What went wrong with Silicon Valley Bank?

March 13, 2023

By Tom Limoges

By Tom Limoges

Vice President - Investments

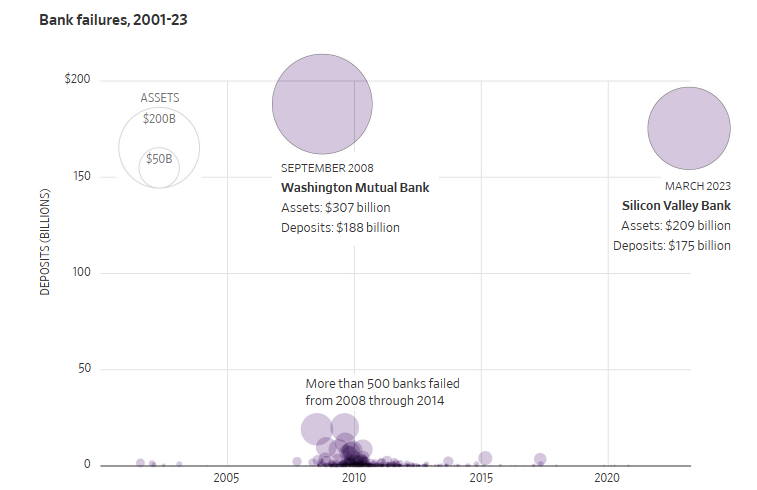

Last week, the markets witnessed the collapse of Silicon Valley Bank (SVB). In terms of asset size, SVB is the largest bank failure since Washington Mutual failed in 2008.

While it is still early, the issues surrounding SVB appear to be isolated and specific to that region; this news brought back memories of the 2008 Financial Crisis and re-kindled fears of the liquidity crunch that had impacted the markets so deeply. This most recent bank failure also highlighted the challenges associated with higher interest rates and their impact on the financial markets.

In this blog, we will summarize the chain of events that impacted SVB, its deposit holders, and shareholders. We will also cover the broader effect this bank failure could have on future markets.

A Perfect Storm

Silicon Valley Bank was a regional bank that offered products to corporations and individuals who were mainly affiliated with technology-based companies. In the years leading up to 2021, the bank saw tremendous growth in deposits as money and investments flowed in from the technology sector. Additional deposits above reserve requirements were invested in government bonds and other debt securities.

Challenges within Silicon Valley Bank started last year as rising interest rates created losses in the bank’s investment portfolio. At the same time, technology-related businesses withdrew deposits because they needed more cashflow to fund operating activities. This perfect storm created a situation where SVB was unable to meet the deposit requirements or withdraw demands; it was subsequently taken over by the FDIC.

Over the weekend, bank regulators took control of a second bank, Signature Bank, which had affiliations with cryptocurrency companies. With this announcement, both banks were deemed a systemic risk to the financial system. While this statement may sound negative, the designation actually gives regulators the ability to guarantee uninsured deposits over $250,000. These deposits are expected to be available for transacting on Monday, March 13. At the same time, stock investors in the two banks will likely have their equity position eliminated.

The Fed and Interest Rates

To slow inflation, the Fed has been committed to increasing short-term interest rates. Since last March, the Fed Funds Rate, or short-term rate, was raised by 4.5%. Chairman Powell’s testimony last week indicated that a potential 0.5% rate increase could be possible at the next meeting. However, those odds have lowered since last week. The rate environment is witnessing the traditional flight to quality, and it will likely be reversed.

Higher interest rates can have a slowing effect on the economy as borrowing costs increase. Additionally, higher rates can create competition for yield – affecting everything from equity prices to bank deposits. To connect this concept back to the SVB failure, rising interest rates created stress on the bond portfolio of SVB and the bank had to realize losses as it needed to generate reserve cash to cover the need for withdrawals.

The Fed will likely move forward with pushing rates higher, while still remaining aware of the impact of higher rates on the economy.

Going Forward

Over the short term, the markets will digest information as it becomes available. Regulators have provided the blueprint response to this situation: these specific banks represent a systemic risk, and regulators remain prepared to act.

For investors holding the SNB Managed Investment Portfolios and Target Date Portfolios, total exposure in the failed banks’ mutual funds is zero. With that said, diversification is one of the foundations of our investment management philosophy. Having exposure in various investment styles provides a dampening effect when stock markets become volatile.

In addition to diversification in equities, high quality bonds now offer attractive yields and will provide a balance to equity market volatility; this was not the case a year ago. A well-diversified portfolio of stocks and bonds has served our clients in the past and will continue to in the future. If you have any questions, please reach out to myself or any member of the portfolio management team.