What's the Outlook for Inflation in 2022?

January 18, 2022

By Ted Hanson

By Ted Hanson

Portfolio Manager

Inflation was one of the hottest topics discussed in 2021. Consumers experienced an increase in inflation which hasn’t been seen in decades. The increase — often described as “transient” last year — proved to be stickier than many had anticipated. Let’s take a look at where inflation ended the year.

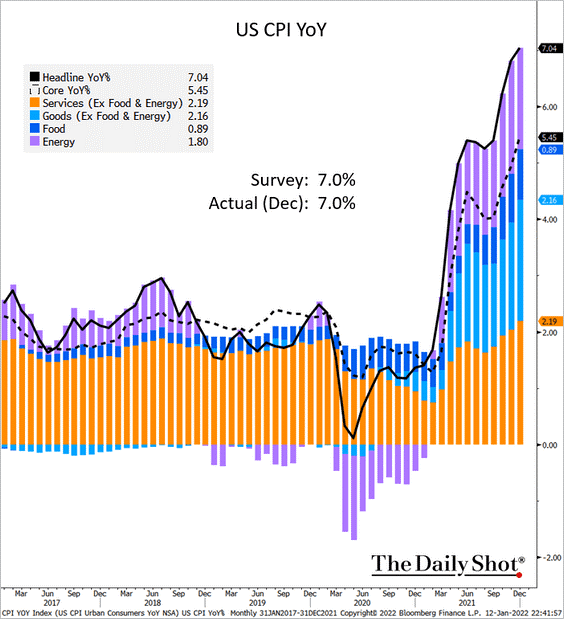

The consumer price index (CPI), which is a measure of inflation, grew at an annual rate of 7% for the month of December. Not only was that the third month in a row of growth over 6%, but it is the highest reading since 1982. Core CPI, which excludes the more volatile food and energy sectors, also grew 5.5% in December. The price increases were wide-ranging, affecting almost all areas of the economy. Prices of used vehicles rose 37.3% in December compared to a year earlier, making it one of the biggest contributors to last month’s CPI number.

Source: The Daily Shot

What's in store for 2022

Built-up consumer savings, combined with supply chain constraints, continue to play a large factor in the recent price increases. However, many economists expect inflation to peak in the next few months and remain elevated for some time after. December’s 3.9% unemployment rate, combined with the recent inflation reading, essentially fulfill the Fed’s requirements to begin rate hikes as soon as March.

Inflation will continue to be a point of emphasis in 2022. Persistent inflation and a rising interest rate environment will provide new challenges in the year ahead. However, inflation is only one of many factors we look at when gauging an economy’s health. We believe diversification is necessary for the long term goals of our clients. Reach out today if you’d like to discuss how your portfolio is positioned for the year ahead!