What Happens When the Stock Market and Bonds Fall Together?

December 11, 2018

By Tom Limoges

By Tom Limoges

Trust Investment Officer

The year 1990 was a start to a new decade and an interesting year in history. George H. W. Bush was in his second year of his presidency. The official demolition of the Berlin Wall began – reuniting East and West Germany. Iraq invaded its neighbor, Kuwait, prompting Operation Desert Shield. Popular films released in 1990 include Home Alone, The Hunt for Red October, Dances with Wolves, and Teenage Mutant Ninja Turtles (Cowabunga Dude!). The Simpsons made their television debut, and the Nintendo Gameboy was a popular toy during the holiday season.

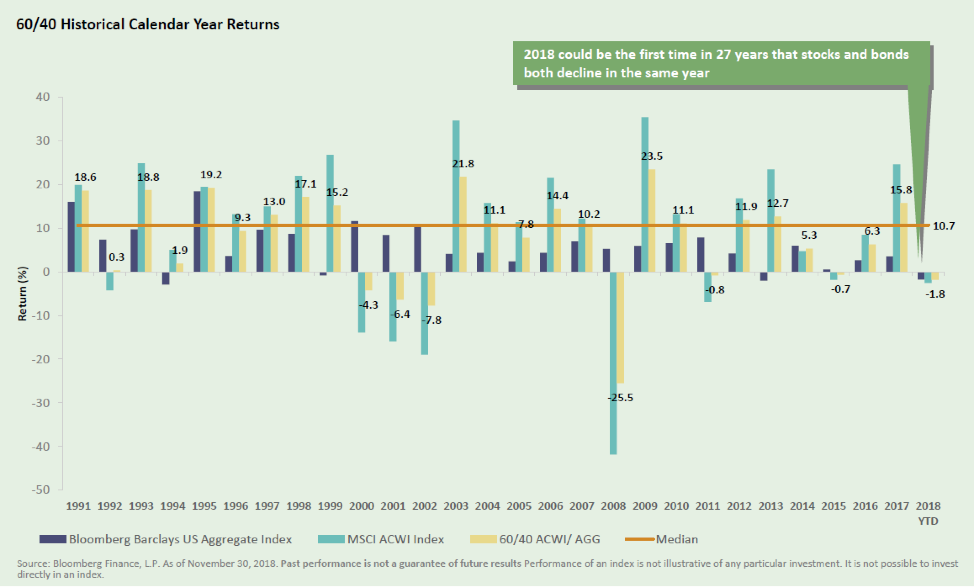

A recession also began in 1990 — and it was the last time both stock and bond market indices ended the year lower than they started:

Source: Bloomberg Finance, L.P.

Source: Bloomberg Finance, L.P.When Stocks and Bonds Fall Together

It is often stated that history repeats itself. As we approach the end of 2018, the markets are facing a challenge similar to that of the early 90’s recession. Higher interest rates are the main culprit in the performance of bonds. Slowing economic growth, tariff concerns and higher equity market valuations have all contributed to the pullback in stocks. If the calendar year had ended last week, both stocks and bonds would have produced negative results year-to-date. In the wise words of Homer Simpson, “Doh!”

Why Diversification is important

While both stocks and bonds experienced negative YTD returns, the diversification benefits of owning both was evident during the 4th quarter. Stock market volatility climbed over the last few months, but bond returns were positive. As a result, a balanced portfolio (50/50 mix) of stocks and bonds experienced less than half of the market decline that an all-stock portfolio experienced during this time.

Where do we go from here?

Despite the challenging start, the 1990s turned out to be a good decade for both stocks and bonds. We look to this pattern as we end 2018 and begin 2019. Higher bond yields will provide protection if interest rates should continue to rise. With the recent selloff in stocks, valuations have improved and reflect lower growth expectations. If economic activity continues to advance, even at a slower pace, it should be a reasonable market environment.

As we approach the end of the end of 2018, it’s a great time to schedule a review of your accounts and financial plan with your wealth management advisor.