Does an Inverted Yield Curve Mean Recession? Not Necessarily

March 28, 2022

By Michael List, CFP®

By Michael List, CFP®

Investment Management Officer

Despite what you've heard or read in the news, inverted yield curves do not cause recessions.

Before we go further, you may ask — what is an inverted yield curve?

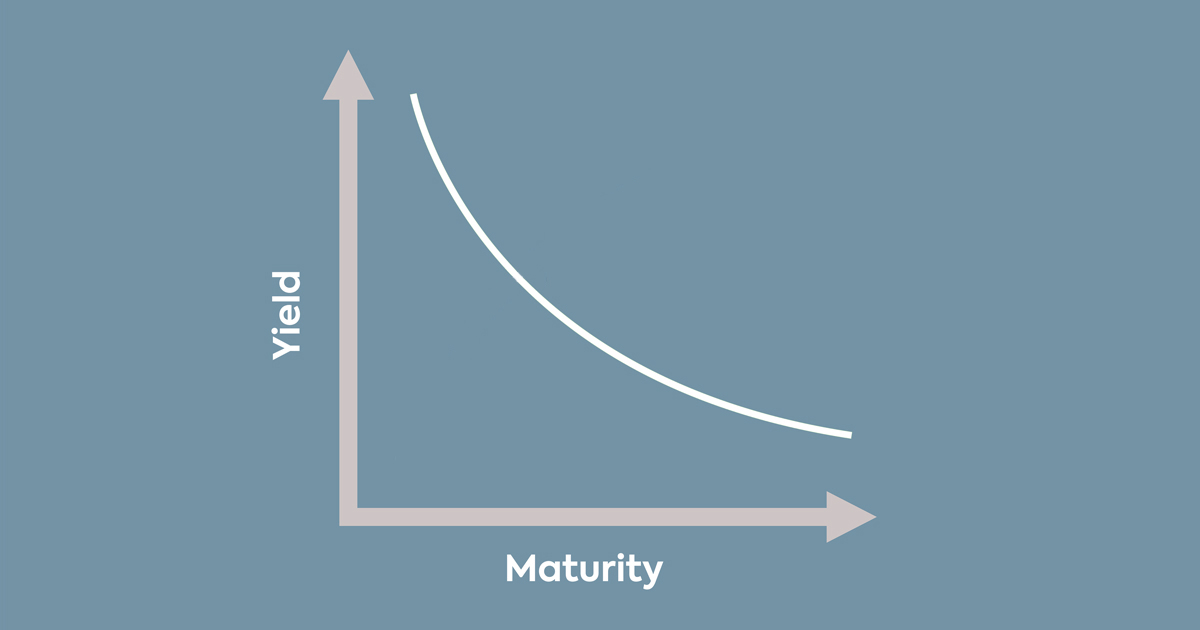

An inverted yield curve happens when the yield for longer-term bonds drops below short-term ones. This is not a common scenario. Under normal conditions, longer maturity debt should have higher rates than similar credit with shorter maturity debt, because the lender is taking more risk. As time to maturity increases, yield goes up. However during an inverted yield, the opposite is true.

Why then, do people associate inverted yield curves and recessions? The answer is that in the past, an inverted U.S. Treasury yield curve has been one of the best indicators of a recession. For example, over the past 60 years the Treasury's yield curve has been inverted 10 times. Eight of those inversions preceded a recession by 13 months on average.

What causes a yield curve to an invert?

Simply put, investors demand higher rates in the short term than the long term. Tighter monetary policy forced by high inflation is one cause for investors being less willing to commit funds to a long-term fixed yield and favoring the shorter duration. This is why our previous commentaries have focused on inflation.

Historically, longer-term rates tend to change with macro data — average inflation, real (inflation adjusted) GDP growth trends, population growth and productivity. Real GDP grew 5.7 percent in 2021, which generally happens when we are recovering from a previous recession. However, real GDP will not continue to grow at that rate for the next ten years. Current expectations are closer to 2.0 percent. Because of this, we have seen long-term rates rise, but remain in the 2.0 to 2.5-percent range.

Why doesn’t an inverted yield curve cause a recession?

The yield curve is simply a tool to measure current conditions and market expectations, in this way it is comparable to a thermometer. A thermometer does not cause water to freeze, but does allow you to see if conditions are right for water to freeze. Similarly, an inverted yield curve will not cause an economic recession, but it shows that investors perceive tighter monetary policy will add stress to economic conditions and increase the risk of a future recession.

The Federal Reserve (Fed) has a dual mandate of “stable prices” and “full employment.” During the past 30 years, the Fed has been able to manage these mandates in harmony ‘reasonably’ well. However, there are times these two mandates are contrary to each other, and in those times, it is important to remember that central banks’ primary objective is price stability. Inflation is well above the Fed’s 2.0 percent target. To correct this, they have started to raise short-term interest rates and that will continue until inflation pressures recede. The voting Fed members and investors believe that will require ten 0.25 percent rate hikes totaling 2.5 percent. And so, this could lead to an inverted yield curve.

Investors expect GDP growth to moderate back toward trend levels, but they also believe the Fed will have to increase rates more aggressively to lower inflation in the short run. By raising short-term rates, lending and borrowing are less attractive, and liquidity is lower, causing inflation and economic growth to slow as well. If however the Fed is too aggressive and rates rise too high or fast, they risk causing a recession.

What this means for your investments:

From an investment perspective, the changes we have made over the past several months should help reduce, but will not eliminate the risks for portfolios we manage. In bonds, we continue to center on high quality issues, shorter duration, with an increased importance of income and the use of inflation-protected securities. In equity positions, we have tilted toward opportunities with lower valuations and higher dividends, and we remain broadly diversified.

For over 138 years, Security National Bank has been resource to help people achieve their financial objectives. Experience matters! If you have any questions about your portfolio, reach out to an advisor today.