When Consumers Panic, Buffet's Advice Matters Most

February 2, 2026

By Ted Hanson

By Ted Hanson

Portfolio ManagerThis year Warren Buffett stepped down from his role as CEO of Berkshire Hathaway, a position he held for 60 years. While this begins an era where he steps back from the investment world, it is not the last we’ve heard of him. An investment legend of his stature will be quoted, studied, and remembered for many generations to come. In that spirit, one of his more famous quotes comes to mind when reviewing the recent consumer confidence reports.

“Be fearful when others are greedy, and greedy when others are fearful”

The Consumer Confidence Index is a survey administered to gauge the optimism or pessimism felt by consumers and their expected financial situations. Surveys gauging consumer sentiment are widely watched, given two-thirds of the U.S. economy is driven by consumer spending. The more confident a consumer is about the economy, the more they are likely to spend. However, January’s readings did not show much optimism. A survey done by the Conference Board showed consumer confidence is at its lowest levels in 12 years, while other surveys show similar pessimism. To be fair, these readings should not come as a surprise. Many consumers feel the effects of a continued elevated cost of living, a softening labor market, and political tension among a growing list of uncertainties.

Fearful Consumers, Faithful Investor

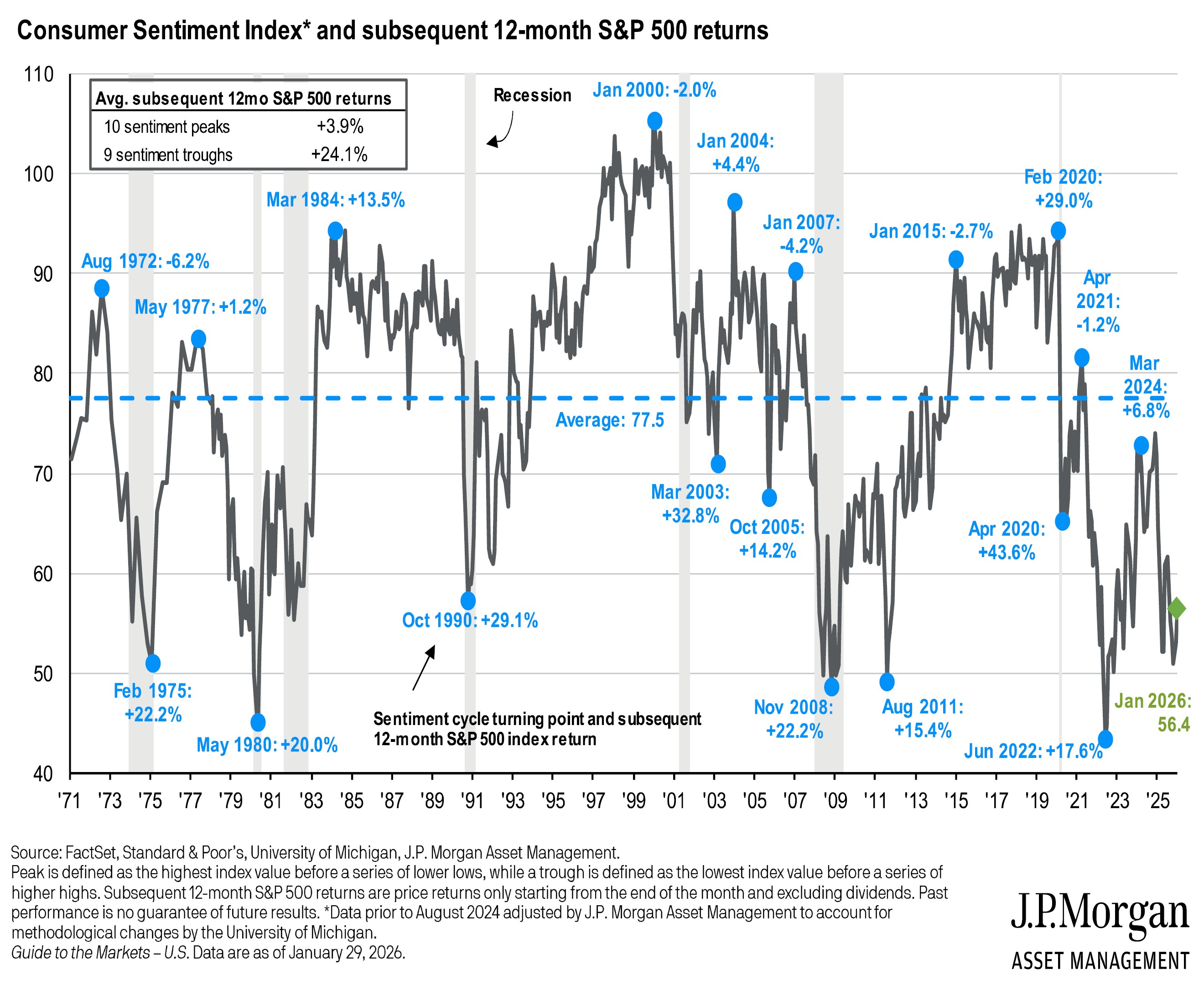

Revisiting Buffett’s quote from earlier, times of extreme consumer fear often prove beneficial for investors. The chart below, provided by JP Morgan, highlights consumer confidence surveyed by the University of Michigan and corresponding returns in the US equity market. Over the last 55 years, the data reveals a striking pattern, when the consumer is feeling their best the average subsequent 12-month return is under 4%. However, when the consumer is feeling their worst the subsequent 12-month return averages over 24%. Highlighting the reality, it is not as bad (or as good) as it seems.

The takeaway from this is consistent with our investment philosophy. We remain cognizant of the risks to emotional highs and lows. Buffett’s advice is easy to repeat, but harder to follow – especially during periods like today. As we progress through an economic cycle, we will remain fully invested, attentive to valuations, and broadly diversified. By conservatively balancing risks, we aim to provide our clients with a consistent and predictable path to financial success – regardless of where we are in the economic cycle. Please reach out today to discuss your portfolios and confidence moving forward.