Why Should You Stay Invested During Market Corrections?

January 16, 2019

by Michelle Holmes, CFA • Trust Investment Officer

As my colleague Mike Moreland mentioned in his commentary a couple of weeks ago, there was “Nowhere to run, nowhere to hide” in 2018. Almost all major asset classes posted negative returns for the year. The bond market rallied in December just to break even for the year. This felt especially jarring following the abnormally low period of volatility in 2017.

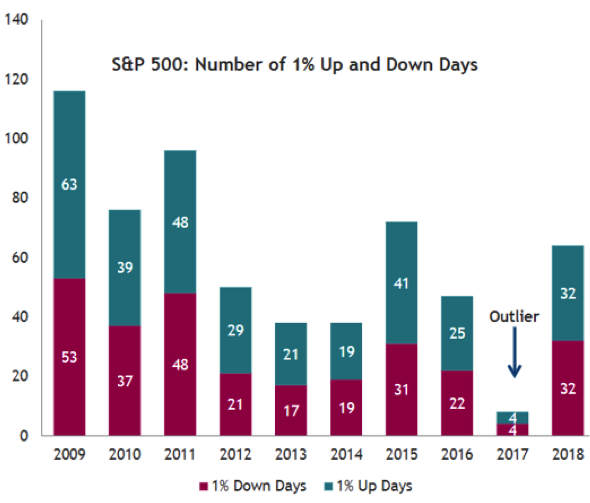

It is hard to believe, but 2018 was close to the average 67 days of "1 percent" movements experienced in the markets from 2009 to 2016. The actual outlier was 2017, which saw only eight days of 1 percent volatility.

Source: Wall Street Journal - The Daily Shot

Source: Wall Street Journal - The Daily ShotWhat should an investor do during market volatility?

The short answer – stay invested. No one has a crystal ball to tell you when to get into and out of the stock market. Timing the market downturn is hard enough, but timing both the market downturn and subsequent recovery is even rarer. This is especially true since the stock market can recover a large portion of its loss in a relatively short amount of time.

The chart below shows that an investor would have given up 10 percent of the market recovery by missing the market bottom and reinvesting just two days after the trough:

Source: Bloomberg and GSAM

Source: Bloomberg and GSAMThe recent market downturn is a prime example. The S&P 500 lost over 9% in the month of December and is up over 10% since the market bottom on Dec. 24, 2018. If you missed the market bottom by two trading days and reinvested on Dec. 27, 2018 you would have given up over half of the market recovery thus far, gaining only 4.4% through Jan. 11.

Over the years of managing money for our clients, we found that the best offense during times of market volatility is a good defense - having a diversified portfolio. We keep clients invested in mix of stocks and bonds appropriate for them to achieve their long-term goals, rather than trying to pick the best time to invest in the markets.

The chart below shows that this type of investment approach historically produces market like returns with less volatility over time:

Source: J.P Morgan - Guide to the Markets Q1 2019

Source: J.P Morgan - Guide to the Markets Q1 2019For more than 135 years, SNB Wealth Management has helped individuals and families turn their plans into reality. Contact one of our professionals today for an appointment to review your long-term financial goals.