How Inflation and Volatility Can Be Your ... Friends?

March 21, 2022

By Zed Heimensen

Investments Intern

Volatility and inflation have always made up a portion of the World’s economic landscape, and both factors are often viewed with a negative connotation. These views are typically justified; rising inflation is the general measure for rising prices in the economy, volatility brings price fluctuations to portfolios.

The markets have seen inflation and volatility run their course over time, but many young investors may be experiencing this type of market for the first time. Because of this, there is a fear-generating component associated with both inflation and volatility. Overcoming these negative perceptions is the first step to capitalizing on the market trends that accompany these market factors.

Turning inflation into opportunity

During the first quarter of the year, inflation has been one of the hottest topics in politics, finance, and the economy. Over the past few weeks, our team has highlighted some of the ways that investors can combat inflation and invest during times of chaos. Understanding the impact of inflation can help you move forward in achieving both your short- and long-term goals.

Real estate investment trusts

Because inflation decreases the purchasing power of your money, real assets have the ability to thrive in inflationary environments. This includes both real estate and commodities. During times of inflation, investors have the opportunity to capitalize by purchasing real estate investment trusts (REITs) directly or by purchasing shares of mutual funds that hold one or more REITs. Both offer investors the ability to receive steady income streams from dividends generated by real estate investments without having to finance or manage properties directly.

Commodities

Commodities, on the other hand, include products such as raw materials, precious metals, and natural gases. Commodities typically perform well in inflationary environments, as we have recently seen through the ever increasing price of oil and gas. While investors may not directly invest into these products, a well-diversified portfolio will have exposure to commodities. This can be accomplished by investing in stocks of companies that are related to a commodity or through the use of exchange traded funds (ETFs) that track the prices of specific commodities.

How to profit from volatility

While inflation fluctuates as we pass through the various phases of our economic cycle, volatility is baring its teeth at investors every second of every day. Markets would not function correctly without volatility because it serves as the hypothetical “consequence” for irrational market behavior. Volatility ensures that good companies succeed while bad companies fail. Volatile market environments grant investors the ability to take on appropriate levels of risk over extended periods of time.

Dollar-cost-averaging

One way for individual investors to do this is by dollar-cost-averaging. This is a strategy to divide up the total amount you invest across periodic purchases of a solid target asset. This spreads out the cost-basis for an individual asset across days, weeks, and sometimes even months. This process reduces overall portfolio risk in an attempt to maximize potential returns.

Just like you wouldn’t leave your star quarterback on the sideline during a playoff game, investors should not let cash sit idly by. If you have excess cash in your portfolio, it should be invested into the market over time. Let your money work for you!

Do not micromanage

In volatile environments, investors must be well-researched and maintain a longer term perspective. Micromanaging your portfolio will ultimately lead to exponential losses. That is where our wealth management professionals come into play. We take the stress out of market timing and daily price fluctuations by systematically managing, rebalancing, and reviewing each client portfolio throughout the year.

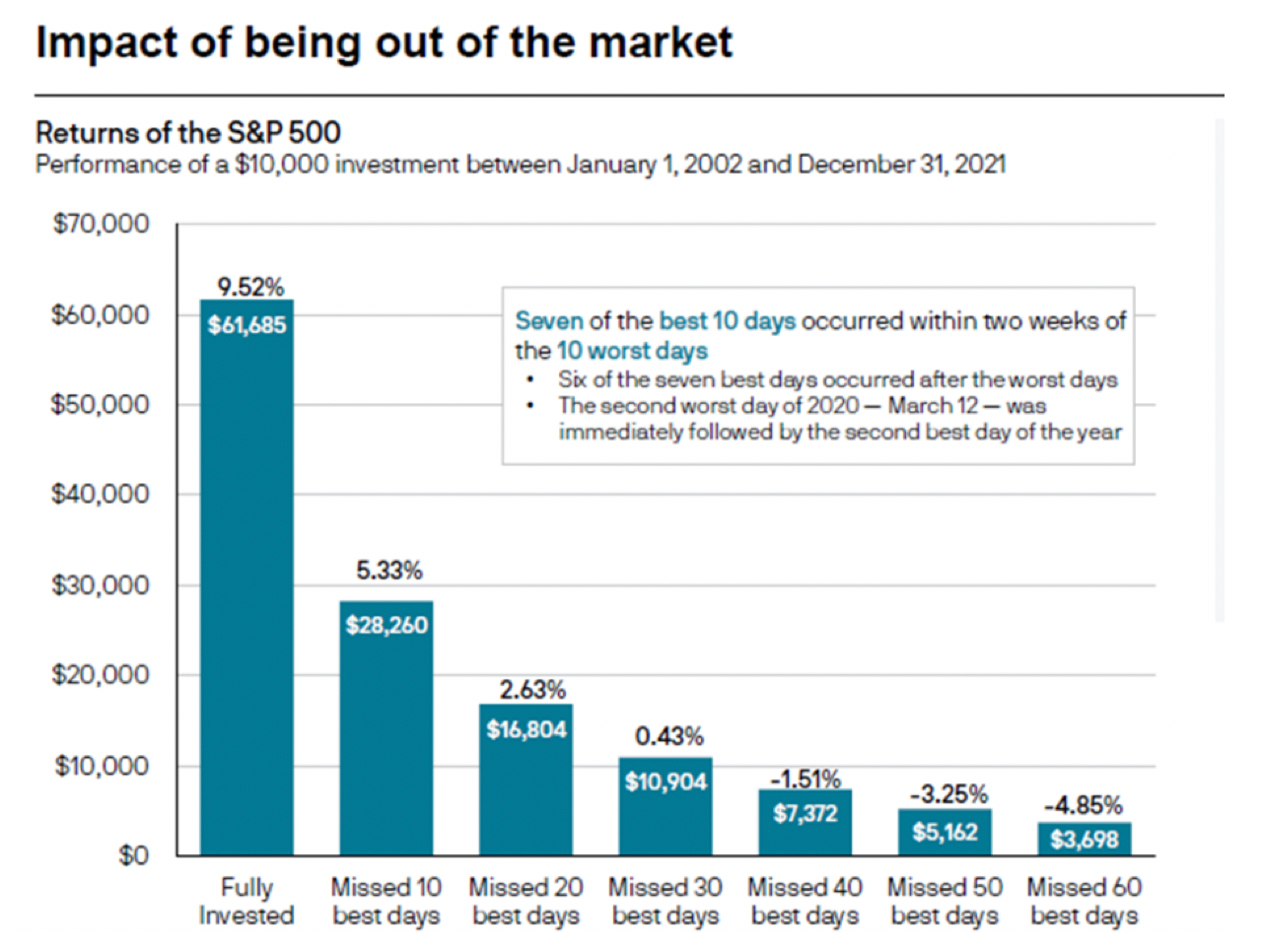

The chart below shows the annualized returns of a $10,000 investment in the S&P 500 from 2002-2021. If an investor was fully invested during the time period, they would have seen a 9.52% annual return. However, if they missed just 10 of the best days, they would have seen just a 5.33% annual return. Understanding market volatility and the value of staying the course at all times can help maximize portfolio returns.

Our focus

While inflation and volatility may generate concern and fear for investors, it is important that you do not sit on the sideline and wait for inflation to subside. Investing during these times can help maintain portfolio value while prioritizing the importance of diversifying your portfolio. Finding hedges to inflation and volatility can protect the buying power of your money.

At Security National Bank, we monitor, review and when warranted, rebalance client portfolios during challenging market environments. For over 138 years we have helped people navigate changing market conditions to make their plans become reality. If you have any questions about market volatility, inflation, or what we can do to help, please reach out. Your financial goals matter to all of us.