A Similar Time for the Fed

September 8, 2025

By Krista Biernbaum, CFP®, CIMA®

By Krista Biernbaum, CFP®, CIMA®

Investment Management OfficerAs we head into Fall, the current environment feels similar to where we were a year ago. For most of 2024, the Federal Reserve (Fed) was on hold with rates, despite expectations from the markets. Last Summer, the labor market showed signs of softening, and this gave the Fed the green light to start cutting rates at the September 2024 policy meeting. Thus far this year, the Fed kept rates unchanged, as it focused more on the inflation side of its dual mandate. That is until recently. As Michael List noted in his commentary two weeks ago, “the balance of risks appears to be shifting.”

The Softening Labor Market

As a reminder, the Federal Reserve has a dual mandate of stable prices (i.e. inflation) and maximum employment. The labor market has gradually softened this year but didn’t gather more of the Fed’s attention until the July jobs report last month. Why? Not only did it show the number of jobs added came in well below expectations, it also had a massive negative revision to the prior two months. A sign that demand for workers is slowing.

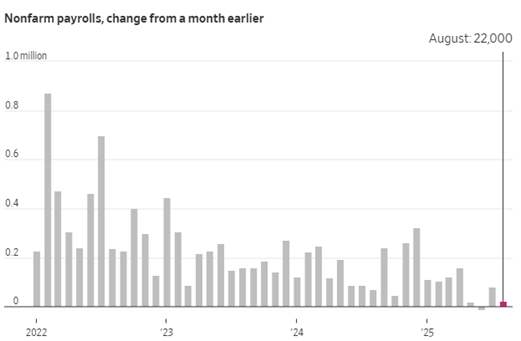

On Friday, the Bureau of Labor Statistics reported the U.S. economy added 22,000 jobs in August. Not only was this well below expectations, it was also lower than July’s monthly increase. In addition, we saw more negative provisions to the prior months. Now, June actually saw payrolls contract 13,000 and the four-month average of job gains is 27,000. The average for the first four months of 2025 was 123,000 jobs added. A slowdown indeed and illustrated below.

Source: The Wall Street Journal

The Fed's Eye on the Unemployment Rate

The important data point in Friday’s report was the unemployment rate. Why? Federal Reserve Chairman Jerome Powell mentioned in a previous press conference it is the labor market metric he was particularly watching. This shows the balance in the labor market between the demand and supply of workers. Both have steadily declined this year (each for different reasons), to allow the unemployment rate to remain range bound between 4.0-4.2% for most of 2025. In August it rose to 4.3. This is the highest level since late 2021.

What does this mean for the Fed? This opens the door for policy members to resume rate cuts at their next meeting on September 16-17. A 25 basis point (or 0.25%) reduction is priced into the market and remains the base case scenario. A point to keep in mind is we get an update on the inflation picture this week, the other side to the Fed’s dual mandate. Both will determine the balance of risks and the ultimate policy decision. With the Fed now in its blackout period, we won’t receive any additional commentary until the conclusion of this meeting.

Great Time to Check Your Cash Positions

In the meantime, what one can do is make sure your portfolio is positioned for the next leg of this rate cycle. With the Fed likely cutting rates this month, it means interest rates on cash and cash like investments are heading lower. However, now still remains a good time to invest in high quality intermediate term bonds and lock up current rates for years to come. If you have not reviewed your cash positions recently, give us a call today. We want to ensure you are positioned correctly for the next phase of the rate cycle. Your financial success matters to us.