Why Diversification Matters in Investing

December 16, 2019

By Michelle Holmes

Asst. Vice President - Investments

As the end of the year approaches, I’m not only thinking about what happened this year, I’ve also started reflecting on what things were like in the market in 1998 when I started working at Security National Bank.

Back then, “tech stocks” were the all the rage. They were outperforming other types of stocks and had been for a few years. Our clients called and asked why we were not investing heavily in tech stocks. Over the years, I’ve found this to be a common theme. Whenever one area of the market starts to outperform other areas for more than a short-time period, people start asking: “Why don’t you just invest in [Insert Area of the Market]?”

U.S. Stocks vs. Foreign Stocks

Today, there is a large disparity in the performance of U.S. stocks versus foreign stocks. In fact, U.S. stocks have outperformed foreign stocks for more than a decade.

So why not invest only in the U.S. stock market? Because diversification matters. The chart above not only shows the recent outperformance of U.S. versus foreign stocks, it shows how abrupt the change in leadership can be. When investor sentiment switches, it does so quickly — just as it did when the tech stocks lost favor in the early 2000s and the dot-com bubble burst. The market index that tracks technology stocks, the NASDAQ (National Association of Securities Dealers Automatic Dealers Automated Quotations), fell 52 percent from its high point of 5,132 in early 2000 to close the year at 2,470 points. The NASDAQ fell even further in 2001.

When we invest on behalf of clients, our philosophy is to stay fully invested in a diversified mix of assets. This means we invest in different areas of the market, regardless of which area is leading performance today. As an example, we maintained our exposure to the foreign stock market and our portfolios will benefit when the market sentiment changes to favor foreign stocks and they start to outperform U.S. stocks.

Just because one area of the market outperformed over the last several years, does not guarantee it will outperform moving forward. If you have a diversified portfolio, you can benefit from whichever area of the market is doing well today as well as benefit when market leadership changes.

Stocks vs. Bonds

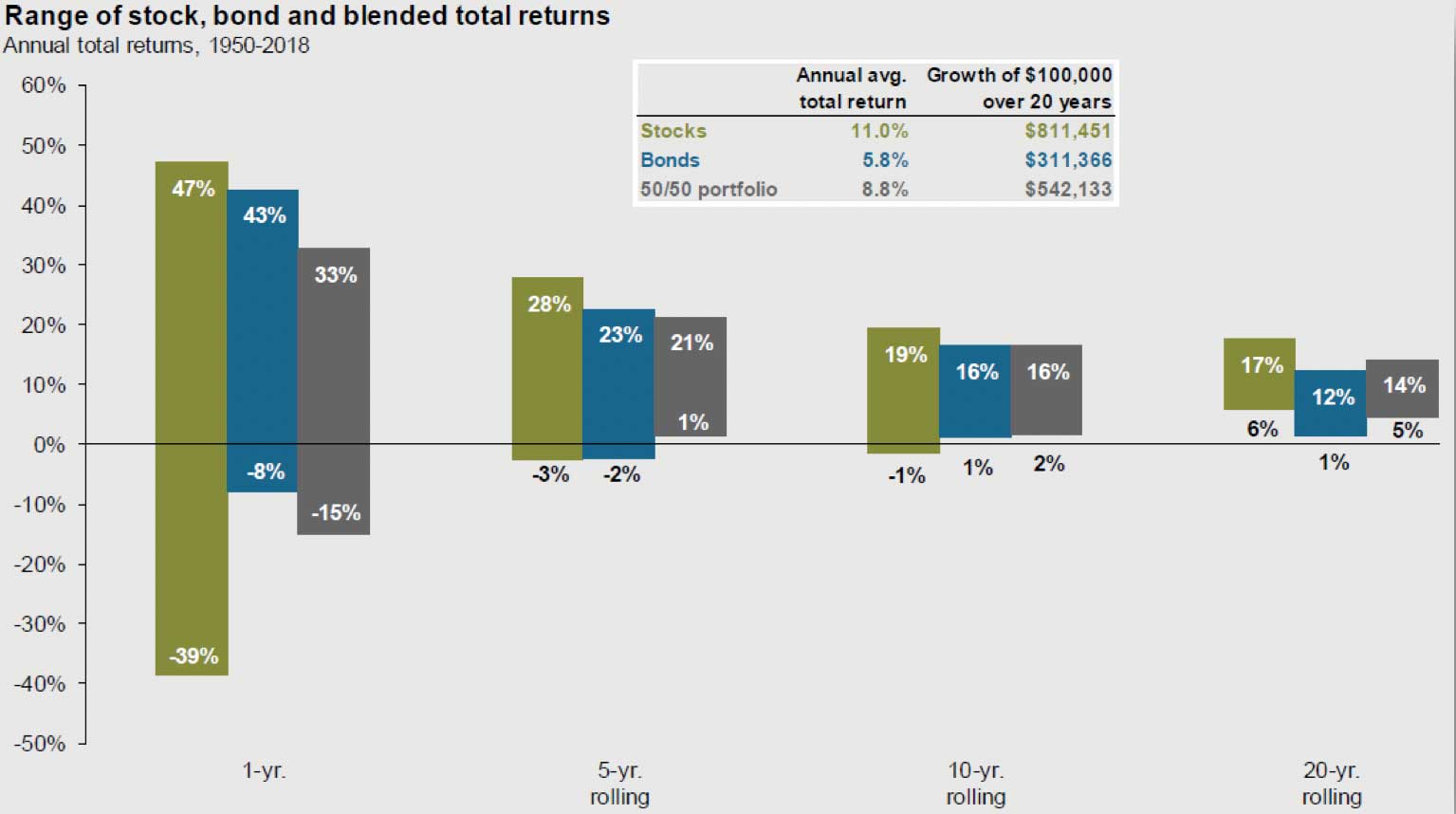

Having a diversified portfolio also helps reduce risk. A balanced portfolio of stocks and bonds has produced most of the stock market return over time with less volatility.

Source: JP Morgan Guide to the Markets 4Q 2019

Source: JP Morgan Guide to the Markets 4Q 2019A diversified portfolio of stocks and bonds typically does not lose as much as all stock portfolio. The reason being that as one area of the market falls, a diversified portfolio has other areas that may be performing better to help preserve market value of the portfolio. This resulted in a balanced portfolio earning about 80 percent of the long-term stock market return with less than half of the downside risk of the stock market in any given year since 1950.

Our time-tested approach to investing dollars entrusted to our care by staying invested and diversified while balancing risk and reward has served us and our clients well over time. We expect it to continue to do so in the future.

For 136 years, Security National Bank has helped families and businesses plan and execute strategies to achieve financially security. Over the decades, much has changed in the community, economy and investment markets, but one thing hasn’t: our ability to help people make sound investment choices. Please allow us the chance to help you develop or enhance your financial security. Contact one of our representatives to discuss how we can help you reach your financial goals.