New Year, New Portfolio: Why Rebalancing is So Important

January 19, 2021

By Krista Eberly, CFP®

By Krista Eberly, CFP®

Portfolio Manager

This week the Wealth Management Division will begin to rebalance our managed accounts. Prior to this point, we perform research and analysis to decide how we want to position our portfolios for the year ahead. While rebalancing isn’t exciting, it is essential to ensure one is not taking on unintended risks over time. This is part of your charge to us.

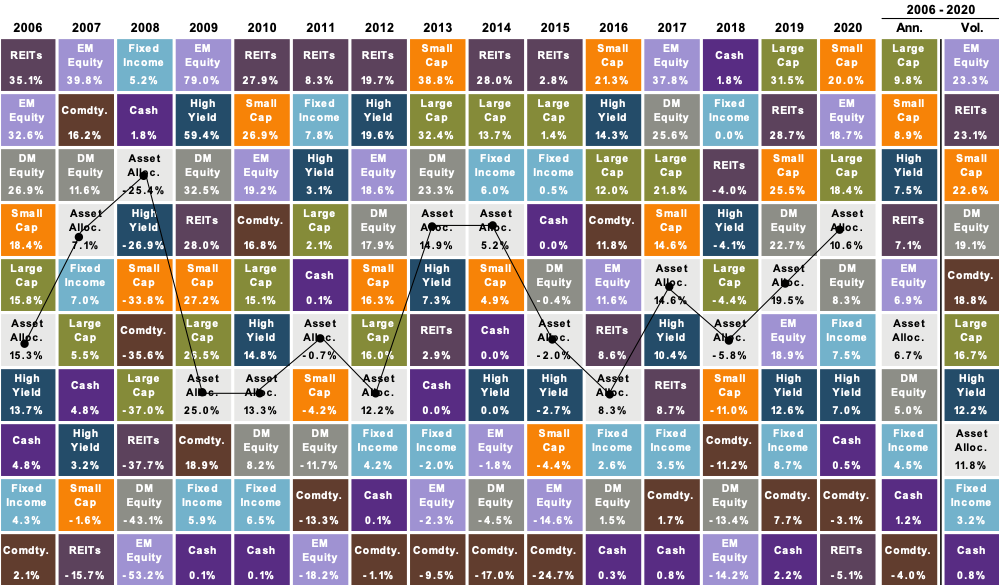

In a broadly diversified portfolio, an investor will own assets in various sectors of both the bond and equity markets. The below chart from J.P. Morgan shows various asset class returns over the past fifteen calendar years with each one represented by a different color.

Source: J.P. Morgan Guide to the Markets – U.S. Data as of December 31, 2020.

You will notice that not only do the returns vary from year to year, but so do the top and bottom performers. Rarely do assets move in tandem with each other. These ebbs and flows overtime will cause the various assets in one’s account to deviate from its target weighting; top performers will be above target and bottom performers will be underweight. Rebalancing brings a portfolio back in line with targeted weightings and helps to keep one’s risk at a tolerable level.

How often should an investor rebalance?

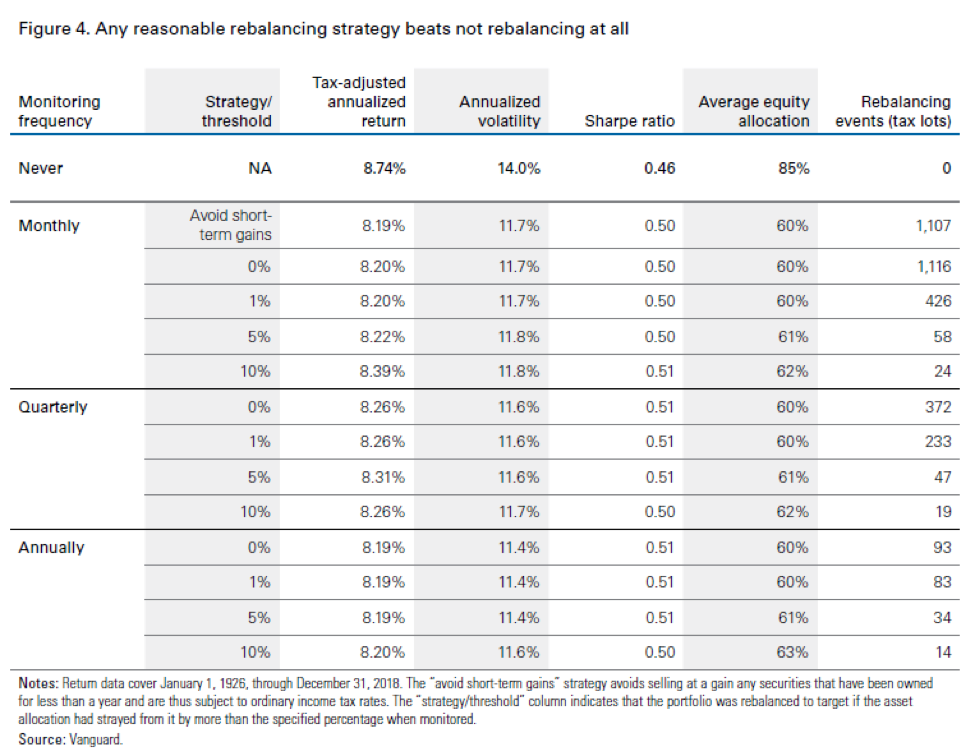

The answer depends on one’s overall investment strategy. Vanguard did a study on the frequency of rebalancing and the strategy/threshold to see how the risk and return profiles compare. Vanguard looked at rebalancing monthly, quarterly, annually, and never. In the data below, the annualized returns and volatility are similar whether you rebalance monthly, quarterly, or on an annual basis. Where it differs is when a rebalance never occurs. With that scenario, an investor can achieve a little higher return from unintentionally taking on more equity exposure over time, but you take on about 20% more risk in doing so. Therefore, your risk-adjusted return is lower, illustrated below by the Sharpe ratio. The key takeaway from this study is the frequency of rebalancing is irrelevant. What matters is that you rebalance - that will generate better risk-adjusted returns over time.

At Security National Bank, our rebalancing frequency is annual and usually takes place within the first quarter of the year. However, we will rebalance more than once a year if circumstances warrant. For example, we implemented a second rebalance in late March/early April 2020 as equity positions in most accounts deviated away from their stated investment objectives when stocks entered into a bear market in a matter of weeks. This rebalance worked out well for clients as March 23 was the trough for the markets and stocks have been on an upward trend since.

What changes are clients likely to see with this rebalance?

It depends on the type of account and its overall investment objective. If accounts hold both equity and fixed income, you are likely to see a reduction in equities with proceeds added to fixed income. This is due to stocks rallying since the March low, which pushed equity allocations above stated targets. Therefore, you will likely see some profit taking to move back to guidelines. Within fixed income, we will increase our credit exposure to capture a reasonable level of income in this challenging interest rate environment. Our equity exposure will have a value tilt.

If you would like to learn more about the specific investment changes we will implement as part of our rebalance, please schedule an appointment today. Also, if you have not already done so, please check out our year-end review video released last week. This will give details on what to expect in the year ahead and more info on our rebalance as well.