Your Portfolio Needs a Wellness Checkup, Too

July 6, 2021

By Ted Hanson

By Ted Hanson

Securities Analyst

My wife is in the healthcare industry, and a common topic of discussion is checkups. She often tells me how wise it is to visit with my doctor occasionally and review my health. I often find myself reminded of investing and the importance of reviewing your financial health. Just like diet, exercise, and genetics, there are a variety of factors that influence your financial health. Since one influence is market performance, let’s review the first half of the year.

Equities

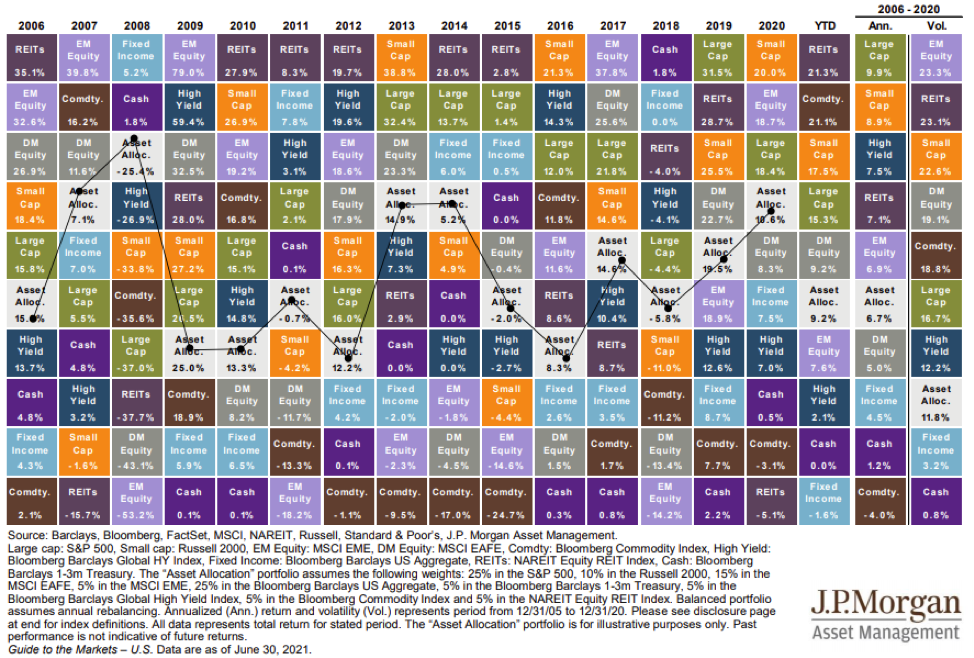

The first half of 2021 ended on a strong note as the S&P 500 closed at a new all-time high on June 30. With the reopening of the economy, progress in vaccinations, and accommodative monetary and fiscal policy, most major stock indices produced double-digit returns in the first half of the year. Commodities, REITs, and small cap companies experienced the biggest gains this year. After being the bottom-performing sector in 2020, energy is the top performing sector in the S&P 500 for the first half of 2021. The chart below, provided by J.P. Morgan, highlights the importance of maintaining a broadly diversified portfolio. Just like eating fruits, vegetables, and protein in a well-balanced diet, having a diversified portfolio provides many benefits as market leadership changes.

Fixed Income

Fixed income investors ended the first half of the year on a better note than many thought possible in March as longer-term yields stabilized. The yield on the 10-year U.S. Treasury note ended June at 1.45%, up from 0.91% at the end of 2020 but down from 1.75% at the end of March. The outlook on a growing economy, monetary policy, and an expectation of increased inflation drove the first quarter rise in yields. Yields in the second quarter stabilized as many investors began to buy into the Federal Reserve’s view that the near term increase in inflation is transitory. Inflation and the labor market will influence yields in the second half of the year as the Fed looks to achieve its dual mandate of price stability and maximum employment.

Going Forward

The past year is a prime example of how anything can happen in the near term. Our economy shut down due to a pandemic and reopened with a vaccination. While in the near term we will be ready for whatever life throws at us, we will continue to take a long-term perspective. Valuations point to favorable opportunities in international markets. Fixed income positions will remain short- to intermediate-term with a focus on upper-level credit quality. In a world of unknowns, we will continue to keep portfolios under our guidance fully invested but conservatively so. If you haven’t scheduled your financial health checkup, contact us today!