Answers to 3 of the Retirement Questions That We Hear Most Often

September 23, 2019

By Michelle Holmes, CFA

By Michelle Holmes, CFA

Assistant Vice President - Investments One of the most rewarding parts of my job is helping people make plans and adjustments to reach their financial dreams. This week a colleague and I were visiting with participants in an employer sponsored retirement plan. We provided updates to the employees and business owners on what is going on in the market and what we think may happen in the future.

I thought I would share some of the questions we hear when helping participants review their investment plans and the information we responded with.

Why is it important to save for retirement?

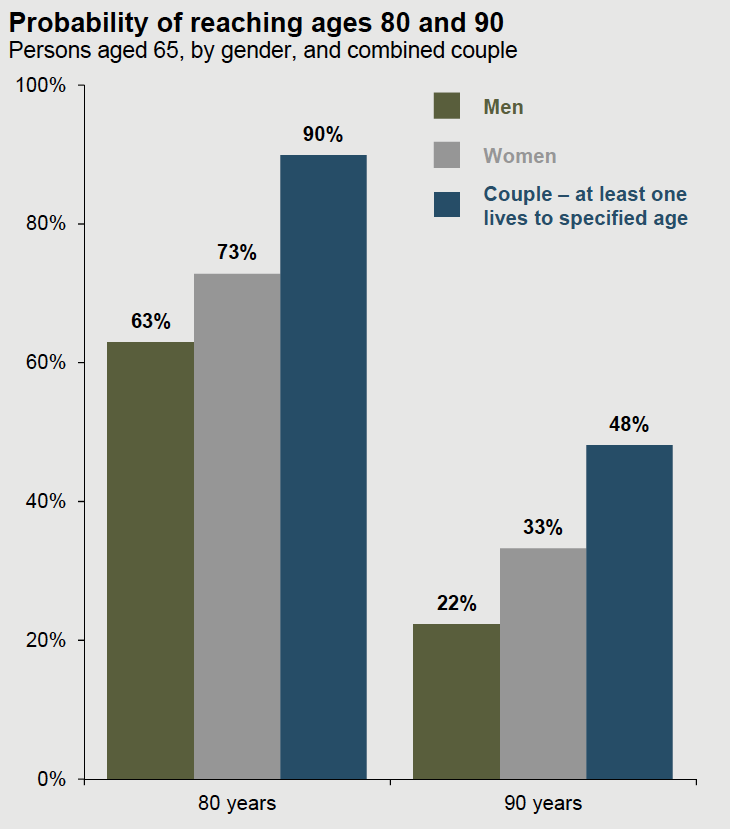

One simple answer is that we are living longer. A married couple aged 65 today has a 90 percent chance that one will live to age 80 and almost 50 percent chance one will live to age 90. This means your retirement savings may need to last well over 20 years.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

How much will I need to save for retirement?

On average, people need between 70 and 90 percent of their current income each year to live comfortably in retirement. There are several planning tools online that you can use to see if you are saving enough to retire, including our Security National Wealth Management retirement calculator. Another way is to use a simple age based guide. The chart below shows someone who is 40 years old should have approximately 3 times his or her annual salary saved for retirement.

What do I do if I am not on track?

Do not panic. There are several options to consider:

1) Take advantage of employer sponsored plans.

If your company offers a match, make sure you are contributing enough to receive the full match from the company.

2) Increase your savings rate each year by 1% or more if you can.

An easy way to do this is to increase your savings when you get a raise or pay off an existing bill.

3) Make sure you are invested in an appropriate mix of stocks and bonds.

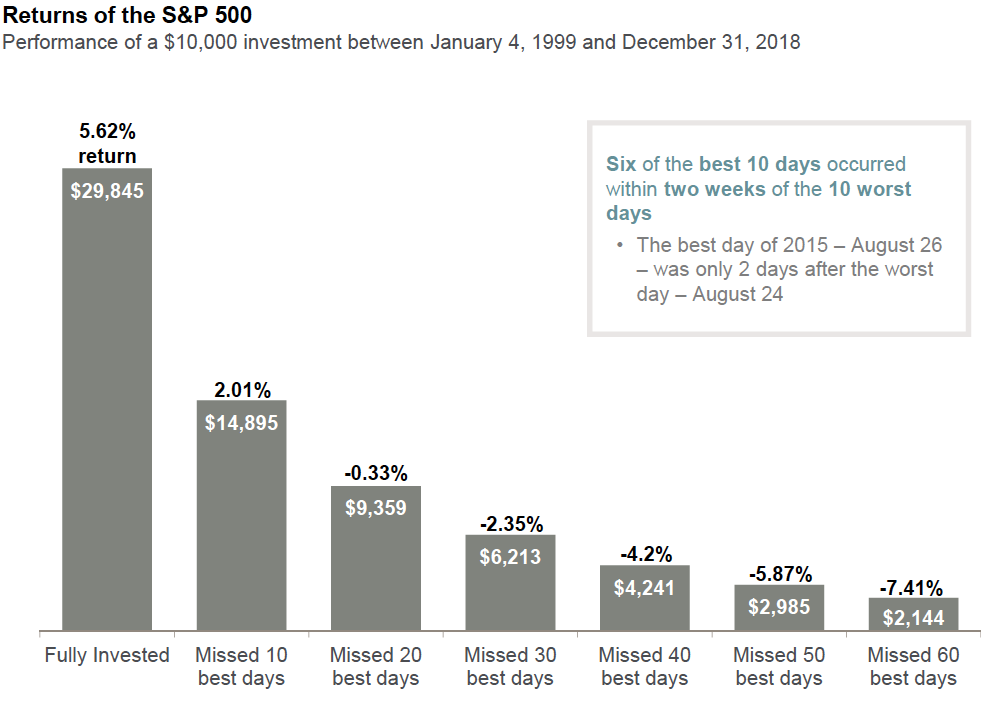

Once you have a plan for investing, stay invested. Trying to time the market is extremely hard to do. Many of the worst days in the market are followed by some of the best days. The chart below is a great example of this. It shows that you would have earned less than half of the annual return of the market over the last 20 years if you missed just the best 10 days.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

4) Consider working longer, retiring later or working part time in retirement.

The earlier you start planning and making adjustments, the less likely you will have to resort to work longer. Assuming a consistent rate of return of 6 percent over time, the benefits of starting to save more, earlier, are compelling.

Source: Vanguard

Source: Vanguard

For 136 years, Security National Bank has helped families and businesses plan and execute a strategy to make them financially secure. Over the decades, much has changed in the community, economy and investment markets and we have helped people make sound investment choices. Please allow us the chance to help you develop or enhance your financial security. Contact one of our financial representatives to discuss how we can help you reach your financial goals.