Will Overcorrection Ultimately Bring Inflation Down or Lead to a Recession?

January 17, 2023

By Michael List, CFP®

By Michael List, CFP®

Investment Management OfficerHave you ever been driving and overcorrected?

When we hit a patch of ice and start sliding, our first instinct is to turn the other way to straighten out. Alternatively, we are daydreaming and the median bumps catch our attention, we jerk the wheel to get back in our lane. These are often split-second reactions to correct our course; the trouble is sometimes it leads to overcorrecting.

(Over?) Correcting the 2020 Stimulus

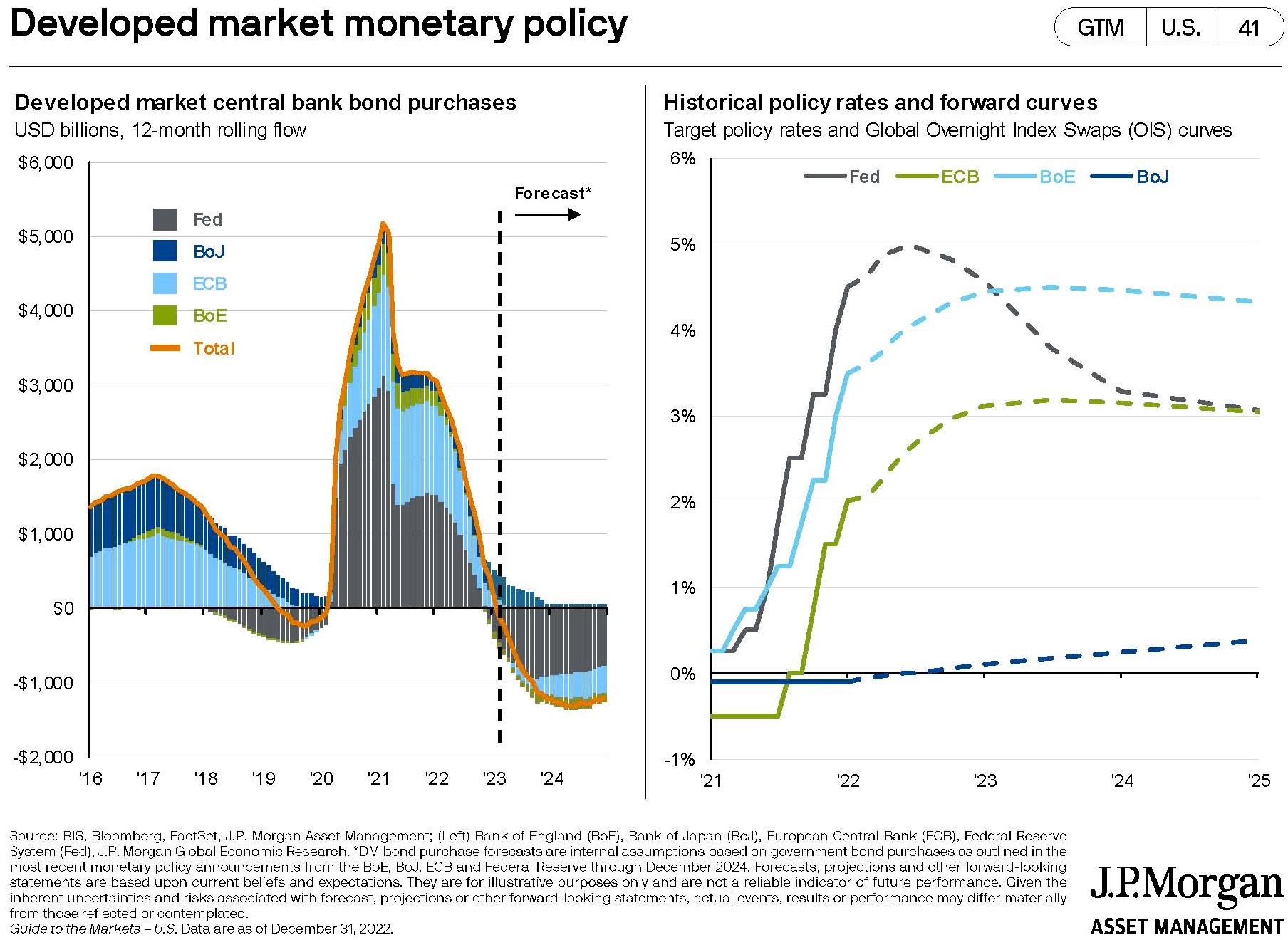

Three years ago, the Federal government unleashed enormous stimulus into the economy. The Federal Reserve Bank purchased trillions of dollars of bonds to inject more cash into the system and was the most aggressive global central bank (seen on the left chart below). The Fed overcorrected to limit the impacts of many parts of the economy shutting down. While it helped avoid a prolonged recession, it also brought about inflation rates not seen in decades. This presents a new problem for the Fed.

As the Fed was the most aggressive central bank worldwide in terms of its stimulus response to Covid, it has been the most aggressive in raising rates in response to inflation. The problem is, if the Fed raises rates too high, that risks pushing the economy into recession.

On the right hand chart below, the market, believes the Fed will overcorrect to bring down inflation. In addition to the moves last year, markets are pricing in several additional rate hikes in 2023, with rate cuts later this year or early next year. In contrast, other global central banks are raising rates, but they are trying to match their long term neutral rate, not to overshoot it.

Volatility and Risks To Remain Elevated

With a restrictive Fed near term, volatility and risks of recession will remain elevated. Longer term, current valuations suggest better future returns for both stock and bond investors. As we rebalance portfolios in the first quarter, we are mindful of both.

We will remain diversified with an emphasis on valuations, credit quality and income, which should help reduce downside risk in the near term. At the same time, we always keep an eye on the long term while rebalancing portfolios back to their target allocation. Please reach out to an advisor today with any questions. Your success matters to us!