Financial Planning vs. Saving For Retirement: What's the Difference?

February 15, 2021

Michelle Holmes, CFA

Michelle Holmes, CFA

AVP - InvestmentsMany people go through life without truly planning for their financial future. Sure, you may sign up for your employer’s retirement plan and hopefully put in at least as much as the company matches (that is, if your company provides that valuable benefit). Then, you might work until you want to retire and hope to have enough to live comfortably. But when it comes to ensuring a comfortable retirement, financial planning matters a lot more than hoping.

For some, financial planning may seem like a daunting task. That’s when a financial planner can come in handy. And the earlier you start planning, the better.

Initial Financial Planning

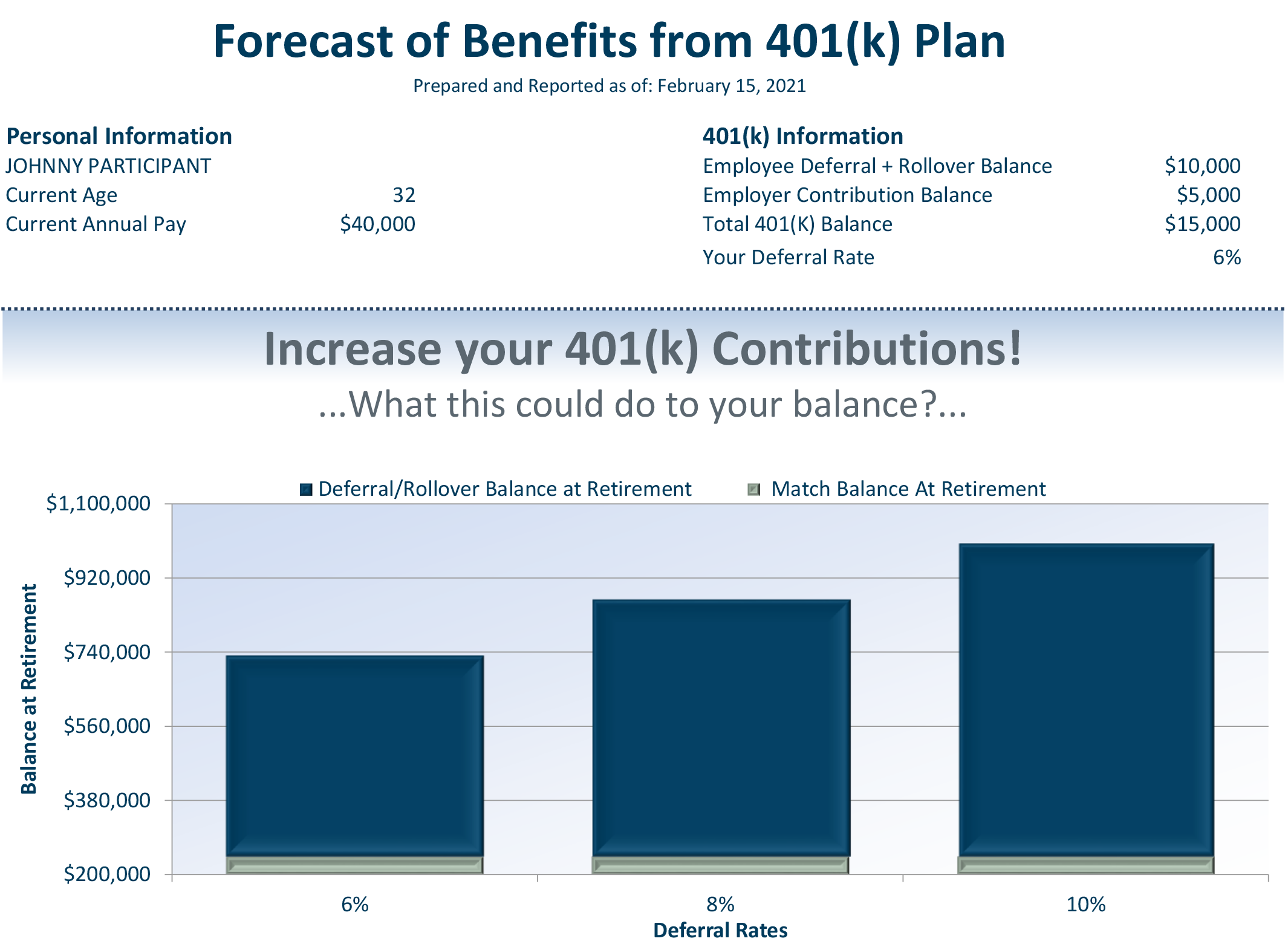

The initial financial plan may be a simple forecast, like the one shown below. This simple projection shows how much a participant in a retirement plan could have if they invest a little more each pay period. Because of the compounding effect of time, making small changes in the early going can make a big difference in funding your retirement goals later on.

Comprehensive Financial Planning

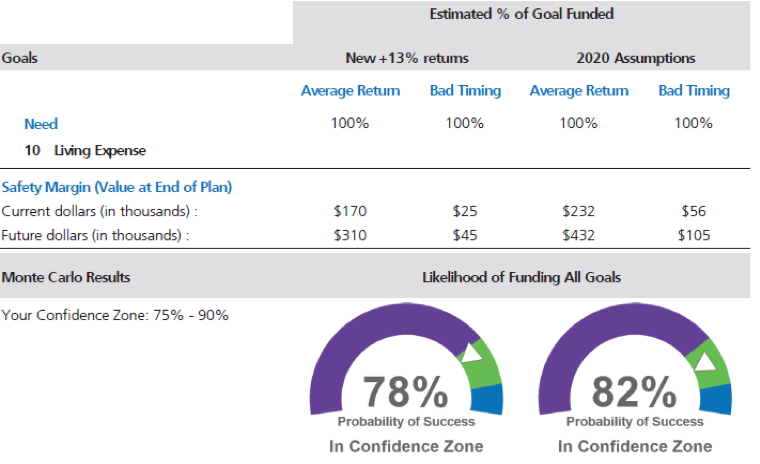

A comprehensive financial plan may be more suitable as you get closer to retirement. The comprehensive plan may include a review of your retirement goals and the assets you have to fund those goals. The financial plan will reveal the likelihood of achieving those goals, such as buying a new car, traveling, or buying a new home closer to the grandkids. Financial plans need to be updated over time. People change, goals change, and so do the markets.

A financial planner can take you through projections that account for these changes — and let you know how close you are to reaching your goal(s):

Sample Screenshot of a Comprehensive Financial Plan

Why Valuations Matter to Financial Planning

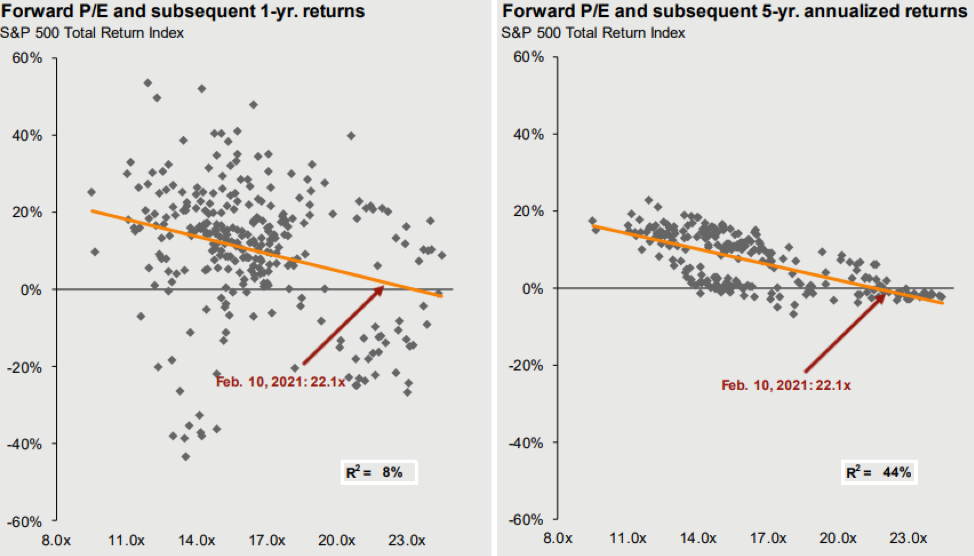

When we prepare a financial plan for a client or potential client, we start with a review of the markets. The markets are dynamic, so simply using the average historical returns for the stock and bond market may not reflect the most accurate picture of what the markets may do going forward.

Anything can (and often does) happen in the short-term, but valuations are a good indicator of long-term returns. The charts below show the dispersion of returns over a 1-year and 5-year time period based on starting valuations as shown by the price to earnings (P/E) ratio—the orange line. As you can see in the left part of the chart below, there is a low correlation between the starting valuation of the stock market and the subsequent 1-year return. The returns are all over the place—again, anything can happen in the short-term.

Source: J.P. Morgan Asset Management - Guide to the Markets

However, the chart on the right shows the returns for the subsequent 5-years are bunched closer together. This shows a higher correlation between the starting valuation of the stock market and the returns over the next 5 years. A higher starting value tends to mean lower returns.

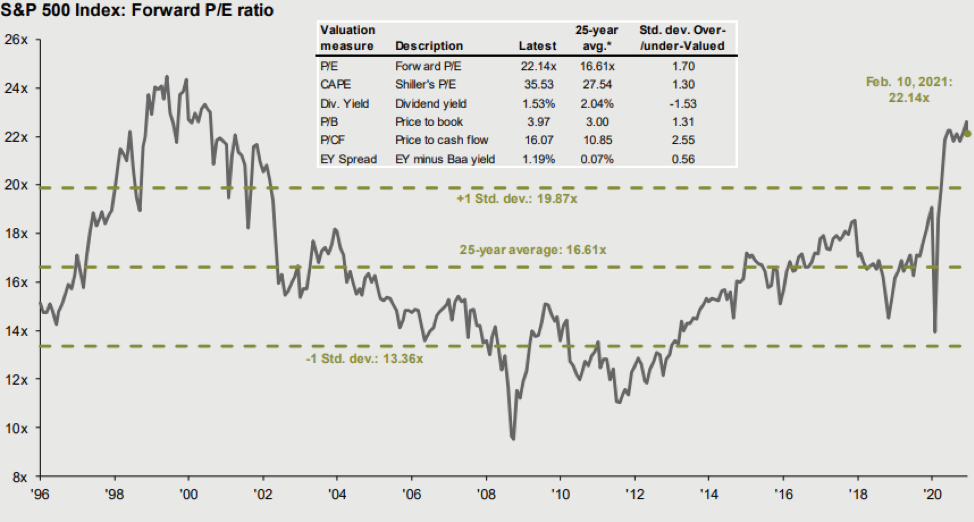

Where are Valuations Today?

Today, the valuation of the stock as measured by the price to earnings ratio is high. The only area the S&P 500 Index — the 500 largest companies in the US stock market — is not overvalued compared to historical averages is the bond market. Over time, these measurements tend to revert to their long-term averages. For the stock market, this means that company earnings need to increase in order to justify the higher prices shown in the stock market today. Alternatively, prices need to adjust down to the current level of earnings.

Source: J.P. Morgan Asset Management - Guide to the Markets

If we believe the stock and bond markets are above their historical average valuations, returns are likely to be below average going forward. As a result, we use our lower forward market return assumptions when preparing financial plans. This provides our clients with a conservative approach to financial planning.

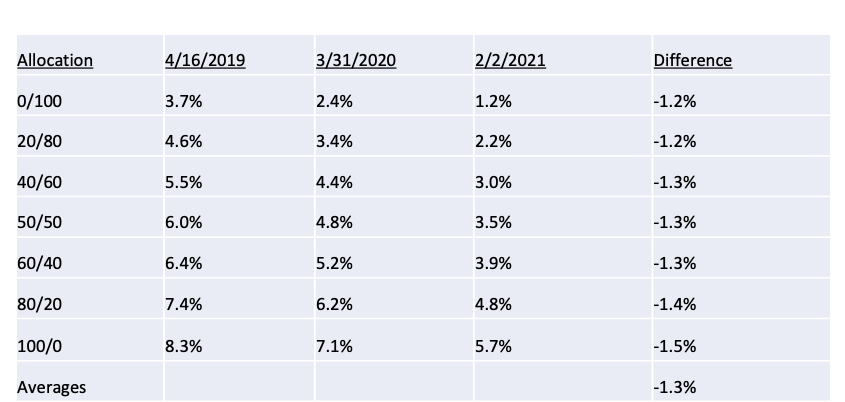

Stock and Bond Market Assumptions

If our clients can meet their goals with lower than average market returns, then they will be more than prepared if the markets outperform these assumptions. Then we continue to fine-tune their plans as the needs and wants change over time.

At Security National Wealth Management, we have financial experts eager to help you plan for retirement. Contact us to see if you are on track to make your financial dreams a reality.