What's It Worth to You?

March 20, 2018

By Colin OShea

Securities Analyst

A hobby or collection, like an investment portfolio, starts small and grows over time with proper care. Often, collections can become a large part of one’s legacy.

There is no data on the statistics of collectors in the world; it is widely believed most people collect something of a sort, for reasons that range from knowledge and learning, relaxation and stress reduction, to accumulation and diversification of wealth.

Regardless of the reason for collecting, there are steps you can take to add value and security to your passion, whether you intend to keep your collection until you pass away, sell it at some point in the future to fund your retirement, or donate it for charity.

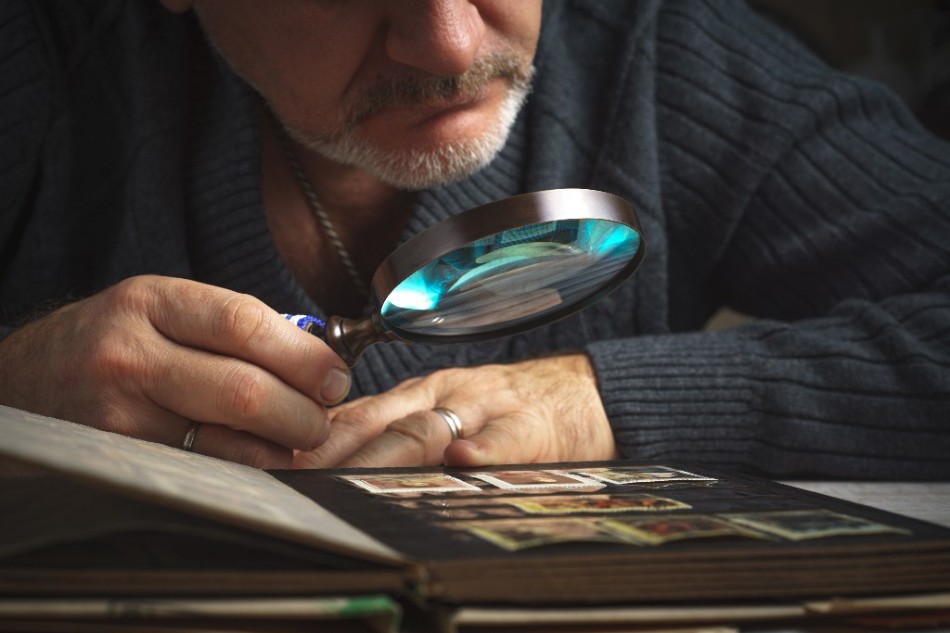

Learn as much as possible about what you are collecting. Knowing how to identify and grade the objects you are collecting is important. While outward appearance is a factor, there are unique aspects of certain models or issues of things that increase their value because of their scarcity. Also knowing when not to try to repair or refurbish is important in preserving the value. Also, with technology today, how do you spot an imitation or forgery? A little knowledge can make a huge difference in knowing what to look for.

Catalogue your collection. There are many apps and programs for computers and all types of mobile devices that help you track physical possessions. These apps let you enter different notes about your items, such as the name, value, year created/obtained, location stored, and even pictures. This is called the “provenance” and if authenticated can sometimes double or triple the value of an object.

Appraise your collection. Knowing what your collection is worth can be rewarding in itself, but it also serves another purpose. If you plan to pass on your collection, the inheritors will benefit from knowing the value of the collection. You might be surprised at what your collection is worth.

Insure your collection. After having your collection appraised, if the value warrants it, obtain insurance to protect from loss. Most homeowner’s policies do not cover collectibles, a personal articles floater is usually required, with the choices being blanket coverage or listing every single item.

Most importantly, have a plan for the future of your collection. Will you sell it or give it away? Will someone inherit it? Depending on the plan, different options, and consequences exist, such as taxes (!). Not having a plan can cause trouble down the road. Over several decades many of us at Security have worked with estates and trusts with unique assets. Let us share our experience with you. Security National Bank has wealth management professionals ready to help with all your estate planning questions and needs. Please contact us today.