When Will Enough “Good News” Tip the “Great News” Scale?

February 6, 2023

By Morgan Altman

By Morgan Altman

Securities Analyst January markets kicked off the first month of the year with a rebound from the rough results we saw in 2022.

Following another rate increase and Fed Chairman Jerome Powell’s comments from Wednesday, the markets remained bullish and continued their upward trend, indicating that the market does not believe that interest rates will remain high – at least not for long. However, the Fed expects that more time and patience will be required before the policy can be eased.

First Fed Meeting in 2023

At the first meeting of 2023, the Federal Open Market Committee (FOMC) hiked interest rates by 0.25%, bringing current rates to 4.5-4.75%. During the press conference following the announcement, Chairman Powell suggested that this rate hike would not be the last: “We continue to anticipate that ongoing increases will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2% over time.”

While this quote appears to suggest at least two more rate hikes, the market is expecting the last hike to be as soon as March.

Inflation Remains Persistent

Inflation currently persists at 6.5%. While there has been progress from its peak of 9.1% in June, inflation has not fully loosened its grasp on the economy. Prior rate hikes have begun to make their mark on more than inflation. In 2022, GDP saw below-trend growth of 1%. High inflation is taking its toll on consumer spending.

However, the labor market remains strong, challenging the Fed’s desire to slow the economy. The labor force participation rate has barely changed in the past year, leaving a substantial number of jobs that have not been filled since the pandemic. While the labor market has marginally slowed, it remains historically strong.

The Fed’s goal is not only to bring inflation back to its 2% goal, but to keep it suppressed. Because of this, the Fed will wait for additional evidence to be confident that inflation is under control. In the meantime, they are not willing to become complacent and let inflation rise again. Despite the fact that parts of the economy are already slowing, the Fed anticipates that it will take more time for the full effects of their policy to be seen. The smaller rate hikes are necessary in order to remain committed to their mandates while still resisting inflation.

Smaller Rate Hikes Expected

The evidence of cooling wage growth and slowing inflation is causing the rate hikes to move in smaller increments than what we saw in 2022. Below trend growth is expected to continue into 2023 and labor market conditions are expected to soften. Toward the end of his speech, Powell emphasized, “The historical record cautions strongly against prematurely loosening policy. We will stay the course until the job is done.”

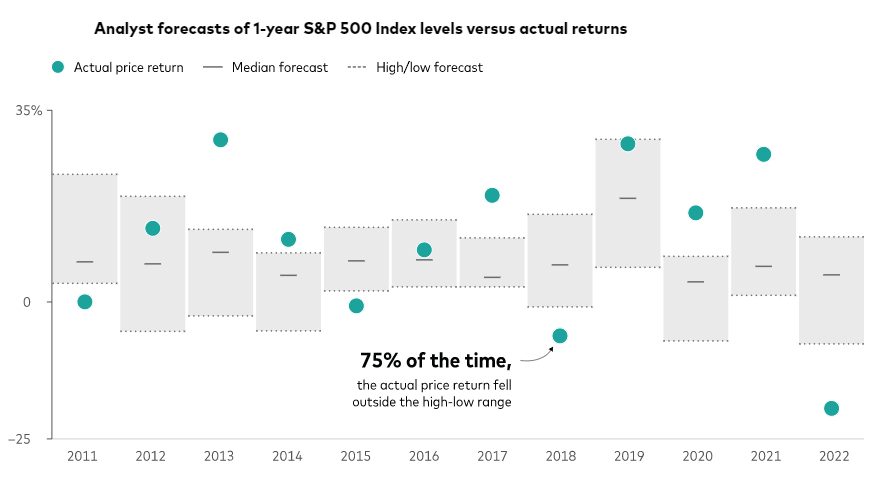

With these expectations in mind for 2023, we are confident in the positioning of our clients’ portfolios. As the odds appear to show that we are near the peak of rate hikes, we are adding high quality duration on the fixed income side, while holding a value tilt in equities. Despite what uncertainty may lie ahead, we continue to hold a well-diversified investment mix. If you have any questions, please don't hesitate to reach out to your wealth management advisor today. Your success matters to us!