to climb in March, as inflation ran hot for both producers and consumers.

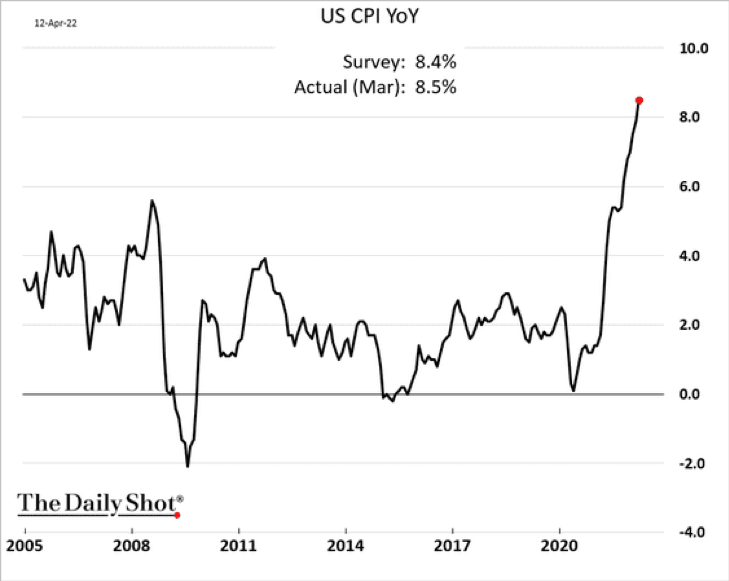

Producers dealt with rising costs as the Producer Price Index (PPI) rose 11.2% from a year prior. Strong demand continued in March while supply-chain issues lingered. These elevated prices were passed along to the consumer as illustrated below by the rising Consumer Price Index (CPI).

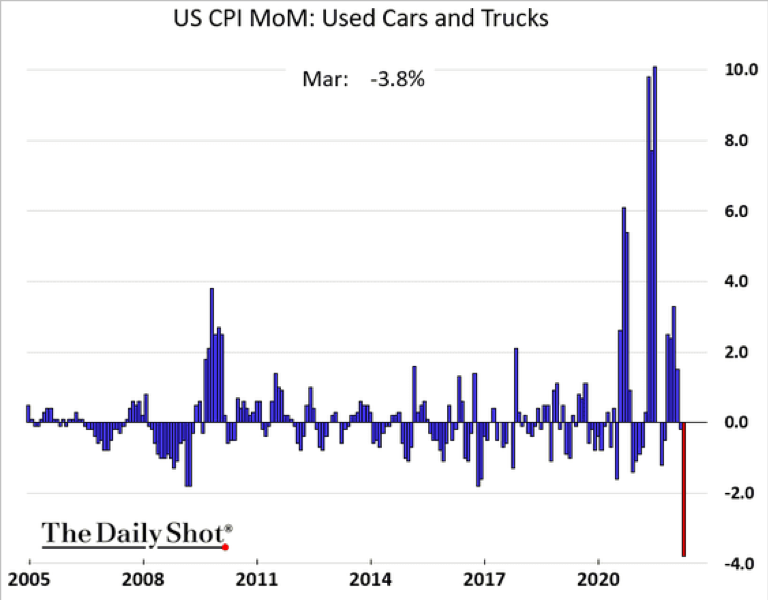

The CPI rose to another multi-decade high of 8.5% year-over-year in March. Gasoline prices, making up over half of the monthly increase in CPI, soared 18.3% in March from a month earlier following the Russian invasion of Ukraine. Consumers also saw their grocery bill increase as grocery prices rose 1.5% last month and 10% over the last year. As seen in the chart below, one encouraging component of CPI was used vehicle prices. Prices fell 3.8% last month but are still up over 35% on the year.

The Fed's response:

With inflation continuing to rise, many are expecting the Federal Reserve to take a more aggressive approach. Economists are now anticipating a 50 basis-point rate hike at the May 4 Federal Reserve policy meeting. The markets are pricing in this more aggressive approach as bond yields continue to rise in April. The rising March inflation metrics support the Fed’s more aggressive approach to tackle inflation.

As my colleague Krista mentioned last week in our Quarterly Market Review, higher rates today create better opportunities. Forward-looking assumptions for bond returns are more favorable now than a year ago.

Acknowledging that inflation will be with us for several months or more, most of us are asking what we can do to mitigate its effects on our daily lives. The first step should be to set up an honest budget and look for ways to trim expenses. More than 55% of Americans do not use a budget, and many that do, approach it only half-heartedly. The average family of 4 was spending over $900 a month for food last year which is even higher now. If you had to choose between a favorite cable channel and dining out one night, which would you choose? Some simple choices can save a family over 5% of their monthly expenses without making a huge sacrifice.

In sum, we are in an inflationary period we have not seen in four decades. Both stock and bond markets are understandably unsettled, and will likely remain so for some time. That said, portfolios managed for you are conservatively structured, broadly diversified, and attentive to valuation. As always, it is important to remain disciplined and focused on the long term. Contact us if you have any questions. Your financial goals matter to us.