Bank Soundness vs. Inflation Control: Keeping the Air in Both

March 20, 2023

By Michael List, CFP

By Michael List, CFP

Vice President - Investments

Last week was historic for a few of reasons. It marked the three year anniversary of the declaration of the Covid-19 pandemic and the one year anniversary since the Federal Reserve launched one of its most aggressive interest rate hiking cycles to combat inflation.

The aggressive rate hikes contributed to the breakdown of three banks last week: Silvergate, Silicon Valley, and Signature. That further led to historic market rate changes including the largest 1 day drop in interest rates in over 40 years. And, for the first time in two years, the release of consumer price index data failed to make front page news.

For those who disconnected from financial news last week for spring break or to watch March Madness, you missed a lot. Keep reading to catch up:

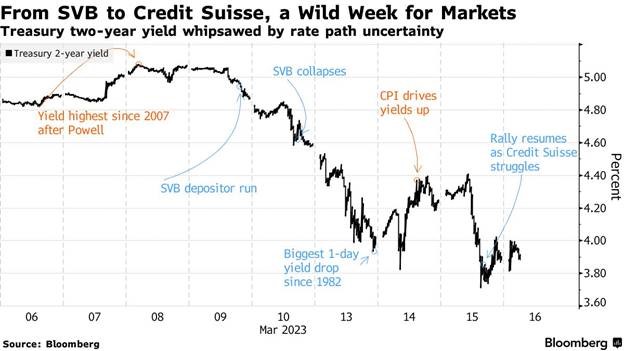

The Effect of Volatile Markets on Treasury Yields

The Bloomberg chart below highlights how volatile markets were over the past couple of weeks. The two-year Treasury bond yield dropped more than 1% in just three days. The chart also provides key events that influenced yields, orange indicating upward pressure and blue for downward pressure. Short-term treasury rates are heavily influenced by expectations of Federal Reserve rate policy. Investors use these key event pressures as they bet on anticipations of future rate hikes or cuts, with cuts winning the battle last week.

The volatility in rates highlights the tightrope the Federal Reserve is navigating, as we have discussed in previous commentaries. On the one hand, inflation remains well above the Federal Reserve’s objective target. On the other hand, the Federal Reserve wants to slow spending and economic growth, but it does not want to cause a banking crisis.

The Federal Open Market Committee will be meeting over the next few days to review data and determine any policy rate changes. Most analysts expect a 0.25% increase, but they will be more interested to hear Chairman Powell’s comments following the announcement, particularly any updates related to the outlook for growth, rate path, and detail related to the stability measures recently enacted by the Treasury and Fed.

Your Portfolio In This Complicated Market

While we did not predict the collapse of Silicon Valley Bank, the events of the past week reinforced the changes we incorporated when we rebalanced portfolios earlier in the quarter. For equities, we remain broadly diversified, avoiding concentrations in sectors and regions. On fixed income portfolios, we improved the credit quality and extended duration to capture higher rates on high quality bonds.

If you would like to schedule a portfolio review or market update, please reach out to your Advisor.