Will Santa Leave a Soft Landing Under the Tree?

December 11, 2023

By Michael List

By Michael List

Investment Management Officer

This week caps off the final major data releases of 2023. The updated data include our last inflation report (CPI) and Federal Reserve meeting and decision. This comes right after an onslaught of data during jobs week with reports on ADP Employment, unemployment rate, nonfarm payrolls, and JOLTS. The market is currently expecting no Fed rate changes in their final meeting and no surprises with inflation. However, next year may be a different story.

Employment

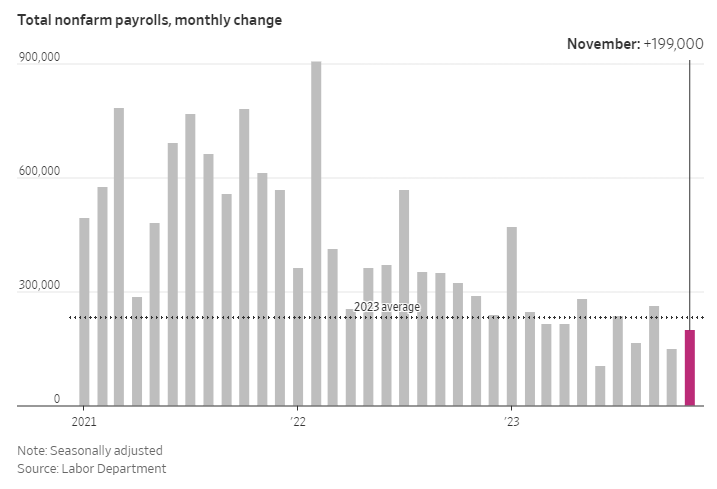

The employment market continues to soften but has remained resilient throughout 2023 as seen in the chart below from the Wall Street Journal. This is welcome news to Fed members and employers as it relieves one of the sources of concern related to inflation. In recent months, change in nonfarm payrolls has been below this year’s average and well below the months emerging from the pandemic, but they remain solid when we consider the unemployment rate of 3.7%. Full employment is one of the objectives of the Federal Reserve and it remains in place.

Inflation

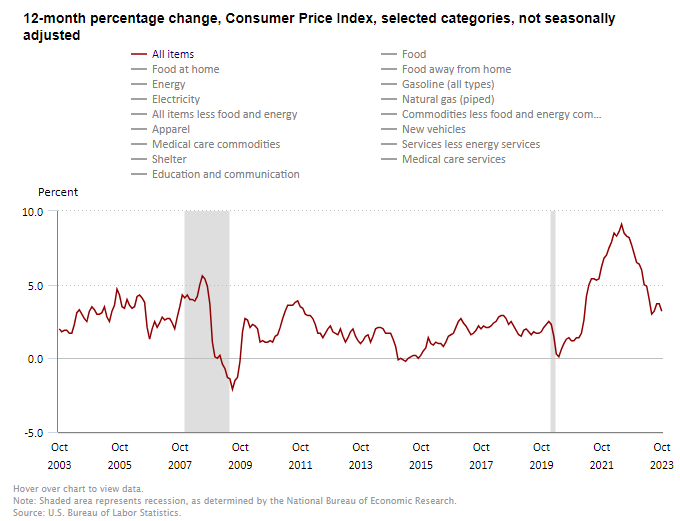

The second objective of the Federal Reserve is stable prices, there is still work to be done on this one. The reported change in consumer prices is below its 2022 highs, but at 3.2%, it is still higher than the Fed’s 2.0% target. Analysts expect this week’s report to show CPI fell to 3.1%.

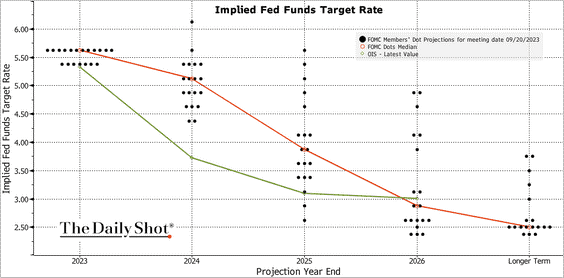

With a softening but resilient employment picture and a declining inflation rate, the market’s hope for a soft landing in the US economy reemerged over the past 6 weeks. This led to a growing divergence in expectations from the Federal Reserve and investors. The Fed’s message has been consistent, they are data dependent but intent to keep rates higher for longer until they are confident prices are stabilizing.

Coming into 2023 there was a similar divergence in Fed and investors’ expectations. In 2023, it was the Fed’s expectation that prevailed. As we look forward to 2024 the correct expectation will depend on inflation and employment. We think investors’ rate cut expectations at this point are pretty aggressive, they would require significant improvement in inflation or deterioration in employment or both. The Fed has been very consistent and firm about their rate expectations, and hint to an old saying, “Don’t fight the Fed.” Our fixed income portfolios remain intermediate term in high quality bonds with a focus on income. We have increased duration in our portfolios over the past year as long-term bonds offered higher rates. This will benefit portfolios if rates do decline next year, which is expected from both the Fed and investors. Declining rates push bond prices higher, and we have locked in these higher rates for a longer period of time. If you have any questions on the structure of your portfolio, please contact your Advisor. Your success matters to us.