A Wild Week in the Markets

June 20, 2022

By Ted Hanson

By Ted Hanson

Portfolio ManagerWhat a difference a week makes! Since the higher than expected May Consumer Price Index (CPI) released June 10th, the markets have gone on a wild ride. The S&P 500 has officially entered bear market territory, yields spiked across the maturity spectrum, and the yield curve flattened. Let’s take a look at what happened.

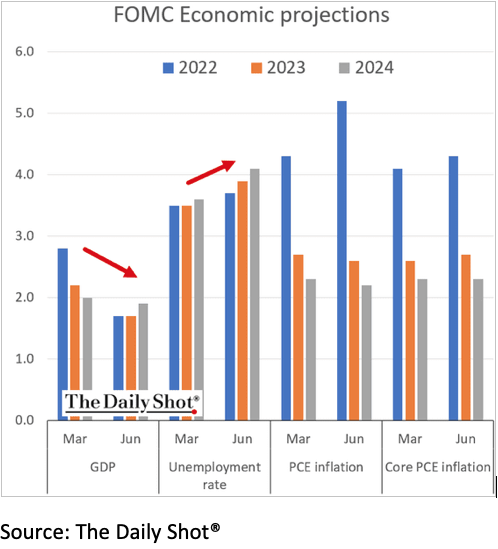

Last week the markets repriced expectations that the Federal Reserve is going to have to do even more to get inflation under control. This lowers the odds of a ‘softish landing’ and increases the risk of a recession. The Fed met for its highly anticipated policy meeting and raised interest rates by 0.75%, its largest increase since 1994. In Fed Chairman Jerome Powell’s press conference, he noted that we could see either a 0.50% or 0.75% increase at the next meeting in July. These series of rate hikes will continue to increase borrowing cost, drive down consumer demand, and slow the US economy. With the updated economic projections, the Fed sees gross domestic product (GDP) growth slowing this year to 1.7%, down from the 2.8% forecasted in March.

As you can see in the chart below, the Fed also forecasts that year end inflation will remain high at 5.2% and the unemployment rate will inch up to 3.7% from the current rate of 3.6%. In addition, the Fed will continue to raise the federal funds rate through the remainder of this year. All of this points to a Federal Reserve that is committed to getting inflation under control and believes policy needs to be restrictive in order to do so.

What Does This Mean for You?

Going forward, investors will look to continue to navigate these uncertain times while the Fed attempts to achieve its primary goal of returning inflation to its 2% long term target. With volatility expected to remain elevated sticking true to ones long term investment goals and principals will be key to success. As my colleague Mike Moreland said last week, lower starting valuations do point to better opportunities ahead. In addition, rising fixed income yields will provide stronger income streams for investors going forward. However, risks remain to the downside so caution is warranted.

Portfolios under our charge will remain fully invested as we continue to progress through a full market cycle. If you’d like to discuss your portfolio reach out today.Your success matters to us!