What Happened to the Markets Last Week?

January 24, 2022

Michelle Holmes, CFA

Michelle Holmes, CFA

Assistant Vice President - Investments

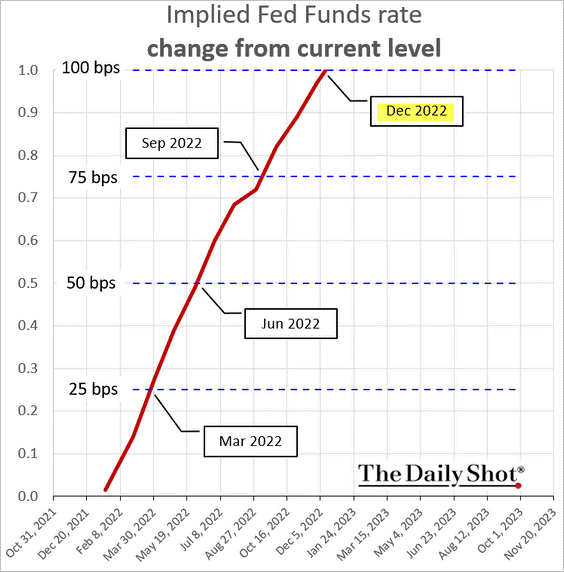

With inflation running high and the unemployment rate dropping, the Federal Reserve (The Fed) signaled it will start raising overnight interest rates sooner than previously anticipated. Bond market participants now believe the Fed will have to be more aggressive in raising interest rates and could begin as soon as March. The bond market is now pricing in four rate hikes this year. Economists are also predicting three to four rate hikes this year in line with what Fed participants are projecting. Let’s take a look at what this means for the bond and stock markets.

Source: The Daily Shot®

Market Reaction

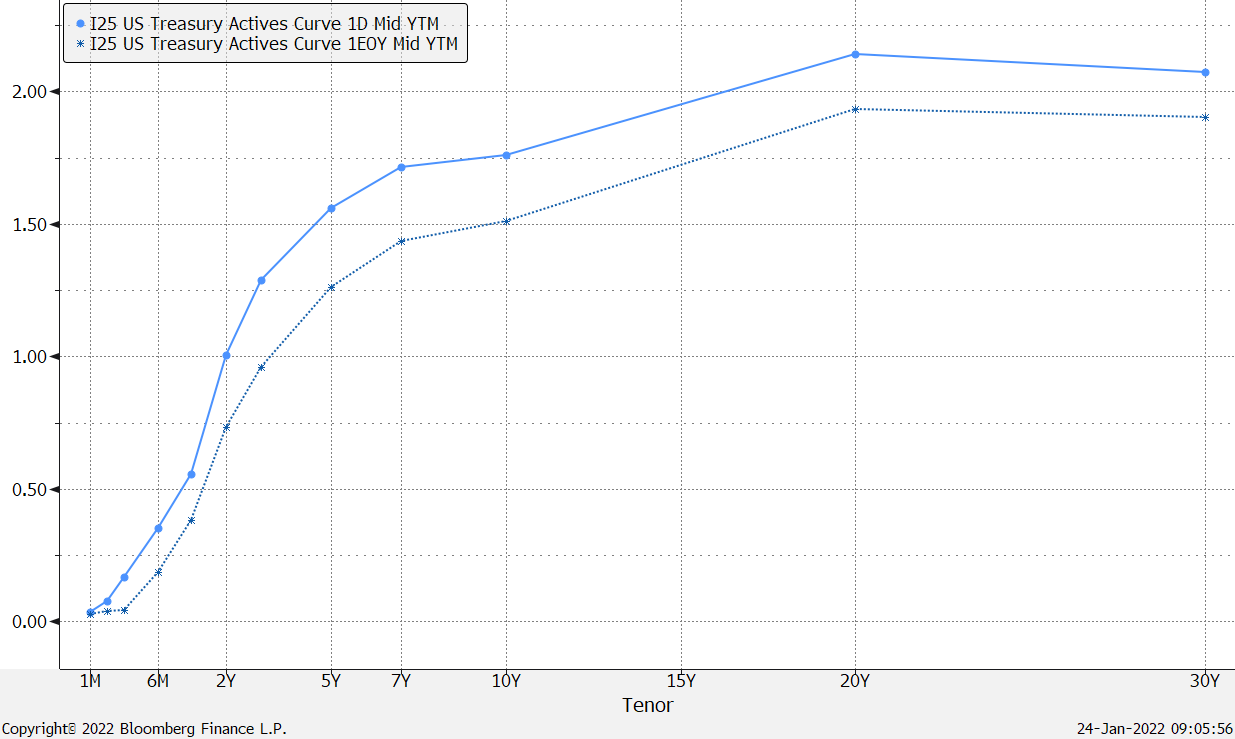

The bond market priced-in more rate hikes by increasing yields on U.S. Treasuries. The two- year Treasury is yielding over one percent now which is close to 30 basis points or 0.3 percent this year. The ten-year Treasury is off its highest level, but it is still about one quarter of a percent above last year, closing at 1.76 percent on Friday.

Source: Bloomberg Finance L.P.

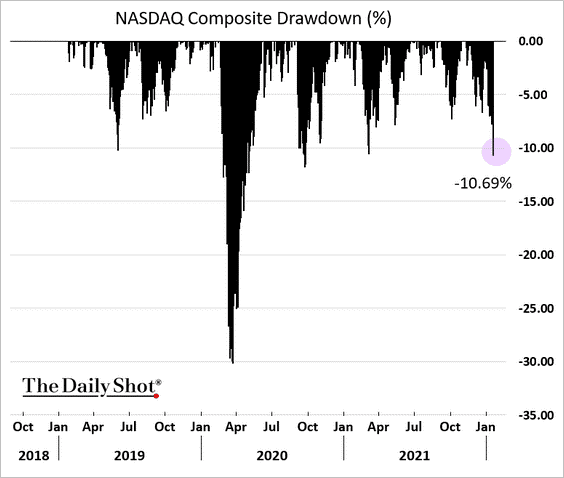

The rise in interest rates caused the stock market to decline, led by the technology sector. As a result of the change in anticipation of persistent inflation forcing the Fed to be more hawkish, investors pushed interest rates higher this week. Higher growth companies like many in the technology sector tend to fall more when rates rise. This is shown by the decrease in the NASDAQ composite, which is more heavily weighted to technology stocks. The NASDAQ fell over ten percent from its high mark last November.

Source: The Daily Shot®

What Does the Fed Say?

The markets will get an update on what the Fed is thinking after its meeting this week. Most economist believe the Fed will signal the first 25 basis point (0.25%) interest rate hike at its meeting in March. The Fed is not bound to change interest rates in 25 basis point increments or wait until its next meeting to raise rates. If the Fed feels that it is falling further behind taming inflation, it could raise rates faster or in larger increments.

Our Portfolios

We are making changes to our client portfolios early this year that should help protect value in this volatile, higher inflation, rising interest rate environment. We decreased interest rate risk in our bond portfolios by lowering the duration, which measures how much bond prices fall when interest rates rise. On the stock side, we have a tilt towards those areas of the market that tend to hold their value better in a rising interest rate environment – value oriented and foreign stocks.

The key to weathering the more volatile times is to have a long-term plan, be diversified and appropriately allocated between stocks and bonds to reach your individual goals. Reach out to your financial advisor to review your goals today. What matters to you, matters to us.

PHOTO CREDIT: Getty Image